-

An analysis of 13 comment letters from the financial industry highlights the most important changes banks want to see to rules proposed by CISA.

July 17 -

In this edition of American Banker's news quiz, catch yourself up on the latest news surrounding Project 2025, Patelco Credit Union's cybersecurity breach, fines against Citigroup and Fifth Third and more.

July 15 -

The four lawsuits allege that attackers stole members' Social Security numbers, among other data. Patelco has not yet confirmed whether any data was stolen.

July 11 -

In June's roundup of top tech news: U.S. Bank partnered with Greenlight to provide financial education resources, ransomware group LockBit released data belonging to Evolve Bank & Trust, banks consider the merits of open-source and closed-source generative AI and more.

July 5 -

The attack knocked out online banking, mobile banking and the call center at Patelco Credit Union.

July 3 -

Wise, Affirm and Bilt Rewards are among the seven fintechs whose customers' data has gotten tied up in the breach. The number of affected companies is likely to grow.

July 3 -

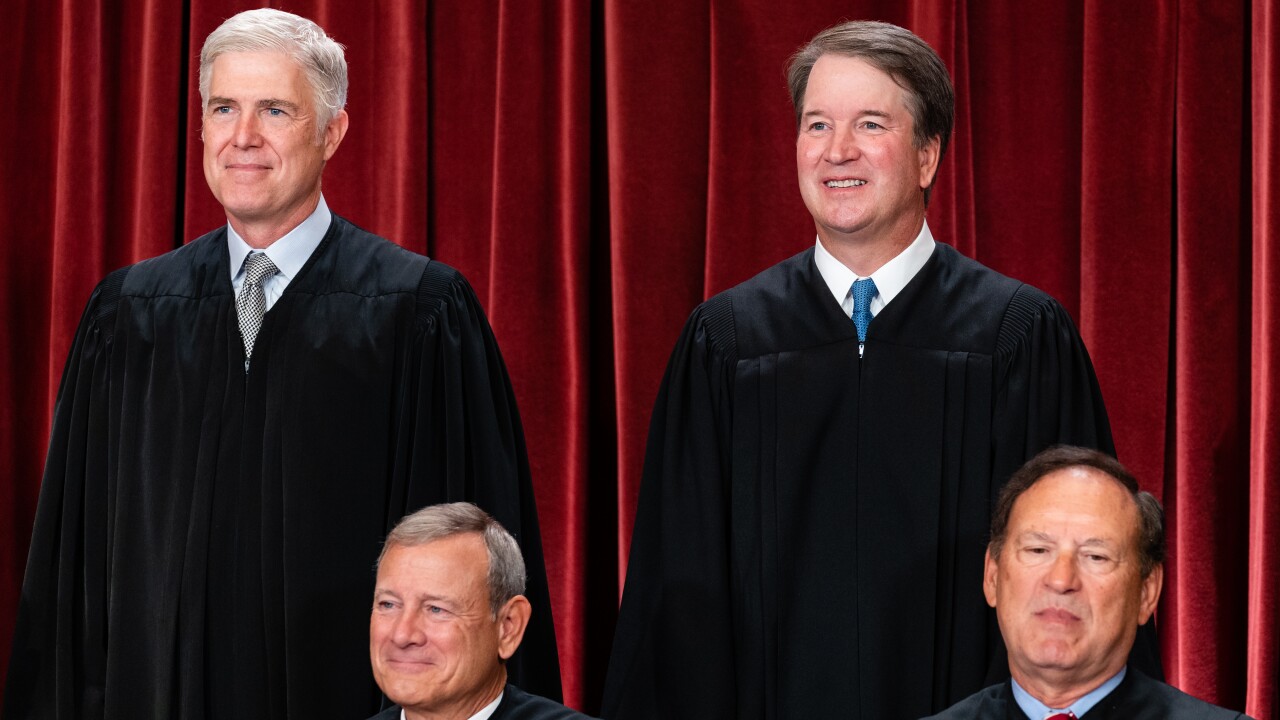

In this month's roundup of top banking news: a cease-and-desist issued by the Federal Reserve, high CFO turnover, the end of Chevron deference and more.

July 3 -

The bank has seen positive returns expanding its national branch network, but it is contending with fraudsters who are increasingly targeting branches.

July 1 -

In this edition of American Banker's news quiz, test yourself on the Synapse bankruptcy, the growth of alleged violations of the Fair Credit Reporting Act, Funding Circle's sale of U.S.-based assets and more.

July 1 -

The trade groups said Friday that a proposed rule from CISA would burden firms with overly broad reporting requirements as they scramble to respond to incidents.

June 28