-

-

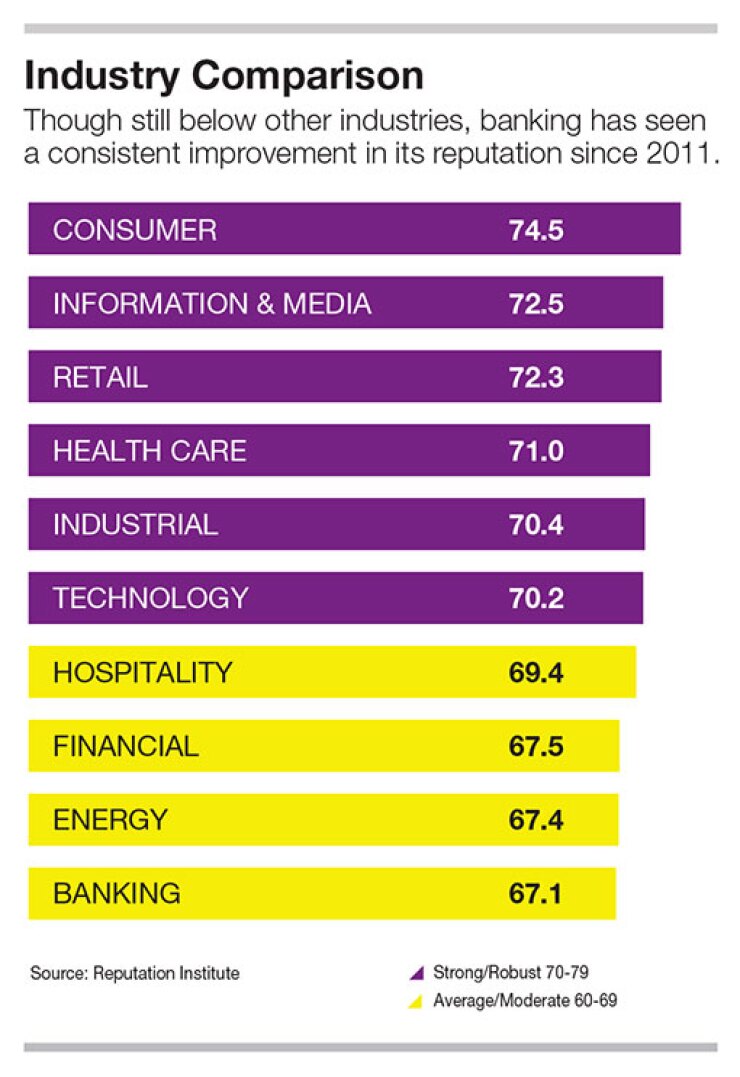

Large banks are gaining momentum as regional banks stall in the annual American Banker/Reputation Institute Survey of Bank Reputations. Chase even barreled its way into the top 10 of the customer ranking.

June 27 -

Synovus Financial struggled along with its customers during the financial crisis. Now that it's healthy again, it credits the strong ties it built with those customers, and the involvement of its executives in the communities they serve, with helping restore its status as one of banking's most reputable brands.

June 27 -

Its credibility damaged by shoddy lending and questionable accounting, the Birmingham, Ala., company rebuilt its reputation by putting customers and communities first.

June 25

What a bank stands for matters more than the products it sells.

Depending on your view, that could be a radical idea or a familiar one. But either way it's a key insight to remember for banks that want to work on bolstering their reputation, says Stephen Hahn-Griffiths, a vice president at the Reputation Institute.

"You can't just drive reputation by coming out with new technology or new smartphone solutions or new creative ways of borrowing money or new credit card offerings," he says.

"You drive reputation around enhancing the perceptions of the enterprise. And that's not just important for customers — it's especially important for noncustomers."

Humanizing the corporate identity of banks is an emerging trend across the industry — one that's proving critical in helping build reputations back up after the damage of the financial crisis.

Integral to this approach is leveraging leadership to give the bank more of a personality, make it more relatable and help raise its visibility in the community. Though chief executive officers are key, the same applies to all those in top roles.

"It's not about putting the CEO on TV and having him say great things. This is about elevating the entire leadership of the organization," Hahn-Griffiths says. "That's how we become viewed as more human and less the bean counters."

Efforts must go beyond press releases and blog posts. Hahn-Griffiths suggests getting executives involved in important local projects and prompting them to offer thought leadership on social issues, rather than just having them be a mouthpiece for quarterly earnings.

It's about creating and sharing compelling content — "videos and sound bites" — that bring the personalities of executives to life with transparency and emotion, he says.

The Reputation Institute is our partner on the annual Survey of Bank Reputations,

This year leadership replaced performance as one of the top three drivers of bank reputations overall — a shift in emphasis that Hahn-Griffiths considers telling.

"Trust, especially in this political election year, has become such a valuable commodity," he says.

"Performance is a measure of financial stability and it solidifies your relationship with the bank. But it's not enough to inspire trust. So we see the elevation of leadership as being a metric of trust that says, 'I trust the people leading that company.'"

For banks that want to capitalize on this insight, an important consideration involves rethinking efforts focused on marketing and customer acquisition.

The prevailing wisdom is to entice people with sweet deals — free checking or a credit card with no fees, for example. Banks spend millions on marketing messages like these.

"Most banks go into conversations around customer acquisition very much blinded by brand market communication," Hahn-Griffiths says. "Hey, if we spend $10 million, how many new customers are we going to drive?"

But, he argues, resources could be better spent on efforts that cast banks in a positive light and help create good will in the minds of consumers. So when they see or hear a marketing message, they are more likely to respond positively.

"If you could start to divert some of those resources from just customer acquisition and brand messages, and redeploy some of those resources around telling the corporate story about the company behind the products, you'd actually be more successful," says Hahn-Griffiths, who