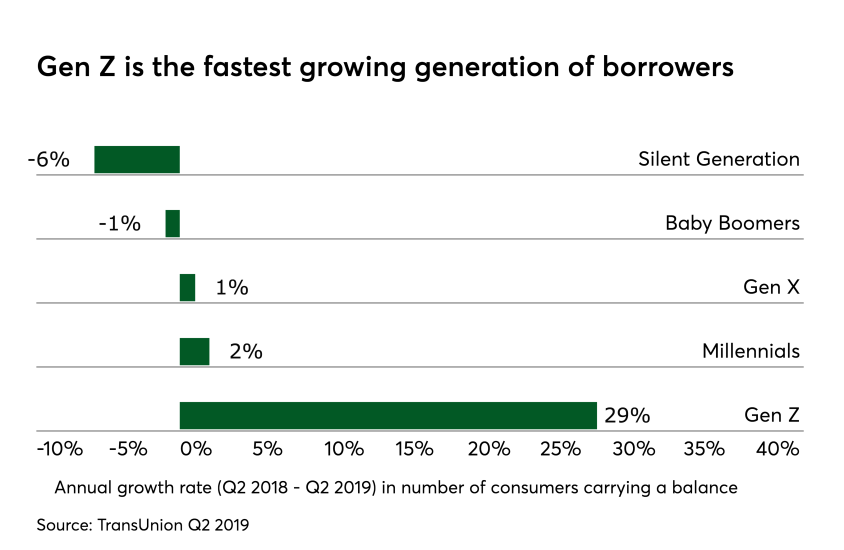

As Gen Z starts entering adulthood, financial institutions are beginning to ask what the new generation wants in terms of lending, and how will they choose to access it? For the executives who’ve been busy serving up financial products to millennials, there is an additional question on everyone’s mind — will this new generation be as slow to adopt credit cards and personal loans as millennials, or is it going to be different?

Gen Z is defined as consumers born between 1995 and 2010, so the oldest are just 24 and the youngest are still in grade school at the ripe age of nine. Millennials, born between 1980 and 1994 range in age between 25 and 39 years.

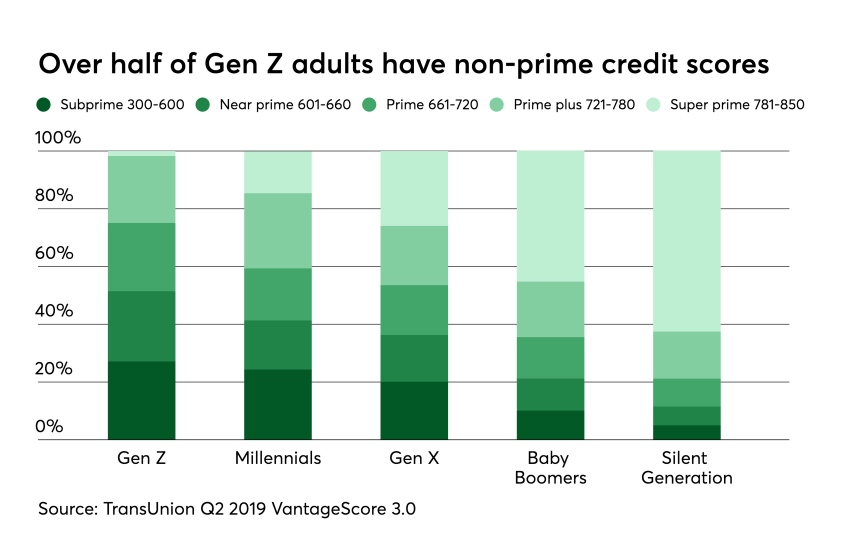

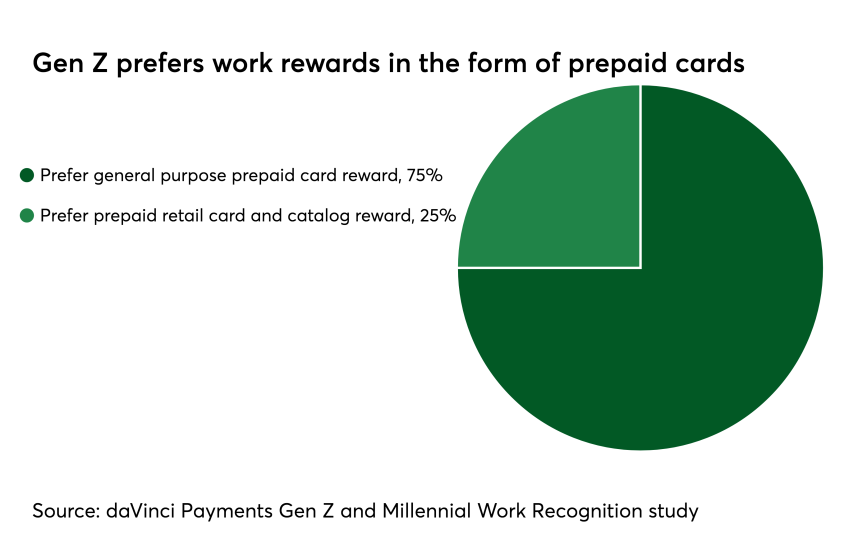

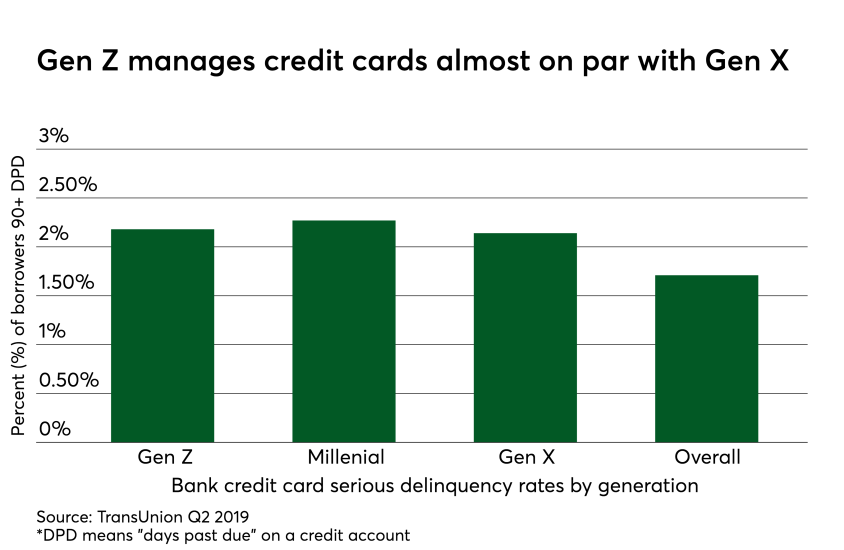

While Gen Z is just beginning to transition into adulthood there are some healthy indicators of how it is approaching credit as well as how it manages debt.