-

Readers weigh the BB&T-SunTrust deal, consider how a new accounting standard could affect Fannie Mae and Freddie Mac, debate the impact of the government shutdown on credit histories and more.

February 14 -

JPMorgan's blockchain effort could lead to solutions that overcome industry skepticism and regulatory concerns and perhaps attract more mainstream retail interest.

February 14 -

The government-sponsored enterprises are going through a transition period. From proposals for rebuilding their capital cushions to tackling shortages in affordable housing, Fannie Mae and Freddie Mac face a number of key challenges with wide-ranging consequences this year.

February 14 -

From branch management all the way to a spot on a Federal Reserve panel, credit union executives are making big career moves.

February 14 -

The private equity acquisition of the fintech vendor Ellie Mae will give it some breathing room in a declining originations market because it will have a more patient and strategic investor than its myriad shareholders as a public company.

February 13 -

Industry observers will be closely monitoring Mark Calabria's testimony before the Senate Banking Committee on Thursday for hints about how the Trump administration plans to proceed on mortgage finance reform.

February 13 -

While consumer spending on Valentine’s Day doesn’t approach that of the larger holidays, certain retailers — such as jewelers and florists — benefit more than others, while restaurants, bars and other dining establishments tend to see significantly more traffic for those couples who want an evening out. Increasingly, it’s also a special day for pets.

February 13 -

A number of credit unions across the country have made hires and announced promotions, including to their mortgage teams.

February 12 -

From expanding branch access in underserved areas to a cafe for kids and more, here's another look at credit union outreach efforts.

February 11 -

Venture capital-backed fintech funding surged 120% in 2018. Following is a summary of fintech milestones and potential future moves for the industry.

February 10 -

Wide coverage of the mega-deal between BB&T and SunTrust; GSE reform, CFPB underwriting rule are on collision course; Swift showing more swagger in its rivalry with Ripple; and more from this week's most-read stories.

February 8 -

Readers respond to the Consumer Financial Protection Bureau's overhaul of its payday loans rule, debate reforms to Fannie Mae and Freddie Mac, consider regulatory exemptions for regional banks and more.

February 7 -

SunTrust’s merger with BB&T is the largest bank deal since the financial crisis, and mortgages will play a critical role in the execution of this transaction.

February 7 -

A number of credit unions, including Direct Federal Credit Union, have appointed new executives.

February 7 -

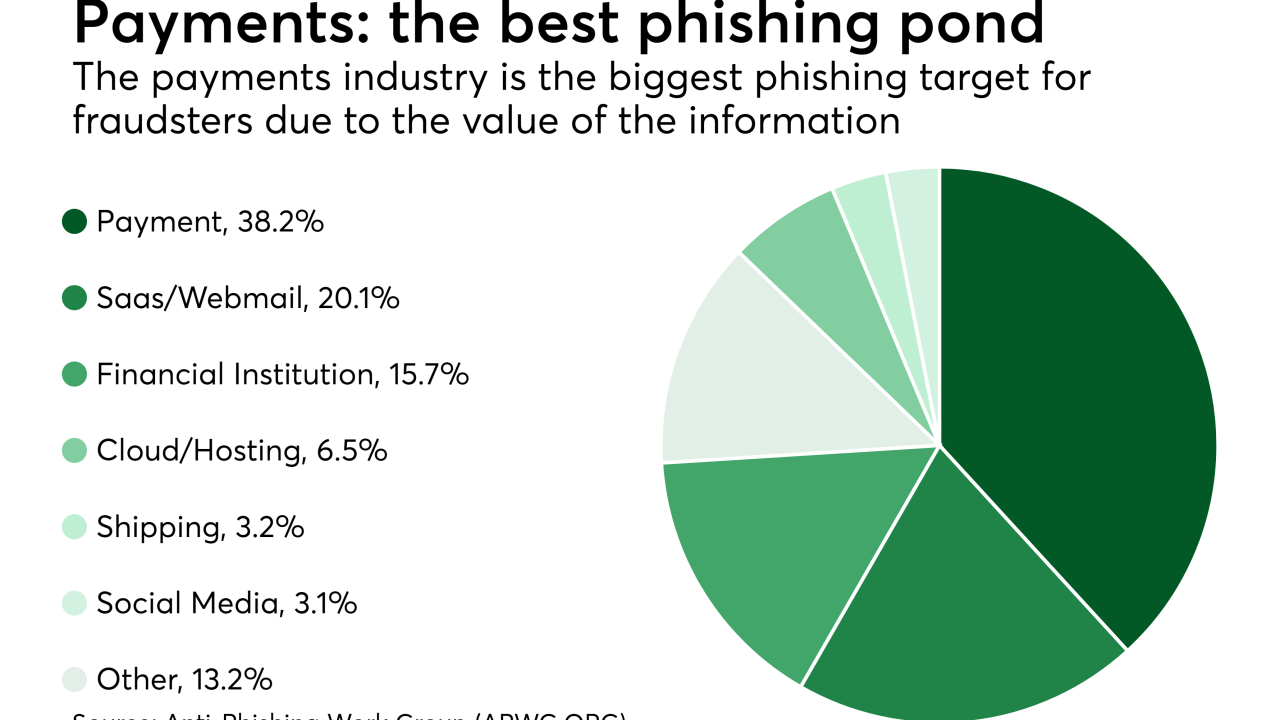

Today phishing scams have become so elaborate that they can take a variety of forms, including a phony job interview.

February 7 -

Volume was steady, but deal values would've been the lowest in years if not for one big, and very intriguing, transaction.

February 5 -

The division of the Indiana Credit Union League, along with CUs and other industry organizations, has made a number of new hires and promotions.

February 5 -

From local accolades to big donations and going to great lengths for financial literacy, here's a look at how credit unions are giving back.

February 4 -

Large banks made appointments in key technology and niche lending roles, while leadership shifts are underway at several community banks.

February 3 -

Banks spend heavily on marketing to win deposits, push digital; Wells Fargo bends to critics in its latest response to scandals; FDIC review of brokered deposits has big implications for branches; and more from this week's most-read stories.

February 1