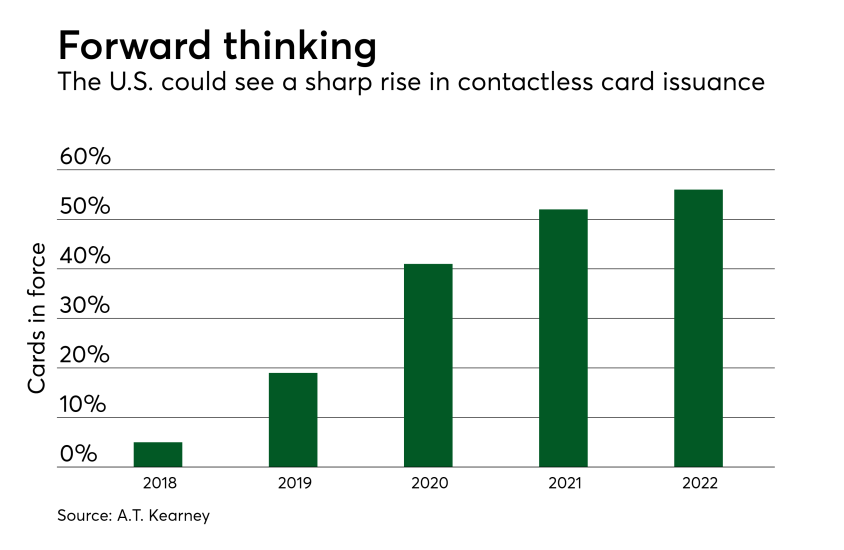

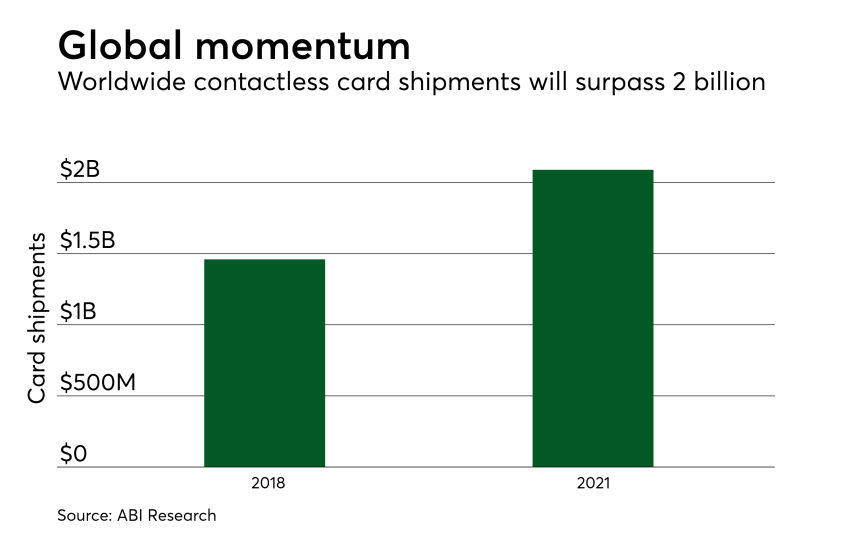

The U.S. may be next to see a surge of contactless credit cards, following other major markets around the world. In many locales similar to the U.S., consumers tap to pay for about 20% of all in-store transactions using Near Field Communication-equipped cards, far surpassing the number of mobile payment users.

But it’s unclear whether enough U.S. consumers are interested in contactless payments for issuers to make the investment.

U.S. issuers previously shied away from contactless cards for several reasons, including the relatively low number of NFC-enabled merchants and the cost of overhauling card portfolios just a few years after the painful 2015 EMV liability shift. But recent moves by key merchants and issuers could spark a change, depending on how consumers respond.