Mobile payments technology has fallen short of expectations in major markets, particularly the U.S., where less than 10 percent of consumers routinely use devices to pay in stores — despite more than four years of aggressive development from large technology companies and banks.

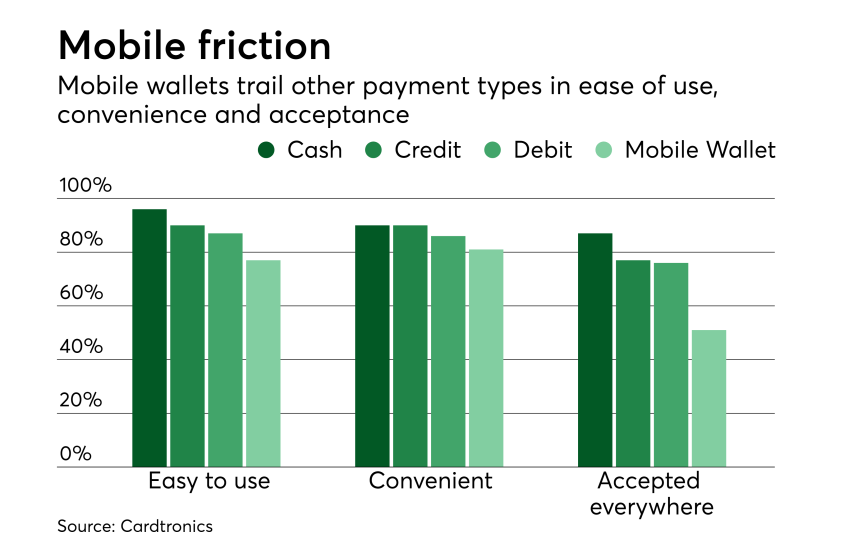

Initial obstacles like the lack of Near Field Communication-enabled devices have been addressed, and merchant acceptance is slowly improving, yet U.S. consumer interest in mobile payments has flatlined, according to many studies.

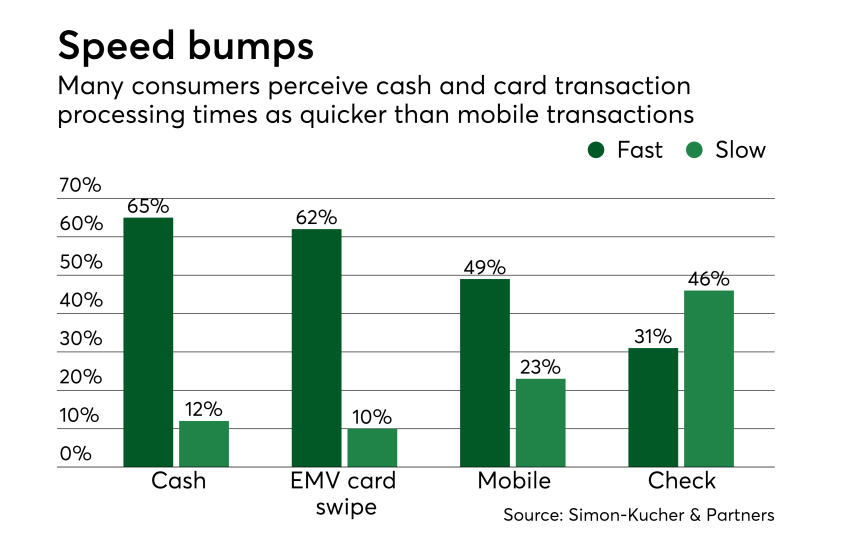

To explore consumers' resistance to adopting new payment methods, some research firms are digging into behavior science. What follows are highlights of what data is revealing about consumers' perceptions versus the reality of mobile payments.