-

The Consumer Financial Protection Bureau has seen a rapid drop in the effectiveness of its cybersecurity program, according to a new report from the Fed's Office of Inspector General.

November 3 -

The U.K. bank's "Scam Intelligence" tool uses Google's Gemini to analyze images and texts for red flags, aiming to reduce losses from authorized push payment fraud.

October 30 -

The global financial services company is providing BaaS infrastructure to the digital asset branch of investment platform WisdomTree.

October 28 -

Banks should seize the opportunity to assert themselves as a key partner for consumers when it comes to verifying their identities across multiple platforms and services.

October 27

-

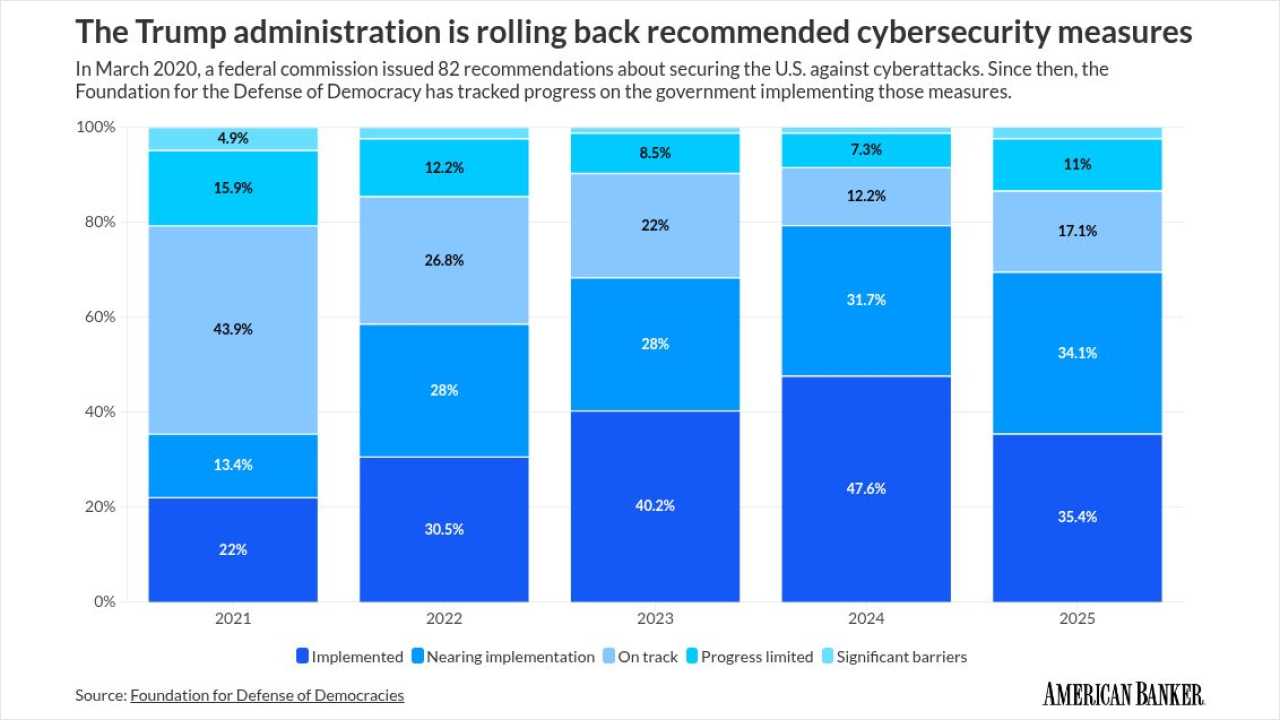

A think tank report details setbacks in U.S. cyber strategy, from shuttered partnerships and staff cuts to the expiration of key info-sharing laws.

October 24 -

The bank asks a federal court to toss claims from five certified classes, arguing victims have been paid and that fraudsters are included in the suit.

October 23 -

New guidance outlines specific due diligence and oversight steps banks must take, reinforcing that they are ultimately accountable for vendor failures.

October 21 -

Coordinated sanctions target two networks behind so-called pig butchering scams, human trafficking and money laundering for North Korean cybercrime groups.

October 17 -

During cybersecurity awareness month (October), financial institutions have ramped up education on phishing, fraud and cyber hygiene. Here's what they're saying.

October 15 -

A new survey finds that fraud losses have jumped significantly in the last year, with digital channels and check fraud posing the biggest threats.

October 9