Shaking it up

Suppressing cash is simply the first step. Through the Astor Place location's use of kiosks and a text messaging system that replaces the pagers it uses at other locations to let patrons know an order is ready, Shake Shack can greatly deepen its relationship with each customer while also slashing its own operational costs.

The typical

Almost all of this process is removed in the company's new model, which relies on kiosks or a mobile device and — crucially — collects the customer's phone number as part of the ordering process so that it can send a text alert when the food is ready.

Going cashierless

It's developing a shopping model that uses cameras to recognize the items that consumers are buying, then handle the payment without human intervention. Standard Cognition got a shot in the arm this month via a $5 million investment that will help the company deploy its technology faster. Charles River Ventures led the round with participation from Initialized Capital, Y Combinator and several smaller firms and angels.

Including this round, the company has raised $6M to date. It has already hired engineers and business staff to expand programming and sales efforts.

The company hopes these new resources will accelerate its timetable, with new plans to have stores up and running by the spring of 2018, or about six months out. It is demonstrating the technology at its facility in Santa Clara and is in "advanced talks" with retailers about full deployment. It did not name its clients, but said it should be ready to make announcements in a few months.

"We have a lab that's up and running, so you can see some of the technology in its development state, but a lot of it is further along," said Michael Suswal, co-founder and chief operating officer of Standard Cognition.

High-risk merchants

The Joint, which has a location in Tacoma, has experienced some challenges with cashless ATMs, but it hasn't pulled the plug.

“It’s kind of a complicated process, there’s a lot of steps as an employee, there’s a lot of buttons that you have to push,” said Eben Shay, an employee at The Joint.

However, Shay noted that more and more of his customers are using the store’s month-old cashless ATM, and that The Joint is getting more business because of it.

“It was just more ways to accept money, which just means more business for us,” Shay said. “I wouldn’t say the majority of the people use the cashless machine, but we have seen an increase week by week.”

But for Alden Linn, owner of World of Weed, it became a hassle.

“Having extra devices at the cashwrap took up valuable sales space,” Linn wrote in an email. “The time to check out was longer because of the missing integration with the POS. Lastly, the fees being charged at the cashwrap caused pushback from customers.”

Frequent flyers

The travel industry is a key vertical that’s driving new use cases and growth as airlines and other suppliers shift paper-based travel vouchers and reimbursements to debit push payments, she said.

“What’s nice about this business model is we’re not competing against similar providers as much as we’re competing against checks, paychecks and certificates, and it’s a big pie,” Turner said.

Mastercard is also in the midst of dozens of

The largest recent initiatives include New York, where the MTA's eTix mobile app, a partnership with Masabi, is used on Long Island Railroad and Metro North trains. In the first three months of deployment, the app was used by more than 280,000 riders and now accounts for 8% of ticket sales for both LIRR and Metro North. In Bogota, Colombia, Mastercard introduced an open debit card to pay fares on more than 10,000 buses, with more than 20 million trips purchased in the first year. Mastercard has also partnered with

Amazon Cash

The feature allows cash-carrying consumers to add funds to their Amazon.com balance by presenting a bar code to a cashier at a network of partner retailers. Users tell the clerk how much cash to add, between $15 and $500 at once, and the funds arrive instantly in an Amazon.com stored-value account.

Systems like this are not new, and earlier models relied on consumers setting up a cash load online and then presenting a printed receipt, as was the case when

Besides bearing similarities to Walmart's Pay with Cash service, Amazon Cash also resembles PayPal's

"It's a bit of a defeat for PayPal, which is increasingly catering to the needs of the unbanked and would had loved to do a deal with Amazon to enable the unbanked to purchase there," said Rick Oglesby, president of AZ Payments Group.

Amazon Cash also shares traits with

Marketing move

The company describes it as a “call to action for small business restaurants, cafés or food truck owners,” with Visa offering up to $10,000 per business that commits to rejecting cash from its customers.

Visa is planning to launch the “cashless challenge” other countries, with

The U.K. recently hit a retail payments inflection point: For the

The speed and convenience of contactless, combined with other use cases such as mass transit with the massively successful TfL Oyster Card, have been seen as catalytic in this success.

Mobile's time to shine

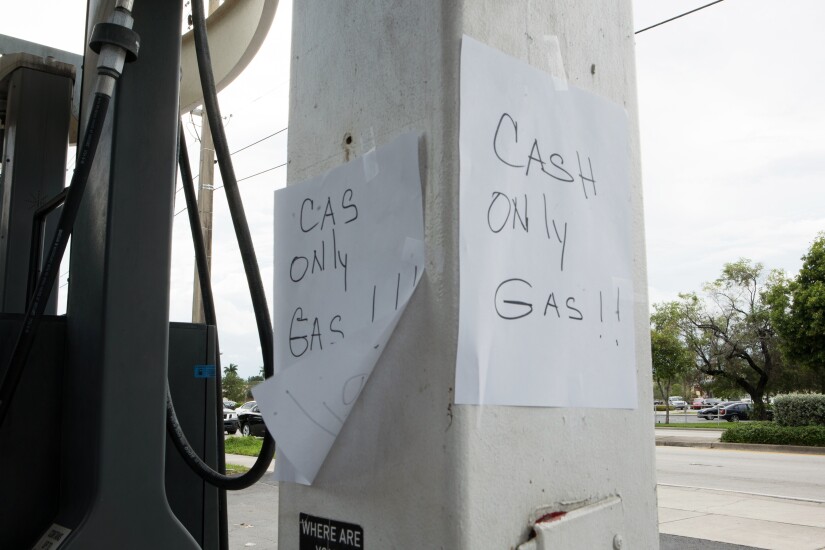

From there, First Data set up to distribute tens of thousands of its Clover Go mobile card acceptance devices in Hurricane Harvey's footprint in FEMA-designated zones, said Dan Charron, executive vice president of global business solutions for First Data.

"The biggest thing is to be able to accept payments and get up and running to do commerce, even if a store's infrastructure isn't working," Charron said. First Data is distributing free Clover Go mobile readers and waiving minimum monthly fees for the next six months for nonclients. It is also giving away Clover Go readers to current clients whose hardware was destroyed.

About 99% of

Hurricane Maria prompted a similar response in Puerto Rico, where companies such as mobile point of sale provider CardFlight and payment processor Dynamics Payments worked to get merchants up and running as soon as possible.