-

The Sacramento-area institution moved quickly and decisively to fill the gap created by the loss of First Republic and Silicon Valley Bank. A first-quarter rise in Bay Area deposits is a sign of bigger gains to come, San Francisco Bay Area President DJ Kurtze says.

July 8 -

The fate of Capital One's acquisition of Discover should be determined based on its own merits and not be maligned for the foibles of other failed banks.

July 5

-

Circle, Stripe and Coindesk all make moves to add scale for digital asset transactions.

July 3 -

Even as more transactions go fully digital via apps and devices, one card manufacturer is betting that metal payment cards have a long-term future as status symbols — and secure payment devices.

July 1 -

Large and regional banks again proved their resiliency in the Fed's annual exams. But analysts noted that a few lenders faced some negative surprises — a development that may scuttle investor hopes for share buybacks by those banks.

June 27 -

Banks and financial institutions face a barrage of lawsuits from consumers alleging they failed to investigate inaccurate information on a credit report. Industry blames the uptick in litigation on social media sites and the proliferation of credit repair companies.

June 26 -

The Consumer Financial Protection Bureau's attacks on credit card reward programs don't square with the fact that the vast majority of consumers are very satisfied with their service.

June 24

-

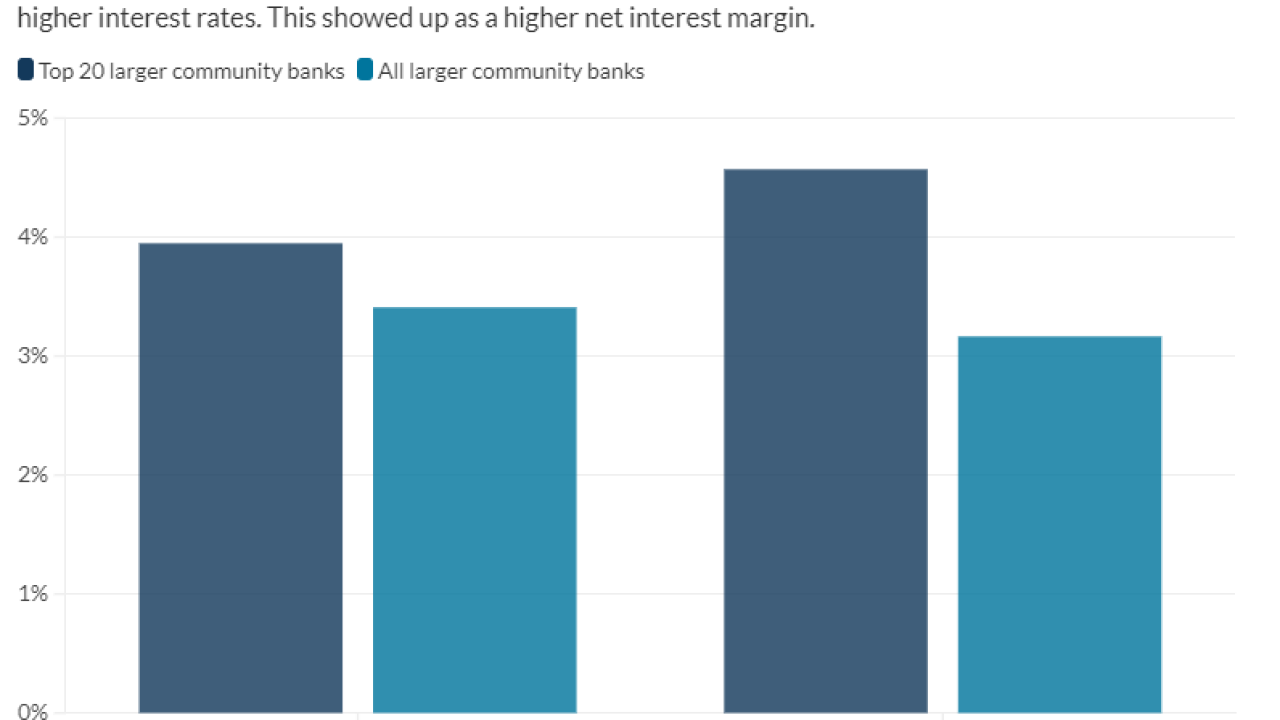

The best-performing larger Main Street Banks, those in the $2 billion to $10 billion asset class, were asset sensitive, a position that worked to their advantage as rates continued to climb in 2023.

June 23 -

U.K. banks are testing machines that can accept deposits from multiple machines.

June 21 -

The Biden administration should widen the scope of its junk fee initiatives and provide small- and medium-size businesses with relief from excessive international payments charges.

June 19