Ant Financial’s Alipay is deploying blockchain technology to power a cross-border remittance service for Pakistan’s Telenor Microfinance Bank (TMB) and Valyou of Malaysia.

The deal is designed to provide a faster, low cost method for Pakistani expatriates working in Malaysia, who send approximately US$ 1 billion annually back to their home country.

The Alipay offering claims to be Pakistan’s first blockchain-based cross-border remittance service. It is being provided to the Telenor Group, which owns and operates Telenor Microfinance Bank in Pakistan and Valyou of Malaysia. The blockchain service will make 24/7, real-time money transfers between the two countries at a competitive exchange rate with Alipay waiving transaction fees during the one-year trial period.

“The new remittance service is one of the examples of how emerging technologies can help countries meet their digital and financial inclusion goals. We’re thrilled to be part of Pakistan’s financial inclusion efforts and we’re dedicated to exploring breakthroughs and applying them to benefit more people in more places,” stated Eric Jing, chairman and CEO of Ant Financial, in the press release.

Telenor launched a mobile branchless banking service in Pakistan called Easypaisa in 2009 that now serves 20 million Pakistanis. The Easypaisa service will be used to receive the cross-border remittances and will enable Pakistani consumers to pay bills and shop both online and at the 70,000+ store that accept it. Last year,

“Currently, Pakistan receives about US$ 1 billion in home remittances from Malaysia and this Easypaisa-Valyou collaboration is going to change it for the better,” stated Roar Bjærum, senior vice president, Telenor Financial Services, Telenor Group in the press release.

The spotlight on remittances has been very strong in the last decade as the

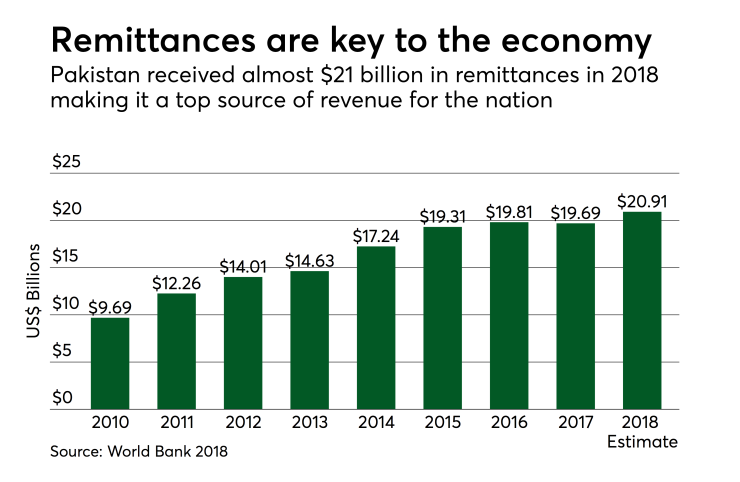

Pakistan received almost $21 billion in remittances from countries across the globe, making it a major source of revenue.

“Home remittances contributed to over 6 percent in GDP, equivalent to over 50 percent of our trade deficit, 85 percent of exports and over one-third of imports during FY 2017-18,” noted Tariq Bajwa, governor of the State Bank of Pakistan in the press release.