Before it implemented an open banking-based method for funding brokerage accounts, Freetrade allowed its customers to move funds manually — and oftentimes, had no idea where those funds were supposed to go.

“At one point, up to 10% of manual deposits were unallocated, and we had to return the funds that we couldn’t match,” said Damon Roberts, head of product at the U.K.-based online brokerage. “People were contacting us to find out where their money was, and we needed additional customer support for unallocated accounts. The problem with manual transfers was only going to get worse as we scaled up.”

Customers had to switch between their online banking app and the Freetrade app while copying and pasting account details and their Freetrade customer reference. Freetrade also supported debit cards, but deemed that too expensive to be the company’s primary funding option, Roberts said.

In September 2020, Freetrade added a third option: payments initiation through open banking.

Using technology from TrueLayer, Freetrade now allows customers to move funds from their bank accounts without leaving Freetrade's app. “Customers can make payments quickly, and since the payment parameters are all there, they are allocated automatically,” Roberts said.

This process is enabled by open banking, which allows third parties to access customer bank accounts and data on a consent basis to provide additional financial services. Customers don’t need to manually enter their banking details, and payment acceptance costs are lower than card payments because these services don't involve the card networks’ rails.

According to the U.K.’s Open Banking Implementation Entity, over 1 million open banking payments occurred in the U.K. in February 2021, compared with 4 million for the whole of 2020.

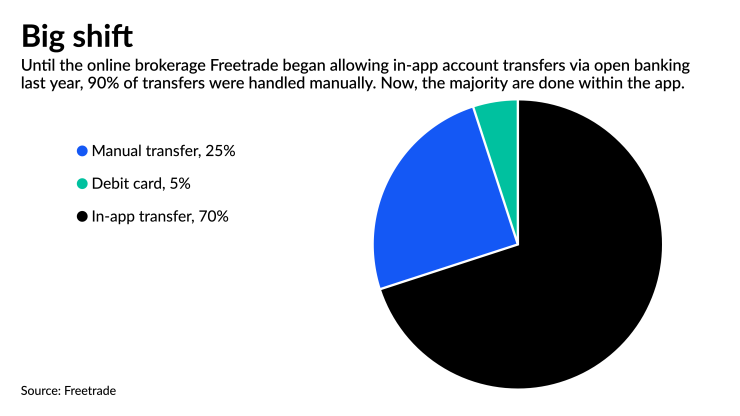

Since introducing payments initiation, Freetrade has seen a 70% reduction in unallocated deposits and an 18% increase in the average deposit value, Roberts said. Now 70% of Freetrade’s investors choose open banking payments as their funding option; manual bank transfers have fallen from 90% of total deposits to 25%, and card payments to 5%.

Many other U.K. and European companies are finding that they can improve customer service and cut costs by taking payments directly and immediately from customers’ bank accounts.

Open banking payments adoption is being facilitated by fintechs that provide standardized connectivity to bank interfaces, freeing their clients from connecting directly with multiple bank APIs which may be of varying quality. Vendors include the U.K.'s TrueLayer, Yapily and Token; Sweden's Tink; and the U.S.'s Plaid.

“I think payments initiation will become the primary payments rail in the U.K. and Europe in the next three to five years,” said Keith Grose, head of international at Plaid. Payments initiation is growing more than 50% a month in the U.K., he said.

Penfold, a U.K.-based provider of pension services for the self-employed, is also using TrueLayer’s API. "For many people, managing pensions is complicated and slow,” said Pete Hykin, a Penfold co-founder. “It takes a week to set up a direct debit to pay your pension contributions, and amending your contributions is a massive upheaval.”

Hykin said that by integrating with TrueLayer, customers can link their bank accounts to their Penfold pension and initiate transfers via open banking, with funds arriving instantly through the U.K.’s Faster Payments system.

“Penfold customers can now pause, adjust or top up their pension payment whenever they like, without having to contact their banks about their direct debits,” he said. They also don’t need to set up their pension contributions weeks in advance of the end of the U.K. tax year, but can pay at the last minute.

Ikigai, a U.K. digital banking and investment management provider, is using Plaid’s payments initiation API to enable users to move funds from their external bank accounts to their Ikigai app-based checking, savings and wealth accounts. Ikigai customers authenticate themselves via biometrics when transferring funds from their bank.

“For Ikigai, quick, simple onboarding is critical,” said Edgar de Picciotto, a co-founder of Ikigai. “Prior to our using Plaid, customers could only fund their Ikigai account by leaving the Ikigai app and opening another banking app to make the transfer. Plaid’s flow results in 75% fewer clicks when compared to a manual account transfer, reducing the time spent on account-opening by 50%."

The U.K.-based Volt provides an open payments gateway based on PSD2-compliant technology from Yapily enabling merchants, neobanks and PSPs to accept open banking payments. Having implemented Yapily’s technology in the U.K., Volt is now rolling it out in Europe, with clients including the Dutch neobank Bunq and the Austrian PSP Ixopay.

“Leveraging Yapily’s infrastructure enables us to route payments through the complex, unstandardized web of payment initiation APIs mandated by PSD2,” said Tom Greenwood, Volt’s CEO. “Our gateway gives clients a single simplified point of access so they can leverage open banking payments to save money and provide their customers with frictionless payment experiences.”

GoCardless, a U.K. provider of bank account-based online recurring payments services, uses open banking technology to enable its clients to accept direct debit payments from customers instead of card-on-file payments. Its Instant Bank Pay service enables clients offering subscription services to pull an initial payment instantly from a customer’s bank account when they set up an online direct debit mandate.

GoCardless client Cuckoo Broadband, a challenger U.K. broadband internet provider, piloted Instant Bank Pay to collect initial and ad hoc payments for new and existing customers before the service’s launch in April 2021.

“Using Instant Bank Pay for one-off payments prevents customers who switch to us from an incumbent telco from losing access to our services, and helps reduce the time we spend chasing late payments and the risk of costs outstanding,” said Cuckoo’s CEO, Alexander Fitzgerald. During the pilot, Instant Bank Pay reduced the time needed for chasing and collecting failed payments from 21 days to seven, he said.