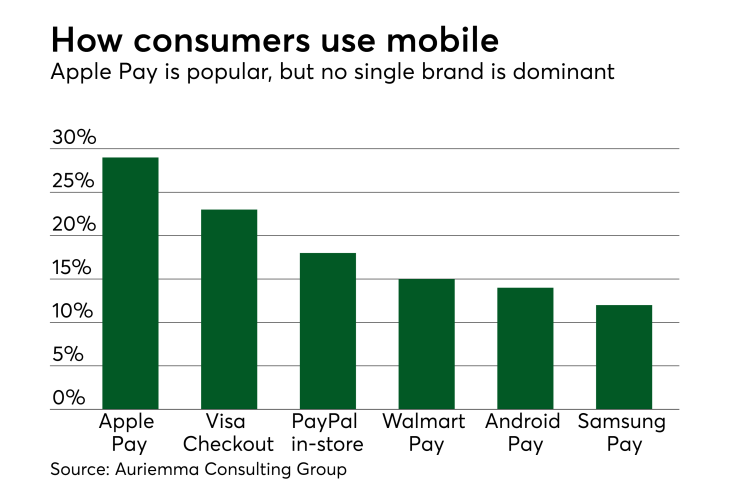

Among consumers who currently use at least one mobile payment app regularly, 29% say they have used Apple Pay in the past month, while 23% indicate Visa Checkout was their payment app of choice.

But even though Apple Pay and Visa Checkout ranked the highest as a mobile payment app used in the past month, they also had the highest percentage of current users who say they have not used the app in the past 30 days, with Visa Checkout at 19% and Apple Pay at 16%, according to new research from Auriemma Consulting Group.

Auriemma conducted web interviews with 800 debit card users in the U.S. the past two months in compiling the third-quarter 2017 mobile payments report. When citing mobile payment app usage, the transactions could be for in-store or online purchases.

Of those using at least one payment app, 58% said they have initiated a mobile payment in the past month through one app, while 16% said they used two apps and 12% said they have made no mobile payments.

As it has in most other quarters the past two years, Apple Pay had the highest percentage of consumers at 34% who said they were familiar with that mobile payment app. Both PayPal in-store checkout and Visa Checkout had 30% citing familiarity.

Those percentages haven't varied greatly with each quarter. Though mobile payment use continues to rise, it remains a slow climb.

"We're still seeing slow adoption when it comes to mobile payments," said Jaclyn Holmes, senior manager of payments insight at Auriemma.

"Over the past couple of years, we've seen a lot of new players enter the mobile payment space," she added. "And while this has led to adoption among the more tech savvy consumers, several of whom are trialing multiple technologies, the value of mobile payments and how they're reducing friction at the point of sale doesn't seem to be resonating as clearly as it could."

On average, the report said, mobile payment apps are used 2.9 times per month and nearly half of mobile apps are used once or twice a month.

Not all mobile payment app users are aware of the default cards, or those placed by them as the top of wallet card choice on their apps, as 31% said they were not sure or not aware of a default card. Walmart Pay and Apple Pay users are not among those, as 86% of the 75 Walmart Pay users are aware of the default card, commonly a Walmart debit card, and 84% of Apple Pay users were aware.

American Express Checkout users had the highest percentage, at 63%, saying they had been offered an incentive to use the app. Apple Pay had the least, citing an incentive at 33%.