Financial institutions are already using real-time transaction processing and data-driven incentives to address macroeconomic problems such as supply chain shortages, and the recent spate of flight cancellations and delays is another problem emerging payment technology could tackle.

"One item that comes to mind around this topic is the availability for the airlines to provide real-time refunds, rebates and stipends," said Sarah Grotta, director of the debit and alternative products advisory service at Mercator Advisory Group. Payment technology that specializes in instant digital business-to-consumer disbursements can address some of the issues airlines face when redirecting passengers, Grotta said.

Of course, banks and payment companies cannot directly prevent flight delays. But there is an opportunity to mitigate some of the friction that travelers encounter when they are informed they won't be reaching their destination on time, if at all. As airlines adopt

"For example, a customer may find that their connecting flight has been canceled and the airline may issue funds to be used to defray the costs of an overnight hotel stay, meals and other amenities," Grotta said. "This is where the speed of a real time payment improves the traveler's experience."

When addressing the supply chain problem, banks such as

For travel, faster payments and incentive points can help consumers quickly switch to a new flight, or at least ease some of the turbulence they encounter along the way. Card brands, for example, are

"It's all about improving the overall experience," said Maria Prados, head of the vertical growth team at WorldPay/FIS, adding digital wallets and trends toward linking more services to a payment app are creating more data that can inform a quick product offering for a passenger who has to change travel plans. "The more data you have on customers, the more you can give them in terms of incentives."

For example, if a flight is delayed two hours, the passenger may receive points toward purchases at stores that are in the airport. Or it could be an "experience" or a hotel discount pegged to a canceled flight. Instead of using points toward a future flight, the points can be used as a form of currency to make purchases or access services that make a flight delay or cancellation more tolerable — with offers tailored for a specific user.

"The closed loop for travel points doesn't necessarily have to be closed," Prados said.

The ability to draw on this data comes from earlier adjustments that WorldPay/FIS made during the pandemic, when travel was largely shut down. During that time, the financial technology firm placed payments, booking, hotels and other transactions related to travel in a single app that's accessible within a larger digital wallet.

"We wanted to make sure we were ready for the market when travel started to open up again," Prados said.

American Express, Capital One and JPMorgan Chase hope to entice affluent travelers by enhancing access to airport lounges, many of which have reached capacity after travel rebounded.

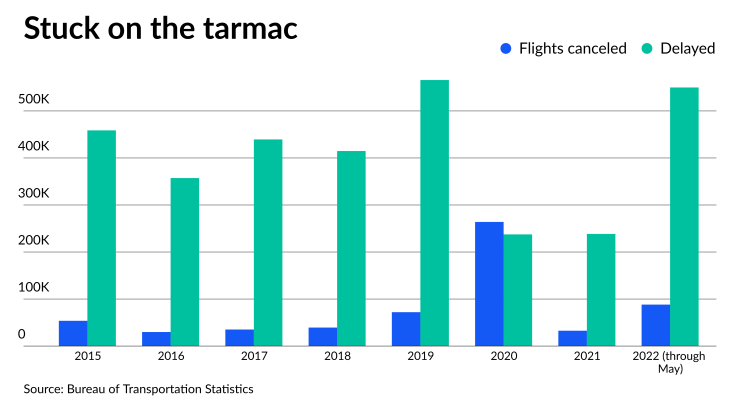

Delays and cancellations are much higher than before the pandemic. More than 550,000 flights were delayed through May in the U.S., according to the

More than 88,000 flights were canceled in 2022 as of May, up from 33,000 for all of 2021 and 72,000 for all of 2019. More than 3% of all flights in the first quarter of 2022 were canceled, up from 1.5% in 2021 and 2.4% in 2019. More than 23% of all flights in the first quarter were delayed, compared with 11% in 2021 and 18% in 2019. The trend has continued into the summer, with numerous delays over the July 4 holiday and more than 4,000 flights canceled in a four day span between August 4 and 8, according to The

The travel challenges and delays echo the early

In an email, Mastercard said it offers Mastercard Travel & Lifestyle Services, which includes coverage of up to $1,500 against forfeited non-refundable unused payments and deposits if a trip is canceled or interrupted for covered reasons. The card brand also offers trip-delay insurance. In an email, American Airlines said travelers are able to make changes to their flights on

"The obvious thing on the payments side would be those benefits offered by some credit cards. Some offer both cancellation and delay, as well as broader travel insurances," said Gareth Lodge, a senior analyst at Celent. "As always, the devil will be in the details. Did you book with that card? What is defined as a delay? Is everyone traveling covered, or just the cardholder?"