-

Stories about data breaches, fraud and one neobank were reader favorites this year.

December 29 -

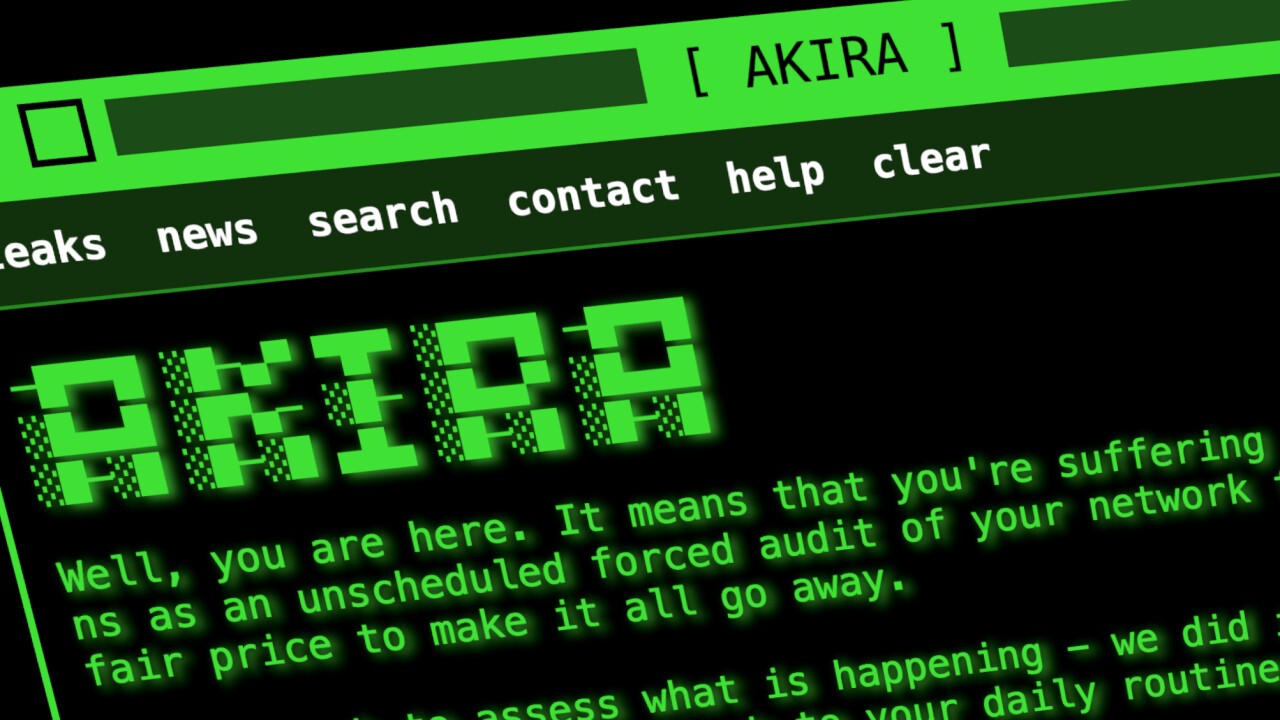

From credit bureaus to software providers, 2025 saw attackers bypass bank defenses by targeting the supply chain and using social engineering.

December 26 -

Banks are beginning to engage with decentralized financial infrastructure. But until lawmakers create a foundation for allowing legally recognized entities like LLCs and nonprofits to govern these networks, compliance burdens will hinder full adoption.

December 26

-

CodeBoxx Academy is filling a void for banks and other companies that desperately need AI experts. Peret's time behind bars uniquely informed how he runs the school, he says.

December 25 -

The card network and bank technology seller partnered to expand AI protocols, while British payment companies face tougher fee disclosures but looser rules for contactless transactions. That and more in the American Banker global payments and fintech roundup.

December 24 -

Fifty-four individuals tied to the Tren de Aragua gang face charges for using Ploutus malware to drain millions from community banks and credit unions.

December 23 -

ServiceNow, with its largest-yet M&A deal, will fold Armis' threat prevention services into its larger cybersecurity suite.

December 23 -

An American Banker survey found that bankers think the industry isn't prepared for growth in artificial intelligence and digital assets.

December 23 -

Noelle Acheson shares her top 4 stablecoin trends of 2025 and what they taught us about the changing nature of money.

December 23 -

The Swedish financial institution has developed an open standard that allows merchants' products to be catalogued and discovered by AI agents. It was designed to complement Stripe and OpenAI's Agentic Commerce Protocol.

December 19