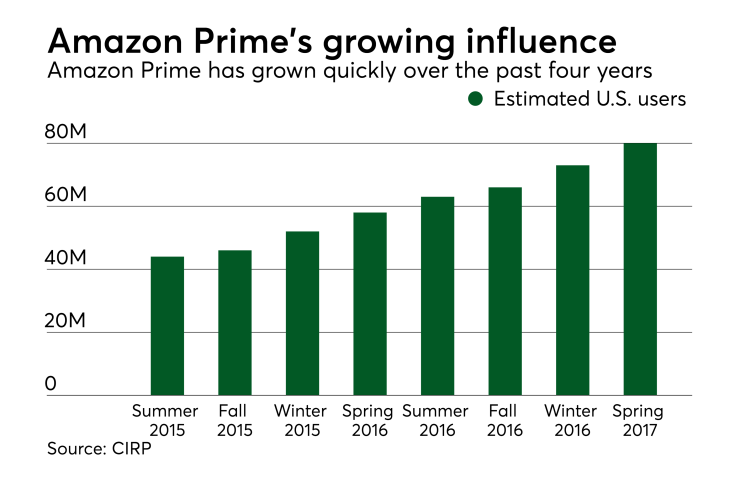

Like almost everything else related to Amazon's incursion into retail, the company's premium loyalty program has achieved a scale that appears ready to swallow the rest of the industry.

"The threat is very high," said Tom Caporaso, CEO of Clarus, a provider of loyalty and marketing systems. "They are in so many different businesses…they are toilet paper to TVs and everything in between. And if you take [Amazon's deal to buy]

One big worry for retailers is Amazon Prime, which provides two-day shipping and numerous other perks to customers who agree to pay $99 a year. Like most of what Amazon is doing, it's a huge encroachment on traditional and online retail.

"Amazon Prime is a premium loyalty product that is crushing the competition," Caporaso said.

To help address that challenge, Clarus has hired Giri Nathan, a former Priceline executive with experience scaling programs, to be Clarus' chief technical officer. While at Priceline, Nathan helped manage a white label business that used Priceline's engine to tailor hotel booking, flight and car rental services around a partner's brand.

His experience will help Clarus improve a similar product, in which it creates and manages branded loyalty programs, as well as the graphics, landing page hosting and creation and integration with online enrollment, Caporaso said. The company did not make Nathan available for an interview for this story by deadline.

Clarus wants to extend and scale the white label program, with a particular focus on premium loyalty programs like Amazon Prime.

Amazon has used its invented holiday,

Beyond these moves, Amazon is adopting traditional

The challenge for Clarus and its competitors is to implement real-time messaging, promotion and loyalty in a way that interfaces with the payment processor and the system that compiles customer level information, according to a June 2017 study on loyalty by Thad Peterson, a senior analyst at Aite.

One example is FIS's "Premium Payback" that delivers a real time point of sale experience with full integration into the retailer's platform. The product has found some traction, particularly in the petroleum sector.

The technology that can accomplish this is relatively new, according to the research, and it creates an opportunity if the messaging, offer delivery and fulfillment are well designed.

The expansion of premium loyalty is a way for retailers to counter Amazon Prime's growth, according to Caporaso.

"The market trends are driving retailers, publishers and other industry verticals to think more broadly around loyalty and premium loyalty in particular," Caporaso said. "What can I do to add value and a subscription fee tied to it?"