The recent tariff escalations could cause financial pain for specific shopping corridors, particularly in price-conscious locales.

The reasons people shop at e-commerce merchants based outside of their home country will play a role in determining how much pain will result from the tariffs, according to research from PayPal that was released Monday.

The scale of the threat to the international online payments market is still emerging — countries have responded to the

At this point, Mexico appears to the be one of the most vulnerable markets, with both inflows and outflows under duress. Shoppers could change their habits because of U.S. tariffs, since about 60% of Mexican shoppers list price as the top buying consideration, according to PayPal's research. At the same time, most of the shopping in Mexico from the U.S. is for bargains.

While most of the media coverage has mentioned China-U.S. corridors as a particular target of tariffs, there's less likely to be a dip in spending. Chinese consumers are primarily motivated by product quality—54% list that as a reason for shopping online for U.S. products, and they would be less likely to notice a higher cost, according to PayPal.

"Chinese consumers trust the authenticity of U.S. goods, and that is what they are shopping for," said Adriana Bello, global lead for Consumer Go to Market for PayPal.

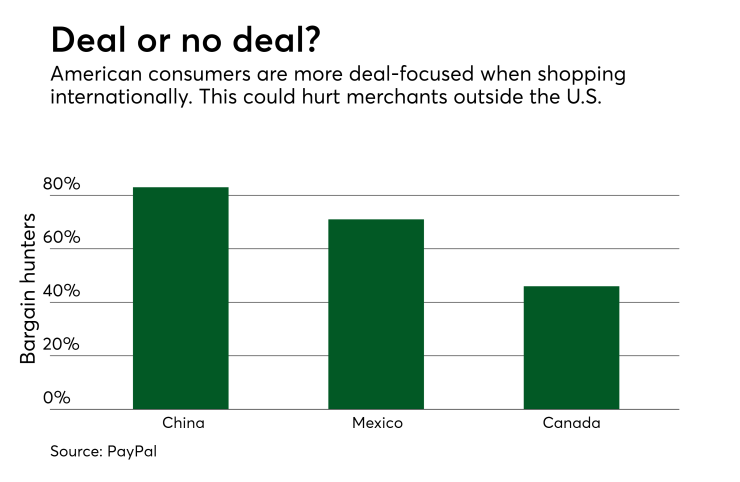

But Chinese merchants could suffer. Retaliatory tariffs could change U.S. consumer behavior, since price is U.S. shoppers' top consideration when making purchases from China, Mexico and Canada, according to PayPal. U.S. merchants overall are likely to at least hold steady, since 21% of international shoppers rank the U.S. as their top destination for online shipping.

PayPal gets about 21% of its volume from cross-border transactions, and Bello admitted being hopeful for either a minimal price impact from levees or a dominance of purchases that are based on factors other than the price. The top product categories for PayPal's cross-border payments business are clothing, footwear, electronics and toys, Bello said.

Prices for items in these categories can vary widely, so there is some chance the consumers could become price-sensitive in corridors where price currently is less of an issue.

"A $10 shirt that becomes $12 may not change a decision," Bello said. "But if you're buying a $1,000 TV that goes to $1,500, [that] is different. It's a larger gap that could give people pause."

The tariffs have caused stress in an otherwise hot cross-border payments market. China, Canada and Mexico are all on pace to expand more than 20% in cross-border trade this year, according to PayPal. And international payments in general have attracted billions in investments over the past couple of years, with

Citi has also launched a project that uses

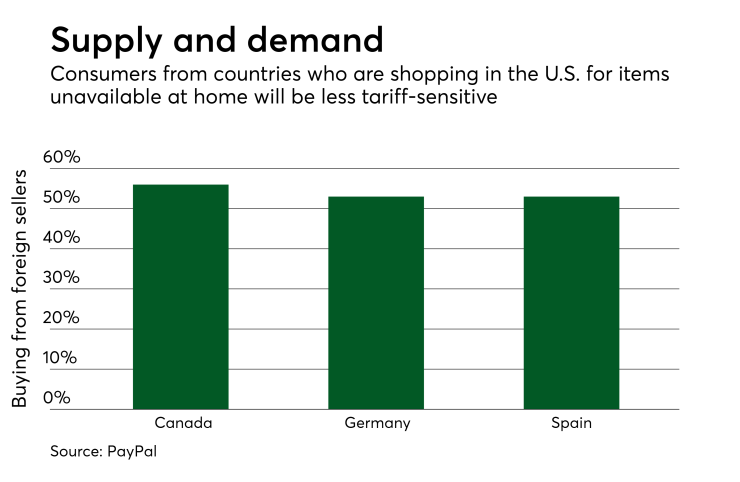

Consumers don't shop internationally without a reason, and mostly that search is performed because an item isn't available locally, said Tim Sloane, vice president of payments innovation at Mercator Advisory Group.

"As a result, the consumer has already recognized that it will cost more and will take longer to be delivered," Sloane said. "That said, an elastic can only be stretched so far and will eventually snap and become an abandoned cart."