Much is made of the U.S. e-commerce market given the influence of

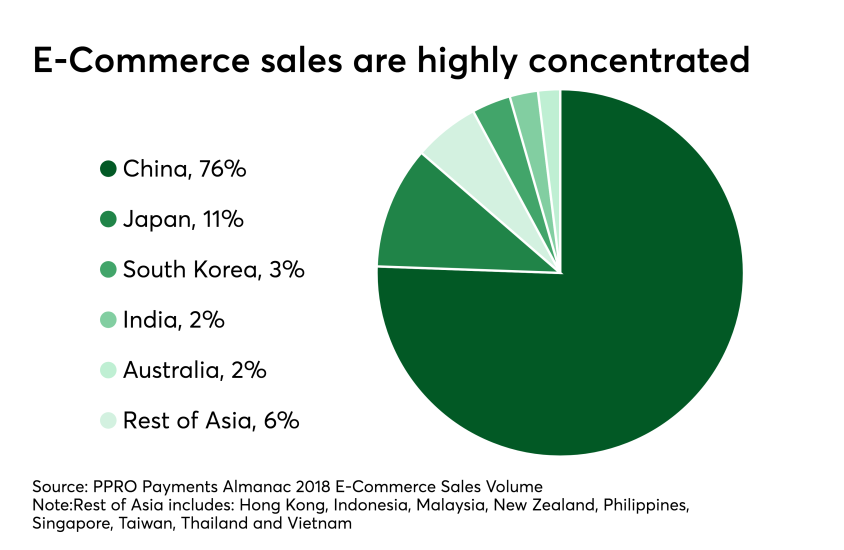

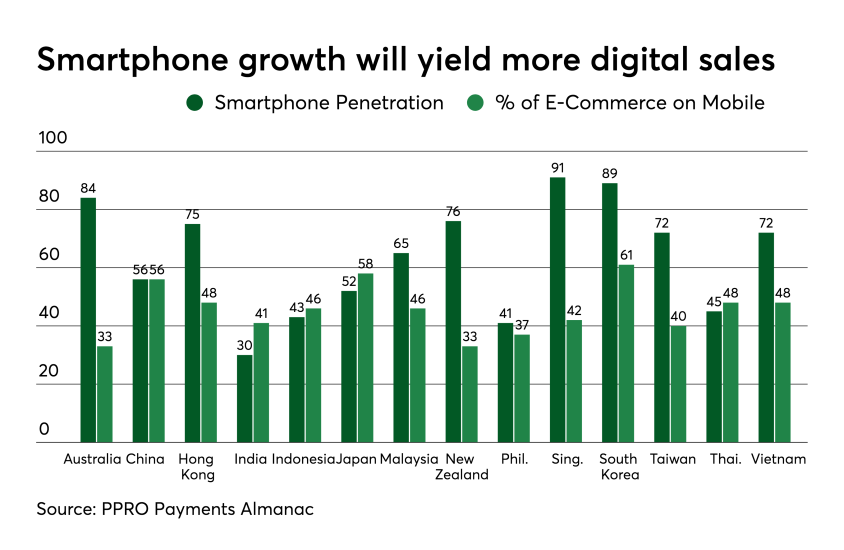

E-commerce volume for the U.S. was approximately $742 billion in 2017, and for the five largest European countries the category rang up a collective $473 billion according to the PPRO Payments Almanac. In comparison, the Asia Pacific region experienced a collective sales volume of $1.36 trillion – almost double the U.S. market.

Three Asian countries — China, India, and Indonesia — hold almost half of the world’s population, according to the