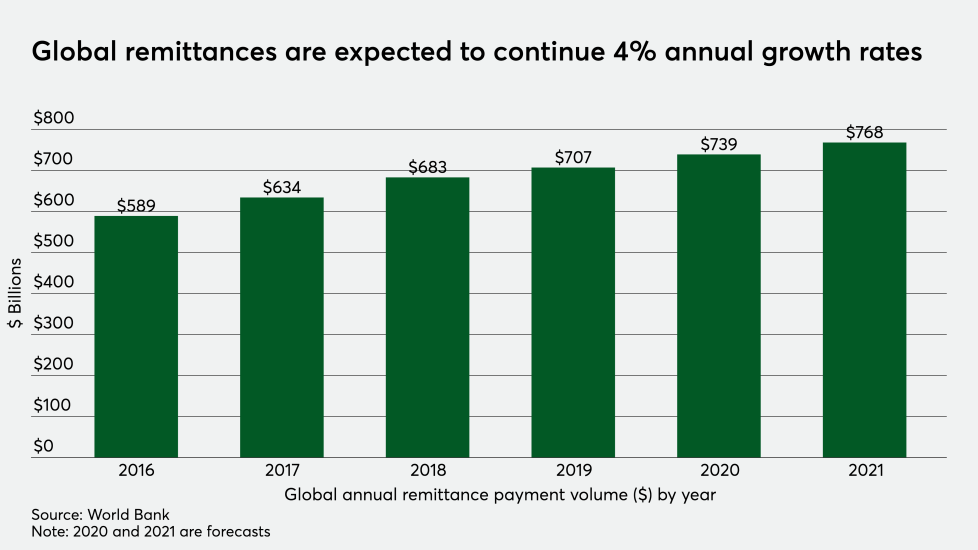

While the size of the global remittances market may ebb and flow with the global economy, one thing is clear – it’s massive, at over $700 billion in payments each year and growing.

As a reference, according to the

Since cross-border remittances affect so many global citizens, both the World Bank and United Nations have initiatives aimed at lowering their cost and improving access. The UN has declared June 16th as the

“Family remittances have a direct impact on the lives of 1 billion people — one out of seven individuals on earth. Added together, remittances are three times greater than Official Development Assistance and surpass Foreign Direct Investment,” said António Guterres, Secretary-General of the UN, in a press release to commemorate the day.