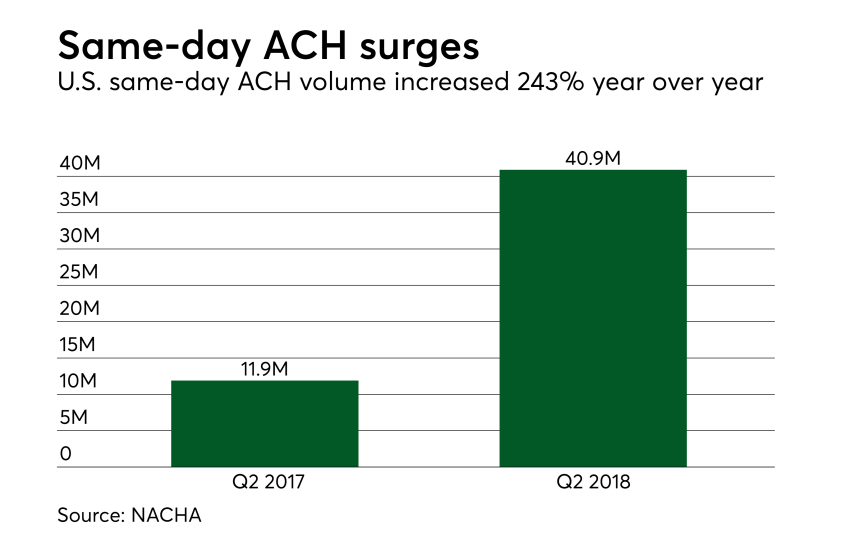

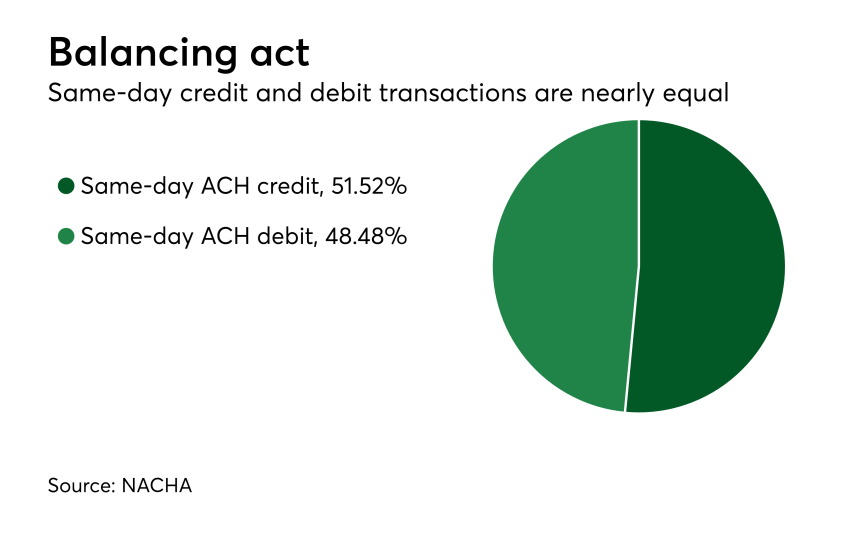

Same-day ACH payments—introduced for credits in 2016 and debits last year—are gaining popularity with banks and corporations. The success prompted Nacha this week to approve new rules for these payments going into effect over the next two years. Speed and access for same-day funds will expand, and per-transaction limits will rise from $25,000 to $100,000.

But many corporations say that’s still not large enough to be very useful.

More than half of U.S. financial institutions have made same-day ACH funds available without seeing any major shifts in fraud, according to Nacha. But some observers warn that as same-day ACH introduces broader access and bigger transactions, it will become a bigger temptation for fraudsters. They urge organizations to improve their account security before the next changes go into effect. Here are some numbers and compliance dates worth noting.