-

The debate over whether NFC or QR codes is the best technology to adopt persists. So far, there has been plenty of room for both.

May 3 -

The debate over whether NFC or QR codes is the best technology to adopt still persists today. So far, there has been plenty of room for both.

May 3 -

Contactless ticketing innovation has long driven parallel adoption nearby retail. New work habits may change that dynamic.

April 30 -

Citizens Bank and Barclays US are among the lenders expanding in this market — with or without fintechs on board.

April 30 -

Citizens Bank and Barclays US are among the lenders expanding in this market — with or without fintechs on board.

April 30 -

Shopkeepers and other establishments say banks' costs have fallen substantially in recent years but interchange prices have held steady since the Federal Reserve capped them in 2010.

April 29 -

Shop owners and other establishments say banks' costs have fallen substantially in recent years but interchange prices have held steady since the Federal Reserve capped them in 2010.

April 29 -

Security is a constantly changing game, with criminals adopting new strategies and the payment industry and other financial institutions deploying increasingly sophisticated techniques to stop them.

April 29 PXP Financial

PXP Financial -

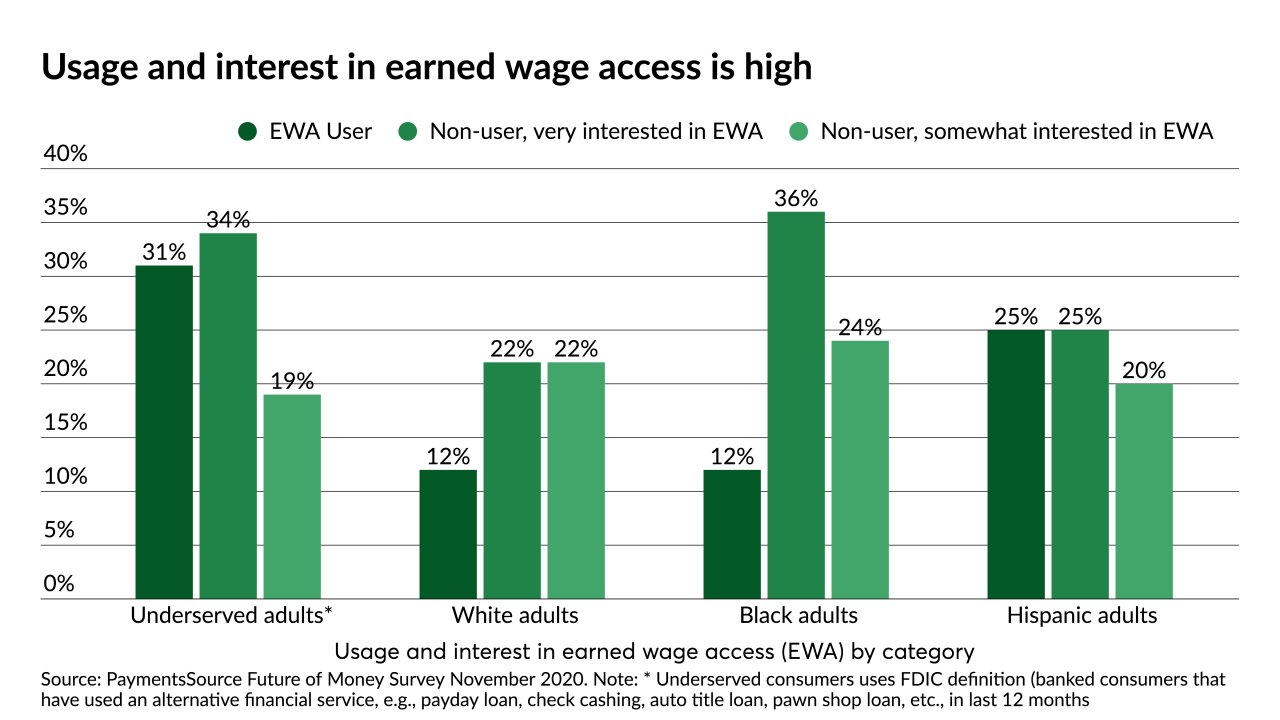

Fiserv is joining the increasingly crowded market for earned wage access in partnership with Instant Financial.

April 29 -

The investment, tied to PNC's deal to acquire BBVA USA, was always going to be large but seemed to grow as CEO Bill Demchak got intimately involved in the discussions and the needs of communities and businesses hit hard by the coronavirus pandemic became more apparent.

April 28