-

The government-backed instant processing network has been live only since the summer of 2023, but it's already indirectly boosting usage at an unrelated bank-led rail from The Clearing House.

July 15 -

Two days after the megabank was hit with $136 million of fines, Citi executives said they aren't changing the company's full-year expense guidance. Citi has 30 days to submit a plan to regulators showing that the bank has allocated enough resources to achieve compliance in a timely and sustainable manner.

July 12 -

The four lawsuits allege that attackers stole members' Social Security numbers, among other data. Patelco has not yet confirmed whether any data was stolen.

July 11 -

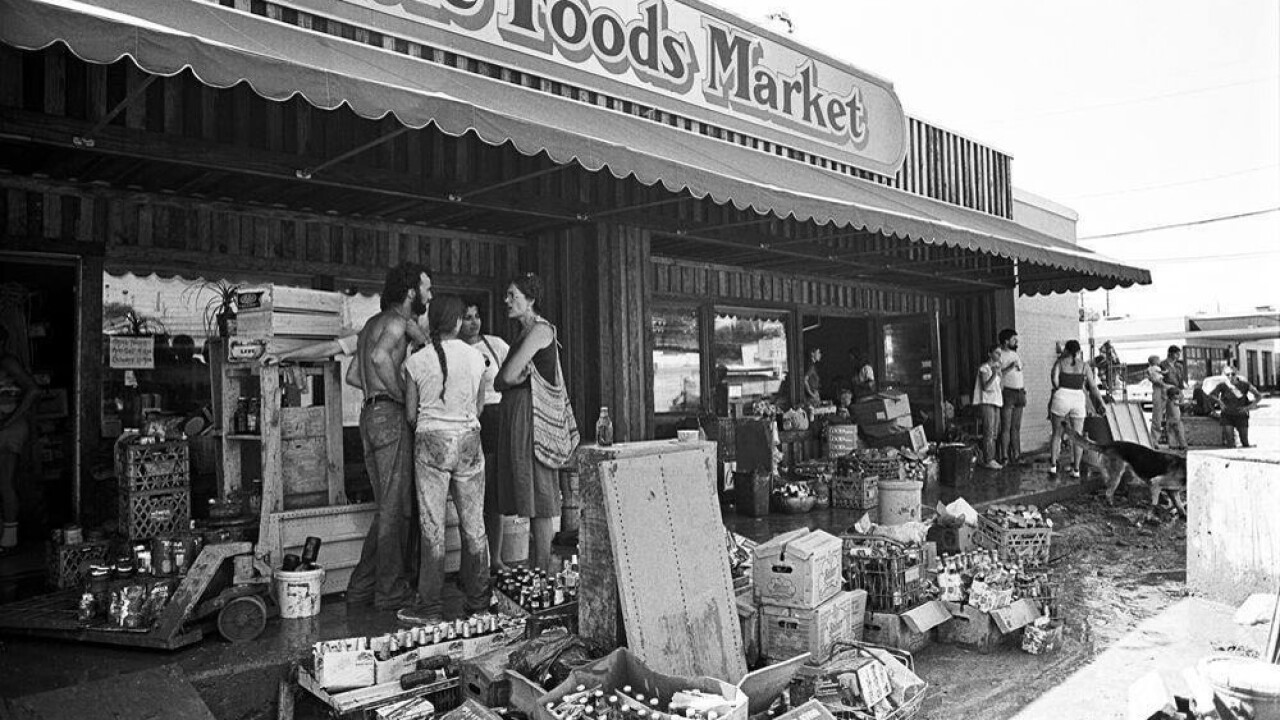

Former employees of the Austin-based City National Bank still recall the 1981 flood that deluged the city and Whole Foods, and they take pride in the lender's role in rescuing what was then a fledgling health food store.

July 3 -

The attack knocked out online banking, mobile banking and the call center at Patelco Credit Union.

July 3 -

Wise, Affirm and Bilt Rewards are among the seven fintechs whose customers' data has gotten tied up in the breach. The number of affected companies is likely to grow.

July 3 -

In this month's roundup of top banking news: a cease-and-desist issued by the Federal Reserve, high CFO turnover, the end of Chevron deference and more.

July 3 -

Funding Circle US fought to win a coveted license to make SBA 7(a) loans only to see its London-based parent company agree to a sale before it could make its first government-guaranteed loan

June 25 -

The Consumer Financial Protection Bureau extended the deadline for lenders with the highest volume of small-business loans to July 18, 2025, and will not assess penalties for reporting errors for a year.

June 25 -

Klarna is looking to get out of one of its key payments businesses after the financial technology giant found the unit created a conflict of interest with peers like Adyen or Stripe.

June 24