In the combative U.S.-to-India remittance corridor, Seattle-based Remitly just raised its game by increasing its daily transfer limits to $30,000 and hiring a Bollywood actor, R. Madhavan, as its brand ambassador.

Remitly’s moves are clearly in response to the growing competitive pressure being placed in a key U.S. outbound corridor. On June 4th

Additional pressure comes from digital cross-border specialists that have made significant inroads to the U.S. market. These include

“The market is competitive and providers compete on not just price but brand trust, ease of use, transfer amounts and transaction speed” noted Sarah Grotta, director, debit and alternative products of Mercator Advisory Group.

The U.S.-to-India remittance corridor represents an almost $11 billion annual payment flow according to the

The U.S. to India corridor has been very successful for Remitly, which likely wants to defend it market share.

“We launched our service in India in February 2015 in order to help India's hard-working overseas community have a secure, fast, and affordable way to send money back home," said Josh Hug, co-founder and COO of Remitly. "As a part of that mission, we've launched an industry-first same day $30k send limit to ensure our customers are able to send more when they need to."

It should be noted that for consumers to access these higher daily transaction limits, remittance companies are required by law to collect critical KYC information such as Social Security numbers, addresses and copies of government issued IDs. These enable companies to identify consumers, cross-check against appropriate Treasury SDN and OFAC lists as well as provide the necessary government reporting.

There are two major trends that are shaping the remittance industry, prompting companies such as Xoom, Remitly, and even

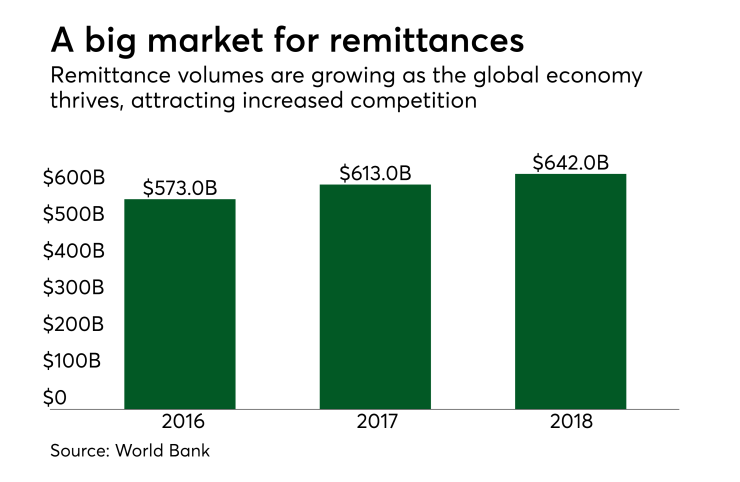

First, the payment volume of remittances is on the rise as the global economies continue to thrive. According to the

The second major factor is that the market remittances being sent from the U.S. are going through a

"The remittance market is moving digital," Grotta said. "The availability to the internet through a variety of devices, particularly mobile has increased the competitive nature of international remittances."

Now there are several major digital-only competitors including Remitly, Xoom,

Funding for the digital-only remittance startups has been flowing freely in recent years, attracting high level VC investors.

Xoom raised $104.3 million in seven rounds of funding before being