Atlanta-based fintech Greenlight has raised $215 million in a Series C round and announced that it has achieved a valuation of $1.2 billion, giving it unicorn status.

“Greenlight’s smart debit card is transforming the way parents teach their kids about responsible money management and financial literacy,” said Noah Knauf, general partner at BOND, in a press release. “Having achieved phenomenal growth year-over-year, this is a company on the fast-track to becoming a household name. We look forward to working alongside the Greenlight team to support their continued growth.”

Greenlight is a money-management platform that is specifically built for families. One of its key features includes a parent-managed debit card for children. This comes with companion apps that give parents the ability to pay allowances, manage children’s chores and set flexible, store-level spend controls. Additionally, the children gain financial literacy through lessons in earning, saving, spending and giving with a smart debit card and app designed just for them.

Greenlight launched its smart debit card for kids in 2017 and now serves more than 2 million parents and their children. In its efforts to teach financial literacy and responsible financial habits, Greenlight kids have collectively saved more than $50 million.

"Greenlight’s rapid growth is a testament to the value they bring to millions of parents and kids every day,” said Gardiner Garrard, founding partner at TTV Capital, in the release. “My wife and I trust Greenlight to give us the modern tools to teach our children how to manage money. TTV Capital is thrilled to provide continued investment to help the company empower more parents."

In recent years several fintechs, banks and even Amazon have been building programs specifically designed to help parents teach financial literacy and smart spending habits. In 2017

This youth payment card segment is designed to help instill a savings mindset among children, provide an avenue for parents to give allowances, monitor their children’s chores as well as put safety guard rails through spend controls on a smart debit card.

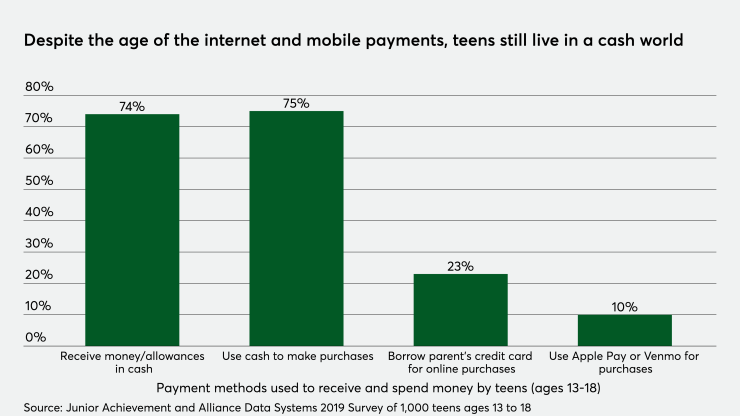

It’s also designed to onboard children to the world of digital payments and cards, while reducing their reliance on cash to make purchases, particularly in the COVID-19 era. It’s also designed to onboard parents in changing habits from paying children’s allowances in cash to sending money directly to a digital payment account. According to a 2019 survey of 1,000 teens, conducted jointly by

According to