-

Despite further delays, the country has taken two key steps to opening up access to its Real-Time Rail, including allowing payment companies to participate without a bank partner, but it has yet to commit to a date for the project to go live.

March 25 -

A key bank stock index ticked up after the Federal Reserve hinted that it could lower rates later this year. But there are still a number of economic uncertainties that are holding shareholders back.

March 20 -

At an American Bankers Association event, Sen. Jon Tester, D-Mont., who's up for reelection this year, said that he hopes the Durbin-Marshall credit card bill won't go anywhere and criticized the Federal Reserve's debit interchange proposal.

March 20 -

The fast-food chain is analyzing the cause of an issue that affected payments in multiple countries. Separately, dLocal, a payments processor in Uraguay, is making changes at the top.

March 20 -

Banks are proceeding with caution as a new generation of AI tools arises.

March 19 -

Thomas Halpin, who heads global cash management for North America, talks about real-time processing, generative AI, central bank digital currencies and why the ISO 20022 messaging standard is cool.

March 19 -

Credit card late fees are annoying, but that's why they work as a disincentive to prevent late payments. By making them much smaller, the CFPB will actually be working against the interests of low-income consumers.

March 19

-

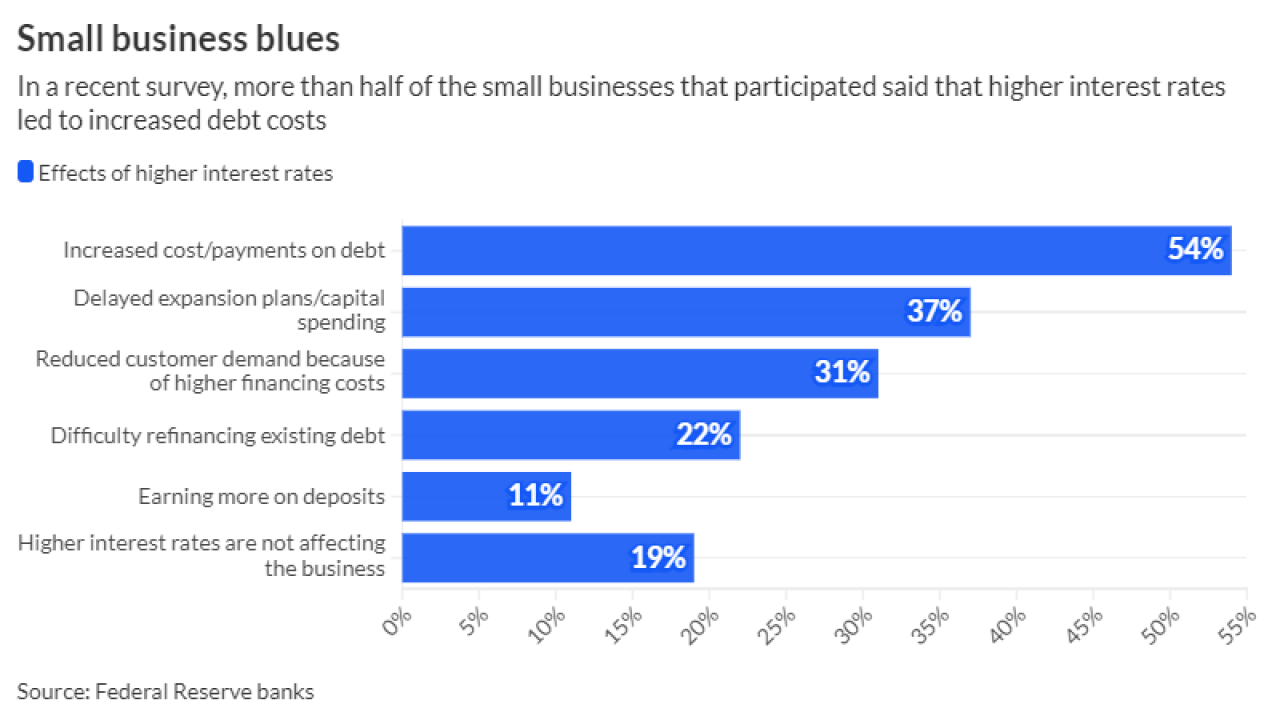

Some 54% of small businesses said in a recent survey that elevated rates had led to higher debt payments. And in a sign that loan demand remains soft, 37% reported delaying expansion plans or capital spending.

March 18 -

The U.K. is considering a bill that would let banks and payment service providers put suspicious-looking peer-to-peer payments on hold for up to four days to conduct security reviews; Giesecke+Devrient is working with Brazil's central bank to develop an offline payment approach to a central bank digital currency; and more in global payments news this week.

March 13 -

Midsize lenders have largely defied the most dire predictions following Silicon Valley Bank's demise. But the nation's largest banks still have structural advantages, and the regionals remain hampered by their real-estate heavy portfolios and the continuing impact of high interest rates.

March 11