Being unbanked can be downright expensive, as many households use alternative financial solution providers such as payday lenders that can charge exorbitant fees for financial services. Additionally, in the current pandemic those who rely on cash are being further frustrated, as fewer merchants want to handle paper bills.

“Since the COVID-19 pandemic began, we’ve seen a huge shift to digital payments — for many, it makes more sense right now to order items online that you’d traditionally buy in-store with cash, or to purchase groceries in advance and then pick them up curbside,” said Brad Hanson, president and CEO of Meta Financial Group and co-president and CEO of MetaBank. “Many of us take these conveniences for granted, but for millions of Americans who rely on cash it’s not that easy, and may leave them more vulnerable."

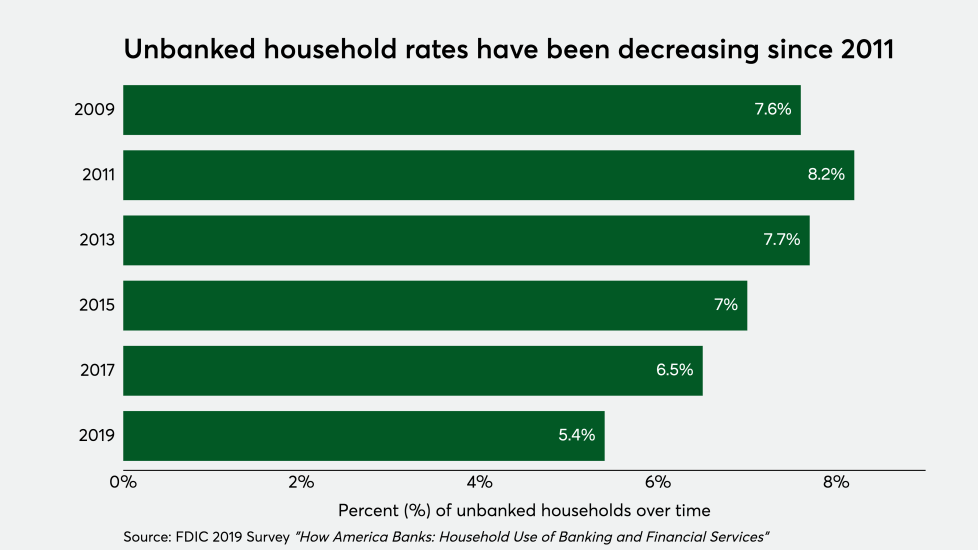

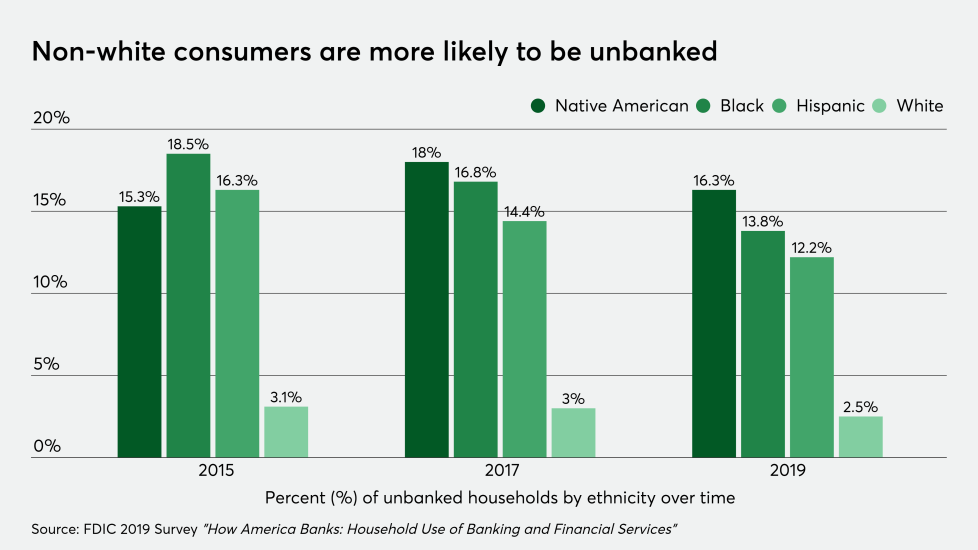

Improvements have been made in reducing the number of unbanked households over the past few years, but progress hasn't been even across different communities. There are also new obstacles coming to light, as COVID-19 drives more banks and consumers to digital channels to acquire and service new financial products.