Nearly a decade ago Marqeta grabbed attention as one of the first companies to deliver white-label card issuing and processing services through an open API platform, bypassing legacy banking technology.

But that field grew crowded, with a continuous stream of startups leveraging API platforms to deliver payments technology, and rivals from Stripe to Wirecard aggressively expanding digital payment solutions for diverse consumer and B2B use cases.

To maintain momentum, Marqeta, of Oakland, Calif., must now branch out to new regions and industries, according to Jason Gardner, who founded the 350-person company in 2010.

“Fintech is still white-hot, with new business models opening up in markets around the world where we have opportunities to provide the modern card-issuing infrastructure,” Gardner said.

Marqeta's challenge is choosing which industry niches to target.

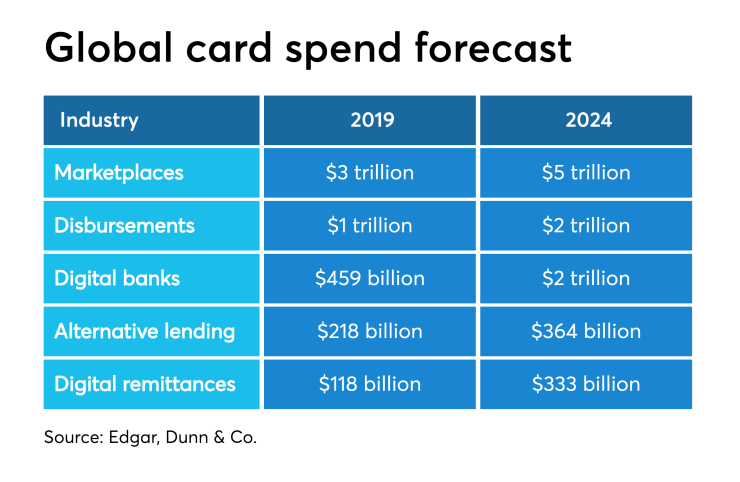

Total estimated global card spending in credit, debit and prepaid is soaring into the trillions in verticals including online marketplaces, alternative lending, digital remittances, corporate disbursements and digital banking, according to data from Edgar, Dunn & Co., but it's difficult to serve all of them effectively.

Strong competition is coming from the likes of Green Dot, Stripe, Galileo and a raft of large platforms that already support both domestic and cross-border payments with digital card-issuing technology, along with Visa and Mastercard, which are aggressively driving their own virtual card services, according to Tim Sloane, vice president of payments innovation at Mercator Advisory Group.

“I agree there will be strong growth from online marketplaces, disbursements, digital banks, on-demand delivery, etc., but each of these verticals has different requirements. I expect individual payment platform providers like Marqeta will excel in two or three specific areas because it requires too many unique capabilities to do them all, especially regarding regulatory compliance,” Sloane said.

Marqeta is embarking on the next phase of its growth with

“The funds will go toward scaling growth and building up our platform,” Gardner said, noting that Marqeta already operates in the U.S. and Canada, and recently

Marqeta hasn't yet narrowed its focus within the available card-issuing industry categories, but online travel and digital banking already stand out as strong prospects for growth.

ConnexPay, a Minneapolis-based payments provider that launched in 2017 serving other new travel and e-commerce companies, is one of the companies for which Marqeta provides virtual card solutions enabling quick, customized payments to suppliers.

Digital banks are another top growth area for Marqeta.

“We power a number of companies in the installment-loan space, a market that’s been a European phenomenon for a long time but it’s now growing quickly in the U.S.,” Gardner said.

There is much pent-up demand for small-business loans that traditional banks are not adequately serving, according to Gardner.

“After the big slowdown in lending in 2008 following the economic crash, banks pulled back and many still aren’t lending, leaving a void for digital banks that are looking for new tools. We help them with that last mile to reach the customer or the merchant with credit, debit, prepaid or virtual card payments in any channel,” Gardner said.

Marqeta has stationed 18 employees in London in preparation for the company’s global expansion, and Gardner plans to target other geographies.

“We’re prepared for whatever happens in the U.K., so Brexit, if it finally happens, won’t affect us,” Gardner said.