Americans 50 and older are a sizable portion of the U.S. population — 115 million individuals in 2018 and growing to 132 million in 2030, according to Census Bureau data and

Since many of these older Americans are members of large extended families (e.g., parents, grandparents, etc.) their financial situation is oftentimes impacted by those around them. Consider, for example, that 12 percent of people 50 and older have student loans, two-thirds of which were taken out for someone else, such as a child or grandchild (

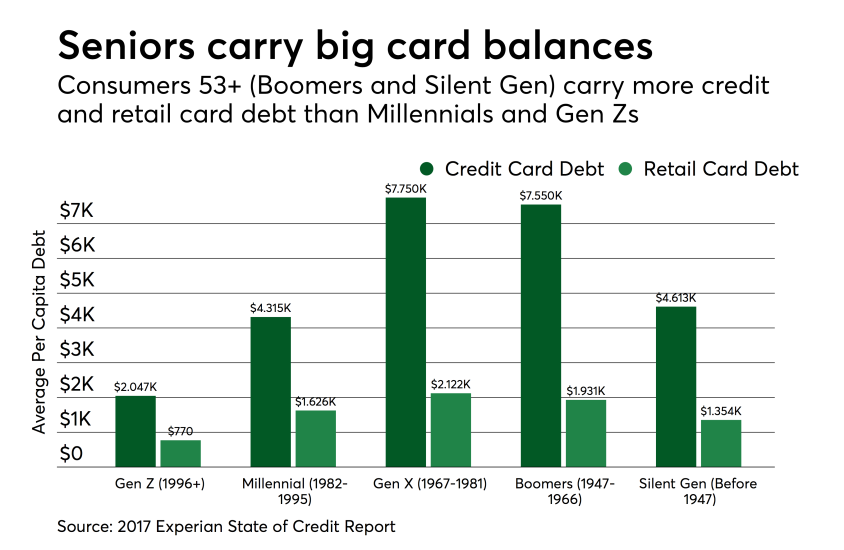

And yet, when it comes to payments research and product innovation, older consumers are often overshadowed by younger generations who have a penchant for technology, social media and their unique approach to payments. The challenge many financial institutions discover as they pursue younger consumers is that they are costly to acquire, have fewer financial assets and hold little to no brand loyalty to their bank. Also, spending too much effort in acquiring new customers can leave an institution vulnerable to losing its more profitable, long-term clients — many of whom tend to be older.