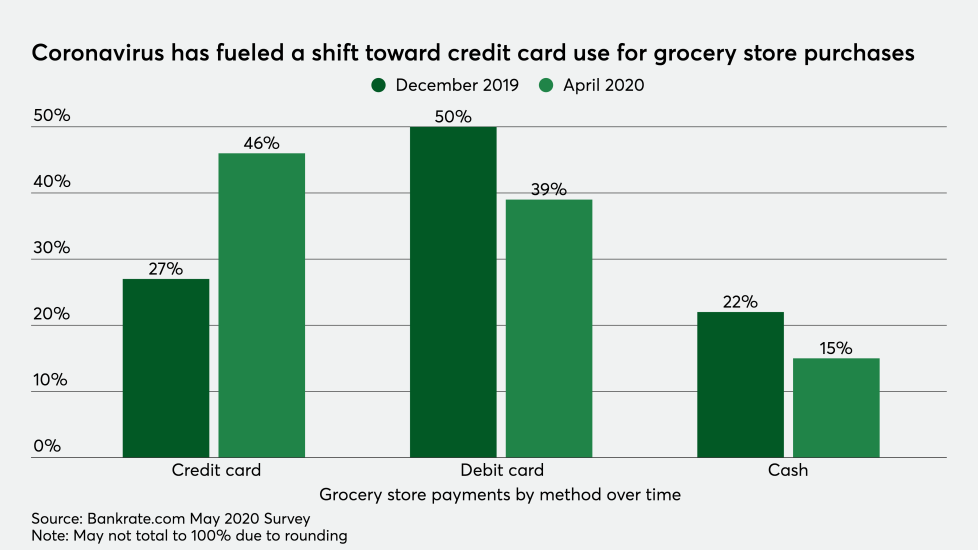

The coronavirus pandemic has had an immediate impact on a wide swath of consumer spending habits and payment choices — some of which may remain in place for some time after the crisis subsides — as certain categories such as travel have fallen to the wayside and others such as grocery stores have risen as more consumers eat meals at home.

Other coronavirus-fueled fears are weighing heavily on the grocery shopping and restaurant take-out experience, to address fears about contracting coronavirus by touching payment terminals or handling of physical

Finally, as consumers shop in the few categories that continue to remain open during lockdowns or are beginning phased re-openings, banks and card issuers are adjusting to the “new normal” where what was once “everyday” spend on gas and groceries, which have razor thin