For the millions of consumers who file auto insurance claims every year, many of whom use digital tools such as mobile apps to submit them, the process grinds to a halt when it comes time to receive their payment.

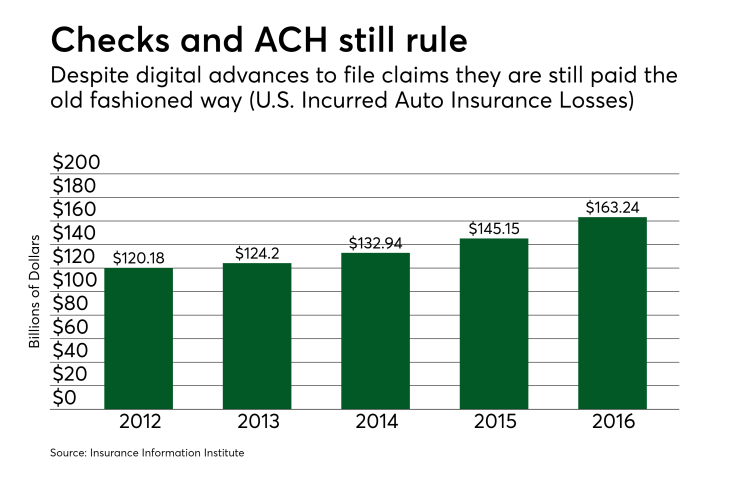

It’s as if the payout process remains stuck in the 1970s by using ACH and paper checks by mail, representing a digitization opportunity for KeyBank and Ingo Money. Since more than $163 billion was paid out in auto insurance claims in 2016, it is a significant market.

“There’s been a tremendous effort spent by the insurance industry on digitizing the claim, removing the paper, in order to improve efficiency, but the payment has not moved forward to keep pace,” said Matt Miller, head of product development and innovation at KeyBank Enterprise Commercial Payments. “At the end of the day, their customers are used to have things happen digitally. This is the last mile of digitization of the claim."

Generating efficiency in the claims process has been critical for insurance companies to reduce their costs in today’s hyper competitive auto insurance market.

“The insurance industry is the first vertical we are targeting,” said Miller. A 2017 partnership and investment in

By adding Ingo Money’s payment platform, Ingo Push, the Snapsheet Transactions partnership, KeyBank will be able target any major national, regional or local insurance carriers still using slow payment methods to convert them to instant payments. The initial payment method to be enabled will be debit push payments.

Ingo Money offers its payments platform in other industries directly, however it felt that the most efficient way to pursue the insurance business was to use a treasury bank partner.

“The next step in keeping customers happy will be in how quickly and easily the claims can be paid,” states Drew Edwards, CEO of Ingo Money. "To kill the [insurance] check, the treasury banks are key since they are the ones producing them.”

The companies' success will hinge not only on their ability to offer instant payments but also the consistency of the customer experience. A system built on debit push payments won't cover the whole target market.

“We don’t believe that any single one rail works for everything, let alone 100% of the time," Edwards said. "You need to offer the consumer the same choices that they use to pay with at the store or on the web, and then have redundancies in case one doesn’t work.”

Ingo Money connects to 25 rails — including Visa, Mastercard, Pulse, Star, NYCE,

The company is currently in discussions to add Zelle. While these additional rails are not yet available through the partnership with KeyBank, Edwards predicts these networks will be supported as the partnership grows.