India’s government has taken drastic steps to encourage and standardize digital transactions, and those moves appear to be paying off.

The United Payments Interface has enjoyed staggering growth over the past two years, according to new figures from the

That expansion is validating the

“It’s one thing to put up faster payment rails and it’s another thing to get folks to participate,” said Mike Braatz, product chief for ACI Worldwide, a Naples, Fla.-based bank technology company. “UPI is the answer to that adoption question. One of the things they got right in India is banks are actively participating and encouraging it — and that’s not the same as in other markets.”

ACI just made an undisclosed strategic investment in Mindgate, an Indian payments software company that’s heavily involved in UPI transactions. As part of the investment, the two companies will collaborate on a cloud-based real-time payments product that will combine ACI's software with Mindgate’s digital overlay. The two companies have markets beyond India in mind, but what makes the deal a potential coup for ACI is the fast growth of UPI.

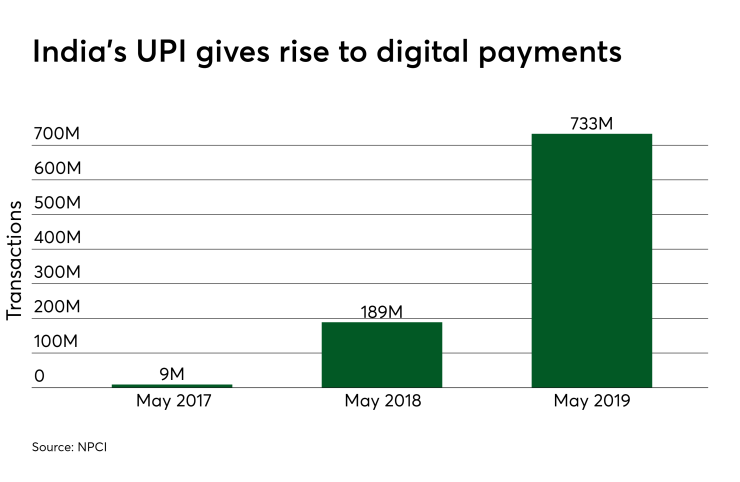

There were more than 733 million UPI transactions in May 2019, up from 189 million in May 2018 (UPI's rails launched in 2016).

The value of these payments increased to Rs.1.52 lakh crore in May 2019, or about $22 billion, from .33 Rs lakh crore, or about $7 billion, the prior year. While there was a slight dip in the number of payments from April 2019 to May 2019, the value of payments still increased and the overall pace of growth should reach 5 billion payments per month by 2023, according to NPCI.

NPCI and UPI are a mashup of a government-based faster payments project, a federated ID initiative and a social transfer app like Venmo or Zelle. People use their phones to make P2P or P2C payments via a single identifier and a network of participating banks.

ACI predicts its investment in Mindgate can take advantage of this gateway, since the Mumbai-based Mindgate processes about 70% of UPI transactions, and ACI’s client base includes eight of India’s 10 largest banks.

UPI gives India a more standardized approach to real-time digital payments than other markets. In the

“In other markets like the U.S., there are real-time payments but [they] haven’t seen the same kind of uptake that UPI is seeing in India,” Braatz said. “Part of that is figuring out the right method to get consumers to adopt and merchants to accept.”

India's fast-growing digital payments market is drawing investment both internally and internationally.

UPI has additionally allowed local fintechs to compete with

“India's the most consequential emerging payments market on the planet, and arguably the most interesting,” said Eric Grover, a principal at Intrepid Ventures, adding the NPCI's real-time interbank payments and UPI schemes are a great utility financial institutions and others such as Google can tap to deliver payments. “While there's an nationalist undercurrent in India; it is open to foreign countries unlike China. It's a market ACI Worldwide a has a play in.”