-

Early Warning's person-to-person payment network predicts that real-time settlement through The Clearing House's RTP network will enhance its appeal.

February 25 -

Early Warning's person-to-person payment network predicts that real-time settlement through The Clearing House's RTP network will enhance its appeal.

February 25 -

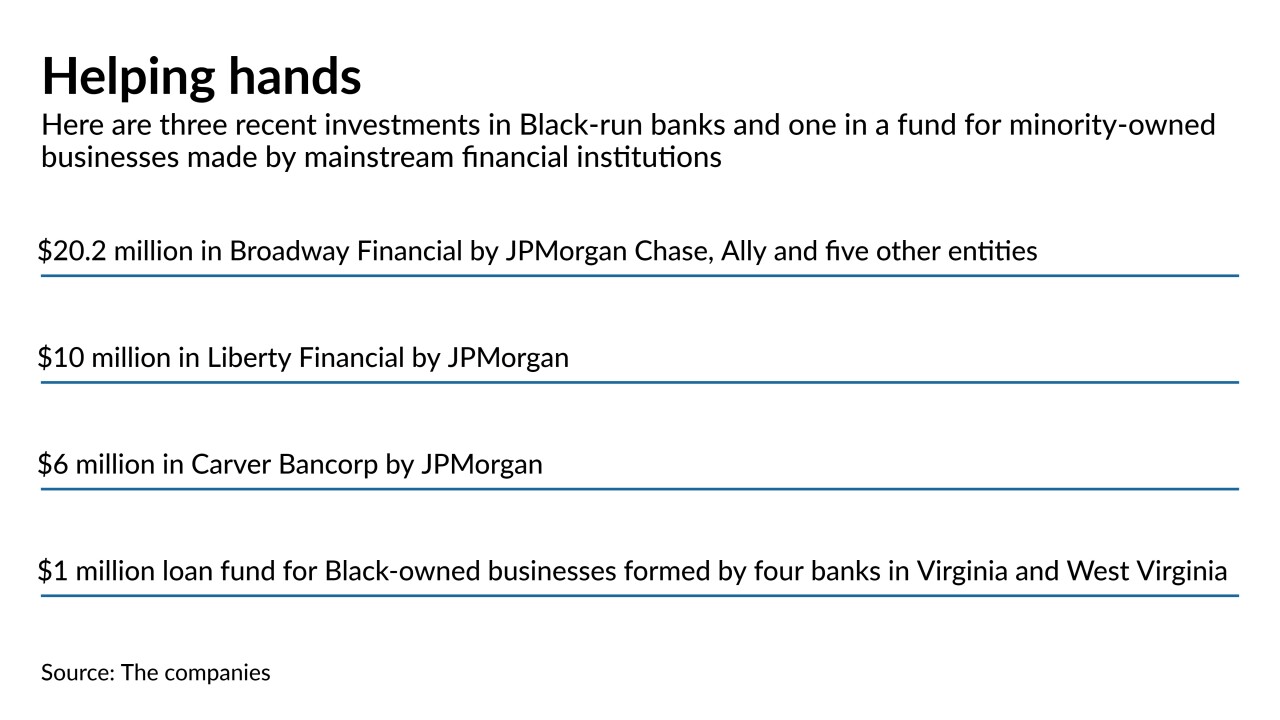

Several large and midsize banks are investing millions of dollars in Black-run banks, while four community banks have started a fund to make interest-free commercial loans in underserved communities.

February 24 -

Best Buy is expanding its test of a new store format that reduces the space for customers to browse by nearly half to focus more on getting digital orders out the door, according to people familiar with the move.

February 24 -

The London company poured cold water on speculation a deal to divest its 152-branch network in the United States was imminent. But biding its time here while focusing on issues in other parts of its global operation could drive up the price in a seller’s M&A market.

February 23 -

Kate Fitzgerald, senior editor at PaymentsSource, talks to Barry Baird, head of payments capability and delivery at TD Bank, about how technology has transformed the way people make P2P payments and handle other day-to-day interactions with the bank.

February 23 -

It would ignore technical glitches plaguing the entire Paycheck Protection Program and could end up delaying loans to larger borrowers who also need relief, bank executives and their trade groups say.

February 22 -

Only businesses with 20 or fewer employees will be eligible to apply for forgivable loans from the Small Business Administration's Paycheck Protection Program.

February 22 -

The Small Business Administration wants to vet Paycheck Protection Program loans of $2 million or more, but lenders have grown tired of waiting for months with no updates.

February 19 -

A survey commissioned by Bank of America found that Black entrepreneurs are more hopeful about revenue opportunities than other small-business owners, though many are still struggling to bring in the capital needed to expand.

February 18