A perfect storm could be brewing for buy now/pay later lenders during the final weeks of the year, as millions of younger consumers with shallow finances push their spending limits in an increasingly shaky economy.

Despite an overall slowdown in consumer spending during the third quarter compared to a year earlier and

Regulators are concerned enough that the Office of the Comptroller of the Currency last week issued

The

"The guidance recognizes the inherent risk of BNPL, but many financial institutions already control the risk by using their own proprietary [loan] offerings within the scope of a cardholder's existing credit line," said Brian Riley, director of credit advisory services at Javelin Strategy & Research.

As BNPL loan usage grows, banks and credit card issuers should be aware of the relatively higher risk in the mix of borrowers, he suggested.

"The Pay in 4 loans typically use a lower underwriting standard than credit cards, and BNPL portfolio performance has not had the test of time or varying business cycles," Riley said, noting that BNPL borrowers tend to be more financially insecure.

The young industry has been developing its own risk-management strategies, said Ariana-Michele Moore, an advisor in the retail banking and payments practice of Datos Insights. "In the past few years, BNPL lenders have been building their own credit histories on consumers and their ability to repay," she said.

Many BNPL fintechs have proprietary methods of calibrating their risks in making split-second underwriting decisions with an audience that includes younger, more vulnerable consumers, said Kevin King, vice president of credit risk at LexisNexis Risk Solutions.

"I think everyone knows there are blind spots out there, with consumers increasingly struggling to pay bills, defaults on traditional loans at decades-high levels, student loan data being reset and a lot of BNPL loan data is not reported to credit bureaus yet," King said.

As a result, most BNPL lenders are using AI and machine learning in new ways to scrutinize borrowers' ability to repay, in combination with alternative data supplied by firms like King's, which uses publicly available records and other asset measures to help BNPL lenders make underwriting decisions, he said.

"We work with a lot of BNPL fintechs and they're aware that in the present economic cycle — with consumers' pandemic-era savings dwindling but many still in a free-spending mood — they need to step up surveillance of all available borrower data to safely underwrite these loans," King said.

The major

"Affirm currently reports some loans to Experian and may report to other credit bureaus in the future," Affirm notes on its site.

LexisNexis Risk Solutions' data suggests that some consumers routinely juggle multiple Pay in 4 loans without going delinquent. BNPL lenders typically give borrowers routine email updates on when their next payment is due, and many loans are resolved within six weeks, King said.

"It sounds risky when you hear a consumer takes out 12 BNPL loans a year, but many of these customers are up to date on their payments," he said.

The pool of BNPL users is diverse, King said. It includes consumers with subprime credit scores for whom BNPL loans provide inexpensive access to credit, credit-invisible borrowers who have money but no credit score and others who just like the customer experience of BNPL loans. Many

"A lot of BNPL users are under age 35 and tech-savvy and they don't want to deal with the complexities of a traditional loan," he said.

The outlook for an agency to formally regulate the still-maturing BNPL industry is cloudy. A study from The Federal Reserve Bank of New York earlier this year concluded that

The

Marketplace solutions are now emerging to help BNPL borrowers

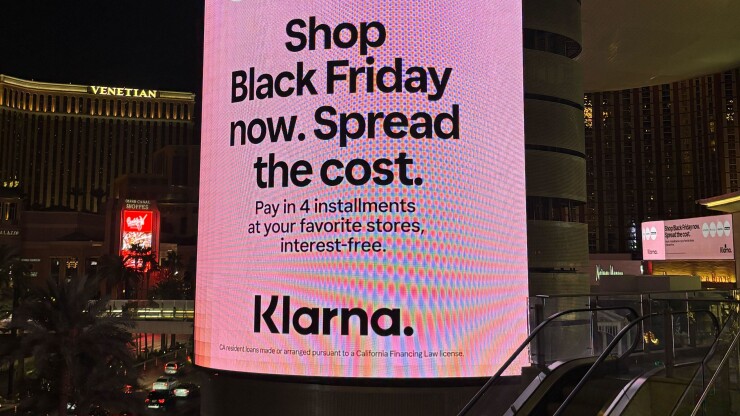

Two of the largest BNPL fintechs, Affirm and Klarna,

"There's every chance the BNPL providers are going to do very well this holiday season; they've done a lot to bring in new tools and tighten lending criteria," King said.