-

This year's honorees are women under 40 who have demonstrated a strong talent for leadership and an expertise in their respective fields. They also took on crucial responsibilities to help their organizations navigate the complexities of the pandemic, and set their companies on a path for continued growth.

May 6 -

Many of the 15 executives selected for our Most Powerful Women in Banking: Next list are in roles that took on outsize importance in a year punctuated by a global pandemic, economic free fall and widespread protests over police brutality and racial inequality.

May 6 -

While German consumers prefer using cash in stores and are accustomed to paying for products after delivery, the global nature of e-commerce is sparking a change in payment habits.

May 3 -

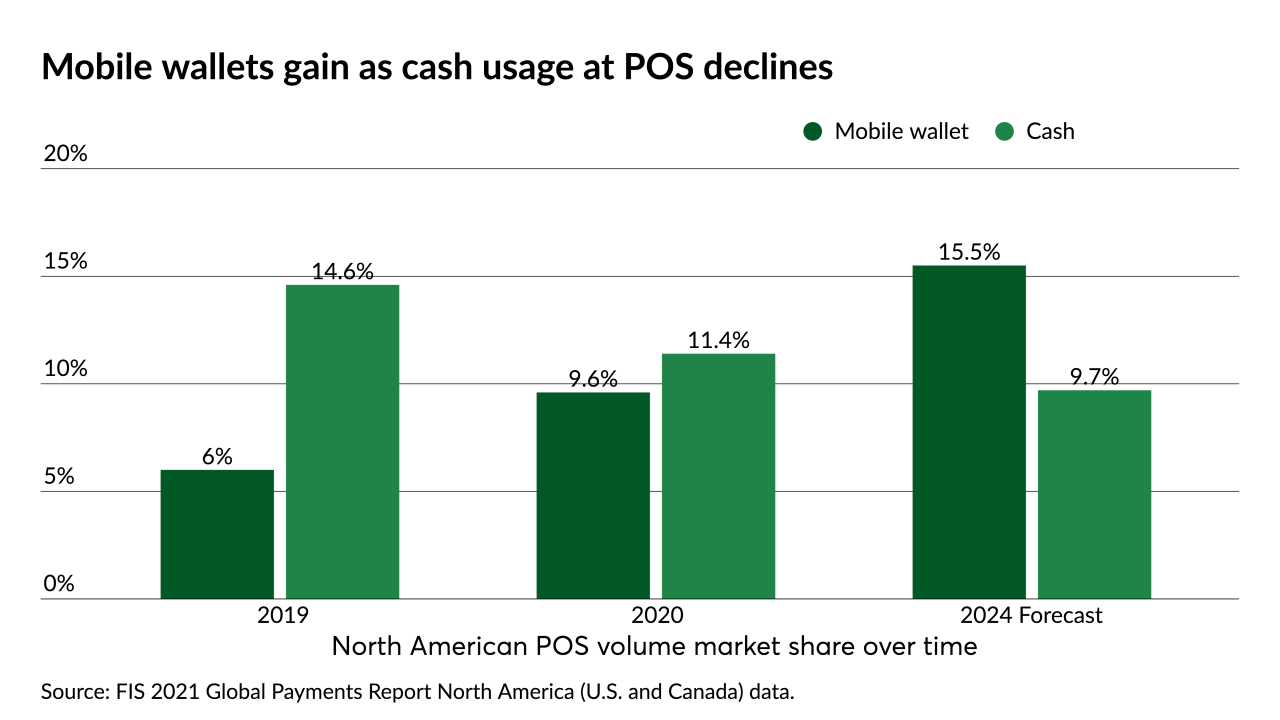

Mobile wallets have seen strong adoption as an in-store payment method in China, but have lagged in appeal in the U.S. until recently. Coronavirus fears have caused many Americans to rethink the mobile wallet’s value proposition.

April 26 -

Deposits keep flooding in, mortgage lending shows signs of cooling, and bankers can’t agree on when commercial lending will rebound. Here’s what we learned from first-quarter results.

April 25 -

From Coinbase and Grab to Affirm, technology companies are expanding their payments operations — and picking up billions of dollars in public listings.

April 21 -

Amid success stories like Apple Pay, Google Pay and the Starbucks app, there are many wallet apps that failed to gain traction — or squandered it when they did. But there is a lot to learn from their experiences.

April 16 -

When it was launched a year ago, the program was criticized for glitches and a focus on larger borrowers. Since then technical improvements have been made, smaller loans have been prioritized, and other changes favored by lenders have been implemented.

April 13 -

Walmart, Amazon, Facebook, Apple and Google are just a few of the non-financial companies that are using scale and innovation to compete in financial services.

April 12 -

Nonbanks claimed more of the top slots based on loan volume, while the origination gains experienced by Hispanic, Black and Native American borrowers were weaker than those of other groups.

April 9 -

In his annual message to investors, the JPMorgan Chase CEO said Big Tech and fintechs are "here to stay" and vowed to be aggressive in taking on these new challengers. He also predicted that the economy would take off this year, but said capital rules prevented banks from doing more to help blunt the impact of the pandemic recession.

April 7 -

Regulators are likely to scrap the Office of the Comptroller of the Currency’s divisive rule and instead pursue an interagency framework. But stakeholders commenting on a Federal Reserve draft plan say several aspects of the OCC regulation are worth keeping.

April 4 -

Where Goldman, Citi, JPMorgan are putting their fintech investments; CFPB poised to reinstate tough stance on payday lenders; refi downturn means no more 'lazy mode' for mortgage lenders; and more from this week's most-read stories.

April 2 -

Top executives from the 49 companies that earned a spot in this year's ranking of the Best Fintechs to Work For cite the need for nimble shifts in business strategy, leadership style and recruiting tactics among the lessons they took away from the challenges of the coronavirus crisis.

March 31 -

Top executives from the 49 companies that earned a spot in this year's ranking of the Best Fintechs to Work For cite the need for nimble shifts in business strategy, leadership style and recruiting tactics among the lessons they took away from the challenges of the coronavirus crisis.

March 31 -

Despite Japan being a heavily cash-based economy, e-commerce has created significant opportunities for banks and mobile wallet providers.

March 31 -

Activist investors are pressuring big banks to further curtail lending to the fossil-fuel industry, undergo so-called racial-equity audits and disclose more about their lobbying practices and financing of nuclear weapons manufacturers.

March 30 -

Exploring whether PPP runoff will expose revenue weakness at banks; Citi, BNY Mellon earn top grades for transparency on how they pay women and employees of color; three new candidates emerge to head OCC; and more from this week's most-read stories.

March 26 -

The country has lots of smartphones, few plastic cards, and it's just starting to get rid of cash.

March 26 -

Twelve months after the public health emergency began, executives say it forced them to reexamine where employees work, retail strategies, office layouts and more.

March 22