-

As 2018 draws to a close, here's one more look at some of the year's most interesting stories and a glance at what 2019 may have in store for credit unions.

December 31 -

Despite years of advancements in mobile and online payments, the physical point of sale remains still ripe for disruption.

December 31 -

The year saw anxiety over how banks would respond to record consumer debt, disruptive glitches at TD Bank and SunTrust, ongoing scandal at Wells Fargo, and much, much more.

December 30 -

With the government shutdown set to extend into 2019, a growing number of credit unions are putting together offers to aid members impacted by furloughs.

December 28 -

Another look at how credit unions across the country are making a difference during "the most wonderful time of the year."

December 28 -

Nearly all new payments technologies strive to become as ubiquitous — and as secure — as possible. It's a goal that is harder than ever to achieve.

December 28 -

Readers this year responded to Mick Mulvaney's leadership at the Consumer Financial Protection Bureau, the banking industry's role in the national gun debate, Rep. Maxine Waters' upcoming leadership of the Financial Services Committee, the influence of tech companies like Facebook and Amazon on financial services and much more.

December 27 -

Here's a look at some of the industry’s latest hires and promotions, along with credit union employees who were recognized for their work.

December 27 -

Credit unions are having a positive impact by doing everything from shredding thousands of pounds of paper to building their 492nd home for a family.

December 26 -

The mortgage industry heads into 2019 with little relief from the market strains of the past three years. To succeed — or at least survive — lenders must confront major questions about demand, affordability and market consolidation.

December 26 -

Younger consumers today have a very different view of, and utility for, general purpose bank and private label retail credit cards when compared to older generations.

December 26 -

It was a year to remember for women executives at SunTrust and Amex’s new CEO, and one to forget for Wells Fargo and investors in bank stocks.

December 25 -

With the holiday season in full swing, a number of credit unions are making their communities a bit brighter.

December 24 -

From making cybersecurity a priority to enhanced biometrics, here's what's on the industry's wish list this holiday season.

December 24 -

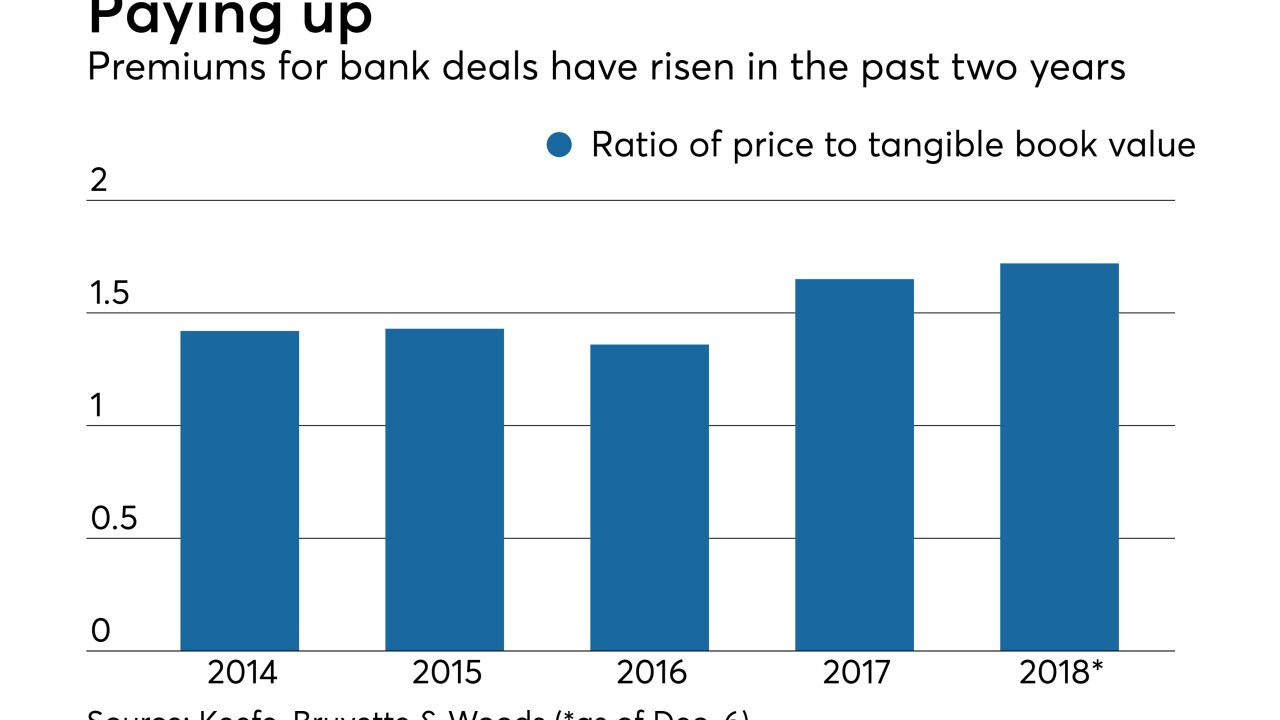

A big splash by Fifth Third, a bid by WSFS to reinvent itself and some bold long-distance expansions highlighted a year where deal activity held steady but premiums rose.

December 23 -

Bankers cry foul over Robinhood's checking and savings accounts; Amazon, Google, Apple and PayPal are at odds with big banks over Fed's role in faster payments; Kraninger scraps plan to rebrand CFPB; and more from this week's most-read stories.

December 21 -

Credit unions are often quick to help their members and communities during times of crisis. This includes providing special loan rates and other relief when federal employees go without pay.

December 21 -

Readers respond to one fintech startup's tough talk, debate failed plans to change the Consumer Financial Protection Bureau's name, weigh reforms to the Community Reinvestment Act and more.

December 20 -

The Massachusetts senator and critic of Trump administration policies sent the new CFPB director an expansive list of to-do items for her first month on the job.

December 20 -

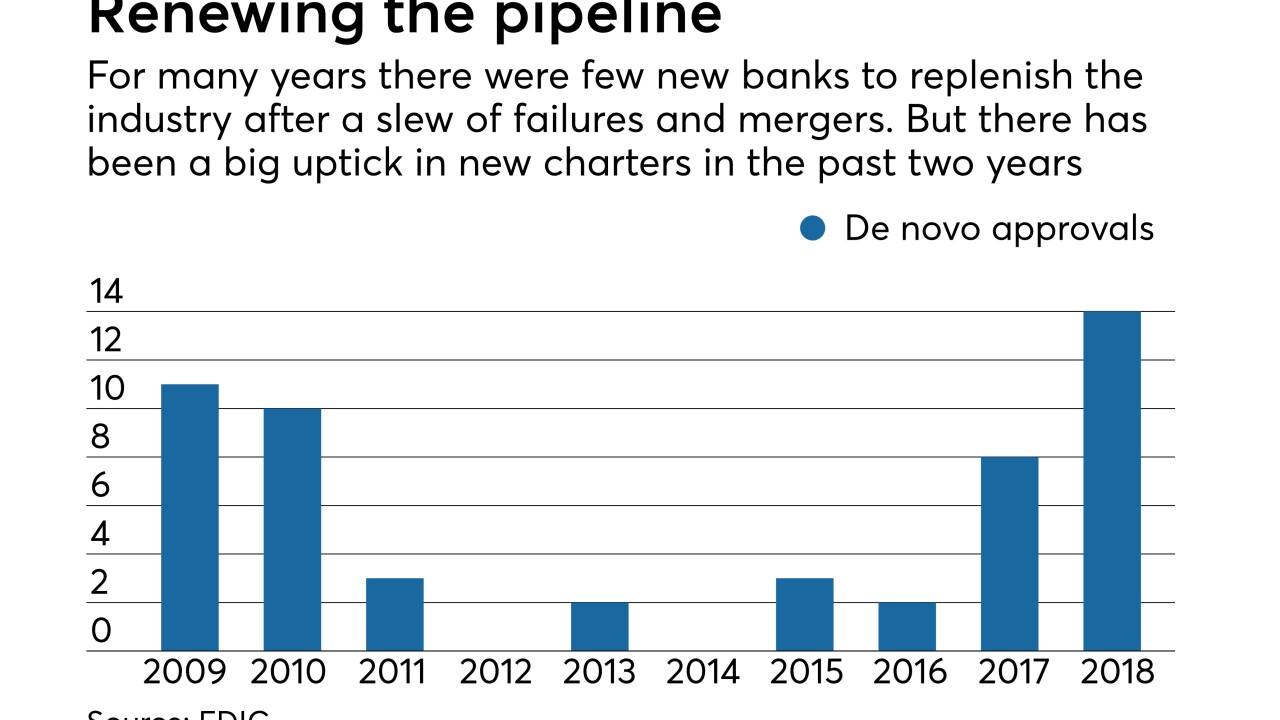

The FDIC has approved more new banks this year than in the last four years combined. Here is a look at the class of 2018.

December 20