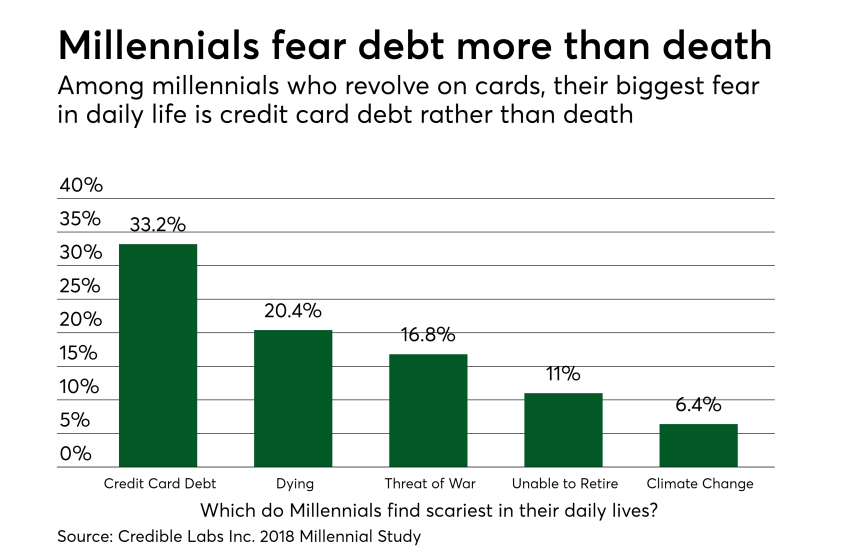

Younger consumers today have a very different view of, and utility for, general purpose bank and private label retail credit cards when compared to older generations. These differences have impacted how banks, card issuers and other financial services businesses serve them as they grow into adulthood, purchase homes and start families.

Millennial spending habits have also led to the growth of the direct lending personal loan industry, which at one time was considered mature. Today, POS installment lending has become one of the hottest sectors in financial services, drawing billions of dollars in capital to existing firms as well as leading to the establishment of major startups such as Affirm, Klarna and more.

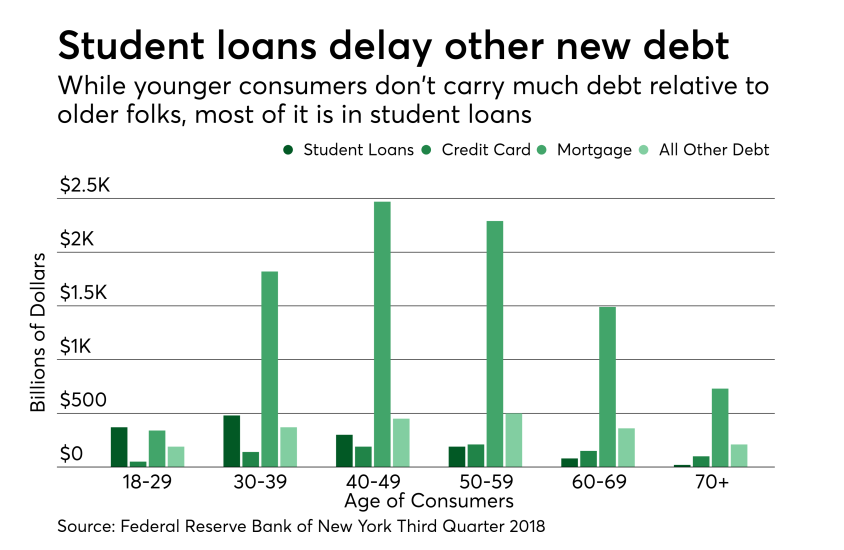

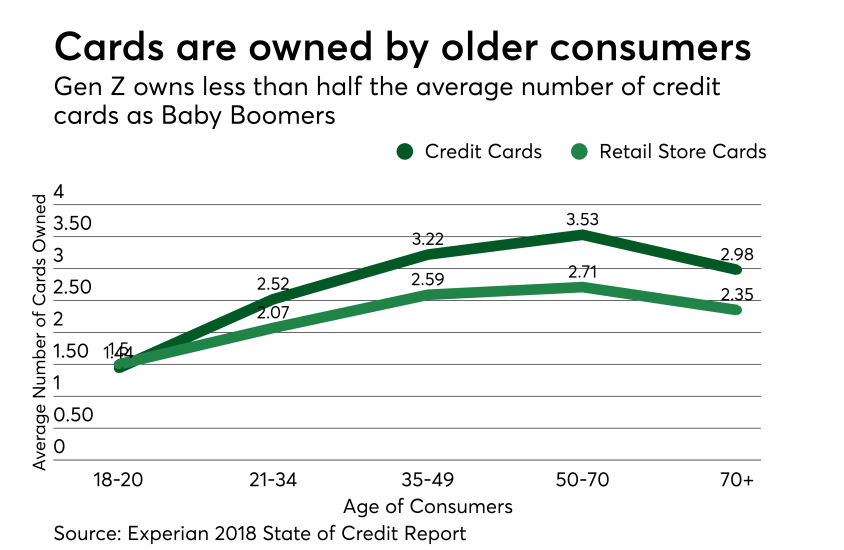

While many factors have contributed to this attitudinal shift away from preferring credit cards at the point of sale, there are two notable ones. The first factor is the explosion of student loans, which are severely burdening America’s youngest adults and their parents. The second factor is the unintentional blowback of the Credit Card Accountability Responsibility and Disclosure Act of 2009, which restricted access to credit cards and permanently changed the business model for banks issuing credit cards, leading them to prefer older, more affluent consumers with established credit.