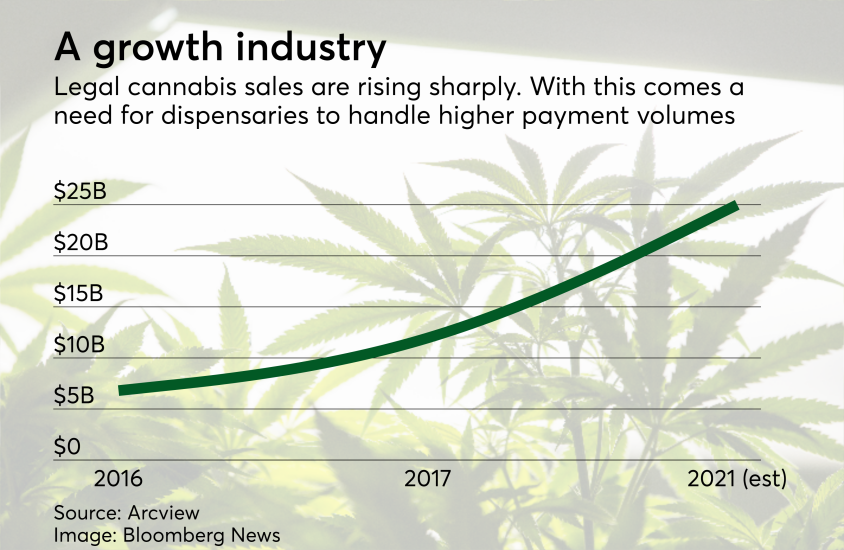

Despite the market's growing legitimacy, many many payment providers remain unwilling to risk working with dispensaries, leading to some inventive workarounds.

This listicle is compiled from reporting by PaymentsSource writers including John Adams, Kate Fitzgerald and David Heun. Click the links in each item to read more.

4/20 is their Black Friday

A huge spike in payments is expected this day. Tracking presale volume against prior years, cannabis technology company

The legal cannabis industry is becoming like any other merchant category, in need of processing variable payment volumes, migrating consumers away from costly payment methods, and tying payments to business functions like marketing and inventory.

"From a B2B standpoint, we see that brands want to capitalize on this holiday in a big way," said Ryan Smith, CEO of LeafLink, a New York-based company that provides order execution, CRM and other services for the cannabis industry.

Cannabis has always been an industry that succeeded in spite of its stigmas. While regulations have loosened in many states, banks largely stay away from providing credit or financial services to dispensaries, forcing them to use alternative payment methods if they don't want to exclusively take cash.

The political climate is also turbulent. On the conservative side of the aisle, Attorney General

It adapts to a rocky regulatory landscape

Part of the issue is regulation — most banks are averse to marijuana's hazy legal footing — but a growing number of workarounds can help make these businesses less cash-based. The problem is these workarounds aren't as seamless as simply paying by credit or debit card at any other store.

“We’re in a gray area and everybody will have to deal with that,” said Eveline Dang, vice president at Cannapay, a vendor to the legal cannabis industry. “In terms of service providers, it’s our job to provide merchants with the right tools and systems and solutions that they will use to make sure they use them properly to be compliant in every way possible.”

Cannapay is part of an emerging category of providers implementing creative ways to make cannabis payments seem more digital than they actually are. The options include cashless ATMs (which initiate transfers when a customer inserts a debit card) and e-checks.

The drawback of these systems is that point of sale technology isn't designed to interact with them, making implementation often seem like assembling a massive jigsaw puzzle.

“POS systems typically are the core of the business with merchant payments, but now the way that POS systems and payment systems work is that it’s like a work around solution,” Dang said.

When a customer makes a purchase, it isn’t directly connected to a payment system. So the merchant has to go into the POS system and manually confirm that the payment was completed. Since most banks don’t work with dispensaries, the merchants have to write out their transactions to avoid discrepancies.

Starbuds, a marijuana store in Denver — where there are

“At this point the industry has kind of gotten used to it,” McCullough said. “Of course we would enjoy to have credit card systems or a way to process them in an easier fashion.”

Banks may be pushed out of the market

However, some companies see this as an opportunity, including Medical Cannabis Payment Solutions, a provider of end-to-end management of medicinal marijuana operations.

If these companies adapt well enough, they may negate the cannabis market's need for traditional banks and payment processors.

The company has announced an upgrade to its site and payment platform in December. The revamped site features a new investor page with updated company news and financial and stock information.

"We have been working for a long time to complete our website and to increase our transparency and provide our customers, partners, investors and the media the information they need in order to understand our best-in-class technology and solutions,” said Jeremy Roberts, Medical Cannabis Payment Solutions' CEO, in a release.

Medical Cannabis Payment Solutions has also rebranded its payment system StateSourced. The company says the product is one of the first purpose-built solutions for cannabis banking that solves cash-handling issues, offers electronic payment and e-commerce features, and provides immediate access to funds while maintaining FinCEN compliance.

Going (almost) digital

This places marketing automation provider

So what does the platform's "Buy Now" button actually do?

At launch, Baker's co-founder and chief product officer David Champion said this: "Currently, the Buy Now button is a fast track to the shopping cart, allowing the customer to quickly add product to their basket and proceed to the last step of the order flow with one click or tap. The payment transaction, for now, still happens during pickup or drop-off."

Cashless ATMs

One idea is the

Customers run transactions at the ATM in the dispensary, which prints out a receipt for the approved transaction. The customer then takes the receipt to the cashier to make a purchase and receive change.

The transaction at the ATM is passed from the customer's bank account to the merchant's bank account via automated clearing house transfers.

Learning from example

First off, this up-and-coming market—which is still illegal under federal law—requires payment companies to have exceptionally strong underwriting, due diligence and risk-management practices. They also need a thorough understanding of applicable laws, regulations and card brand rules. Additionally, it’s critical that they advocate for cannabis merchants proactively and reactively, if issues arise.

“This is how the other high-risk industries have managed to thrive in a high-risk space,” says Anthony L. Ogden, an attorney in Beverly Hills, California, who runs BankCardLaw.com, a provider of legal and consulting services to the payments industry.

Certainly, banks and payment companies operating in, or considering, the cannabis space have special considerations. A lot rides on what stance the Trump administration takes. Despite the substance's illegal status under federal law, the Obama administration decided not to interfere with state laws legalizing cannabis. However, that’s subject to change under a new president who has strongly criticized illegal drug use. Also notable is that Trump’s attorney general pick, Jeff Sessions, is a politician with

“Payment companies are operating in a legal gray area that extends from the Obama administration,” Ogden says.

Compliance is a global problem

The Dutch city is known for its lax laws surrounding soft drugs like cannabis and psychedelic mushrooms. And it’s been that way for several decades. But even still, cannabis companies have trouble landing banking relationships, much

“It’s quite a complex issue just the same as in the States,” said Oliver Margerison, director at Amsterdam Genetics, a producer of cannabis products that are then sold to coffeeshops and dispensaries. “Every cannabis-related company in the Netherlands has or has had issues with banking facilities.”

How much contention with financial institutions is dependent on the sector the business falls in, and whether or not it can be fully honest about its operations, said Margerison.

For instance, coffeeshops which also sell food and drink are categorized as horeca businesses, a sector that also includes restaurants that don’t sell cannabis.

“If you say to the bank you are a coffeeshop, there is no way you will acquire a bank account or any other facilities,” said Margerison. “If you say to a bank you are a horeca company and they do not delve deeper, you most likely will acquire the facilities and once you have received the facilities, it is very difficult for the bank to then retract the facilities if they have not done a full investigation into the company in the first instance.”

This legal loophole allows some cannabis companies to secure bank accounts and accept PIN debit transactions.

The name game

Janell Thompson and Katarina Maloney say choosing the "wrong" name for their company was all it took to run afoul of banks and be labeled as co-owners of a high-risk business.

That name is HempHealthInc.com, an online business that sells cannabis-related products but is not a medical marijuana dispenser. Its name has led to

Thompson and Maloney operate businesses under the names Hookahzz LLC and JKWholesale Inc.

After two years, JPMorgan Chase closed the company's business accounts without specifying a reason, Thompson said, whereas PayPal cited the sale of hemp-related products for not doing business with JKWholesale (

"We know we are caught in Choke Point, but we are not medical marijuana or anything illegal," Thompson said. "We are completely clear legally, but the banks and PayPal don't differentiate it, mainly because of the word hemp in our name."

Some banks are willing to take the risk

And now

Despite this progress, most financial services providers still see compliance as a hurdle. Only about 300 of the more than 11,000 banks currently operating in the U.S. work with legal pot vendors.

“Paradoxically, most of the institutions nationwide that offer business to marijuana suppliers are small and very unhealthy; most are the ones desperate for income,” said Lamine Zarrad, founder and CEO of Tokken, a Denver-based blockchain startup.

The market is welcoming to prepaid cards

In 2014, Cal-Bay International developed the CB Green Card to facilitate purchases of medical and recreational marijuana from licensed dispensaries. It also designed an electronic payment method that could operate on Cal-Bay's payment processing terminal.