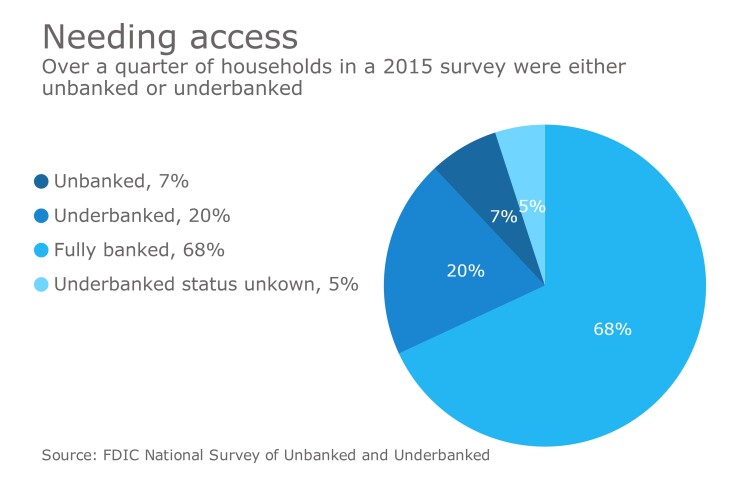

In 2015, a

Yet financial institutions globally are serving more people than ever. A

A common trait among the underbanked, regardless of their country, is their reliance on mobile access more than online or in-person contact. Interestingly though, new financial infrastructure that meets this mobile-focused profile in many cases is being designed and constructed in developing nations more readily than in developed nations. Developing nations, after all, are building the infrastructure from scratch rather than retrofitting legacy systems.

Take India, for example. Unlike people in the United States, many Indians have never owned a personal computer. Therefore, mobile is the primary channel for Indian financial institutions to reach a far-flung population, particularly in rural areas. In fact, in India there are

To be sure, the use of mobile banking is also growing in the United States. A recent Bank of America report found that

In 2015, Pew Research found that although

Mobile banking is clearly an increasingly popular way for consumers to bank, as well as a platform for financial institutions to demonstrate their innovative capabilities. However, financial institutions in developed nations need to remember that for some individuals, mobile is the only way to bank.

When U.S. banks are developing products and services, they need to regard mobile as a standalone offering and not just a complement to their in-branch and online capabilities. A new online tool that can only be fully accessed via computer will not let mobile-only customers experience the product or service like other clients with computer access. Instead, banks should take a page from their developing-world counterparts and recognize mobile as a key driver of accessibility and a means of increasing financial opportunity for all consumers.