-

Wells Fargo buys $14B of delinquent mortgages tied to pandemic; CFPB launches investigation of Quicken Loans real estate affiliate Rocket Homes Real Estate; Truist accelerates cost-cutting plans; and more from this week’s most-read stories.

July 17 -

From affordable housing policy to GSE conservatorship, the next president will wield a heavy influence on mortgage and housing policies.

July 17 -

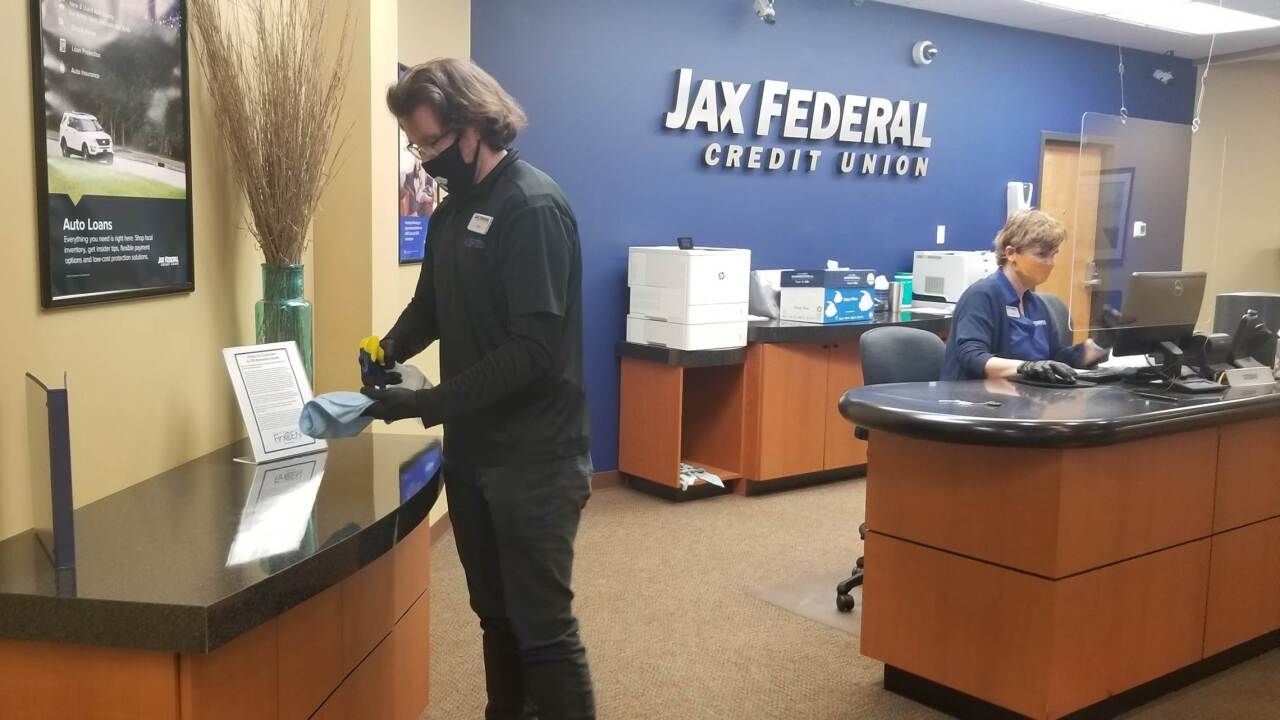

The coronavirus pandemic has cast a shadow over the use of cash, which is often perceived as dirty because it frequently changes hands and is almost never washed.

July 17 -

Policymakers have eased some rules and the Supreme Court recently dealt a blow to the Consumer Financial Protection Bureau. But as the landmark legislation approaches its 10th anniversary, the post-crisis regulatory regime has stayed largely intact.

July 13 -

New president of Promontory Interfinancial Network says recession will cause "hundreds" of nonbank disruptors to fail; lenders face dilemma over offering Main Street loans to noncustomers; PNC Financial expands, diversifies executive leadership team; and more from this week’s most-read stories.

July 11 -

Traditionally, consumers take summer vacations to recharge from the hustle and bustle of daily life, as well as to reconnect with families and friends, before moving on to the next phase of their lives such as the restart of schools or going back to work – but not this year.

July 10 -

The National Credit Union Administration's first-quarter look at credit union performance by state includes several metrics where the industry did not fare well.

July 10 -

As PPP enters forgiveness phase, some banks see outsourcing as best move; after the Fed’s stress tests, Wells Fargo to cut dividend while other big banks boost capital buffer; Supreme Court strikes down CFPB leadership structure; and more from this week’s most-read stories.

July 2 -

The report from the regulator offers an industry-wide look at how credit unions have fared during the pandemic. Since the outbreak worsened in April and into May, credit quality could possibly worsen while earnings may sag even further.

July 2 -

Bank consolidation has been stagnant since the pandemic hit, and the outlook for the rest of the year is bleak.

June 29 -

Wells Fargo customers targeted with phishing attacks using calendar invites; Fed freezes stock buybacks, caps dividends after stress test results; Citigroup names Titi Cole its head of global operations and fraud prevention.

June 26 -

Amazon's Dash devices were an early, blunt take on the internet of things. But over the years Amazon has gradually phased out its Dash product line in favor of voice-based Alexa shopping and other alternatives.

June 26 -

The outbreak has completely upended whatever expectations the industry had heading into 2020. Here's key areas that have been shaped by the pandemic, some potentially forever.

June 24 -

A global health crisis. Economic free fall. A reckoning over racism and inequality. We will not be the same after this — and neither will banking.

June 23 -

JPMorgan Chase, Fifth Third, Truist among banks closing early to observe Juneteenth; inside the OCC's effort to extract $37.5M from former Wells Fargo execs; banks are at a loss what to do with record amount of funds; and more from this week's most-read stories.

June 19 -

The murder of George Floyd shocked the national psyche to its core, spotlighting the persistent, systemic racism that exists in many American institutions, which continues to disenfranchise those who live within the Black community.

June 19 -

PNC open to deal that would boost assets to $700 billion; banks take hard line against accountants seeking fees for PPP referrals; rush to online banking during coronavirus has hackers salivating, bureau says; and more from this week's most-read stories.

June 12 -

The immediate lockdown of the nation’s economy in response to attempts to flatten the coronavirus infection curve has had a widespread impact on the revenues of all businesses, particularly small ones that are more susceptible to economic disruptions.

June 11 -

Big banks call for blanket forgiveness of PPP loans under $150,000; Wells Fargo struggling to stay under asset cap amid pandemic, CEO says; banks are getting aggressive — and creative — to boost profits; and more from this week's most-read stories.

June 5 -

The global coronavirus outbreak has up-ended daily life for many consumers, including where they shop and how they pay for things. The U.K. is no exception, as issues of health and hygiene have now been introduced as important factors when it comes to both planned and impulse shopping.

June 2