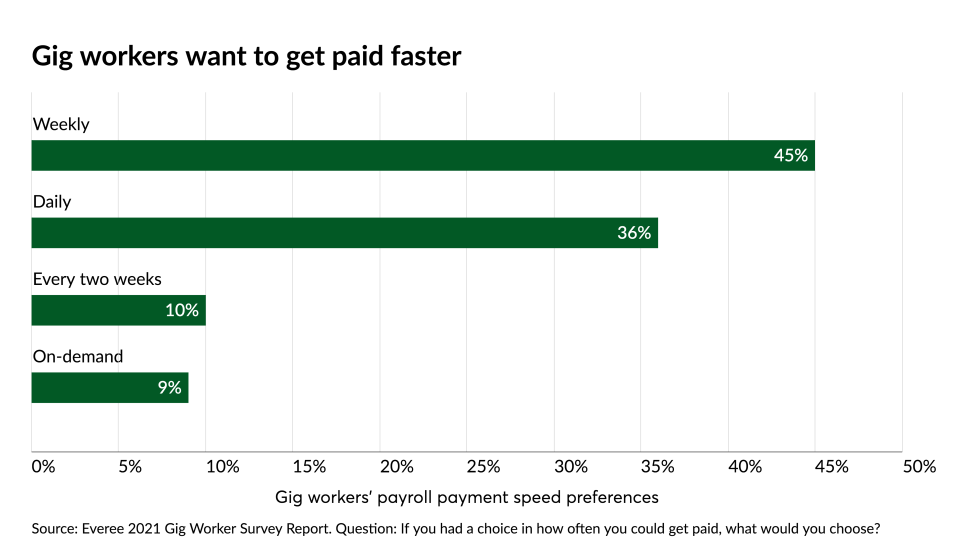

More people are joining the gig economy, and a major driver of this trend — particularly for those working multiple gigs — is a need for faster access to cash to meet expenses.

The gig economy has proven flexible during the pandemic. When ride sharing cooled as fewer consumers traveled, food delivery services exploded. As Airbnb vacation rentals dropped, they were replaced by Airbnb home rentals as newly sequestered workers decided remote work could allow them to trade apartments in New York and Chicago for beach and mountain homes in Florida and Colorado.