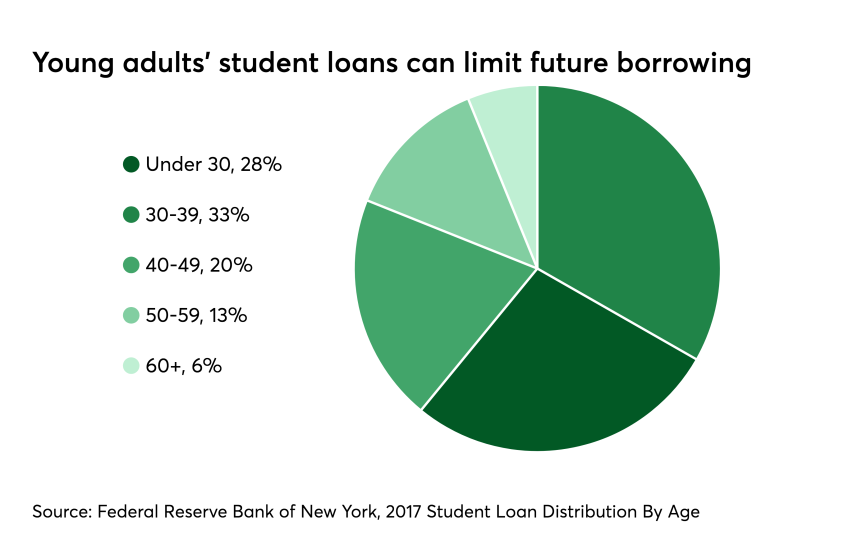

Installment lending, whether it’s online or at the physical point of sale, is a market sector that has been experiencing a global boom in consumer demand for the last several years. Installment loans are different than credit cards since they are not open lines of credit and are typically used for a specific purchase. This can help consumers overcome the stigma of borrowing in certain markets such as Germany, where cash and bank transfers tend to dominate the payments landscape; or in the U.S., where millennials fear amassing unwanted debt.

Is this a short-term trend or are there potentially deeper-rooted factors that could make installment lending, especially online, a major source of future loans? Visa recently announced an