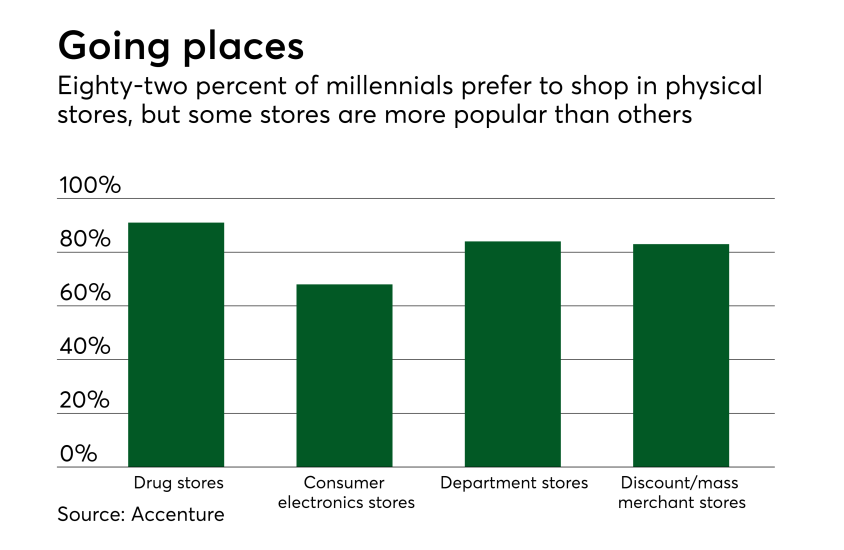

Retail is more digital than ever, but that doesn't mean that smartphones and wearable devices have taken over holiday shopping.

Across all age groups, many consumers still prefer shopping in stores for various reasons. But even when going into a brick-and-mortar store, these consumers don't leave their digital habits behind; many still prefer to pay by mobile or wearable when the option presents itself.