Back in 2008 — when the Consumer Financial Protection Bureau was still a gleam in Elizabeth Warren’s eye — Ohio voters approved a referendum that was supposed to cap interest rates on small-dollar consumer loans at 28%.

The effort quickly went awry, as lenders found a loophole that allowed them to charge annual interest rates of 591%. Now, 10 years later, the state is on the verge of enacting major reform.

On Tuesday, the Ohio House of Representatives passed by a margin of 60 to 24 a bill that

“This day has been a long time coming,” Rep. Kyle Koehler, R-Springfield, said Tuesday during a speech on the floor of the Ohio House of Representatives, just before the vote in favor of the reform package.

A great deal of attention has been paid to the fight in Washington over the fate of the Consumer Financial Protection Bureau’s payday loan rule, as acting Director Mick Mulvaney stymies the actions of the agency’s previous leadership. But away from the spotlight, battles that may prove to be more consequential are unfolding in state legislatures around the country.

Some states are tightening the rules on high-cost loans, while others are loosening them. In both cases, their actions are making a major impact on the ground.

Prior to the passage of the Dodd-Frank Act, small-dollar credit to consumers who didn’t qualify for bank loans was regulated exclusively in state capitals, which were the site of fierce lobbying campaigns by payday lenders. The 2010 law was widely expected to shift power to Washington, D.C., by authorizing the CFPB to enact nationwide rules.

The CFPB’s arrival did help to reshape the terms of long-running legislative debates from Tallahassee to Sacramento, but small-dollar lenders have continued to square off with consumer advocates in state capitals.

Earlier this year in California, a measure that would have banned high-cost consumer installment loans ranging from $2,500 to $10,000 fell just short of the votes needed to pass the state Assembly.

In Ohio, where small-dollar lenders charge some of the highest interest rates in the country, even opponents of the pending legislation acknowledged that some reform is necessary. But they argued that the bill passed earlier this month by the Ohio Senate will force many small-dollar lenders to shut down.

“We’re interfering with the free market,” Rep. James Butler, R-Oakwood, said during Tuesday’s legislative debate. “And I think it’s going to have a detrimental impact on the people who most need access to capital.”

In other states, the small-dollar lending industry has sought to go on offense.

In March, Florida Gov. Rick Scott, a Republican,

All of these state legislative debates are happening against the backdrop of events in Washington.

After five years of research and outreach, the CFPB finally issued its long-awaited payday rule in October 2017. The rule was intended to make it harder for companies to offer traditional payday loans. For example, it would require such lenders to determine whether borrowers can make their loan payments and still meet their other financial obligations.

But the proposed rule, which has yet to take effect, figures to have far less impact on longer loans that require borrowers to make multiple payments.

Even before the CFPB rule was issued, companies that had long offered two-week loans secured by the borrower’s next paycheck began hedging their bets by pushing into installment loans.

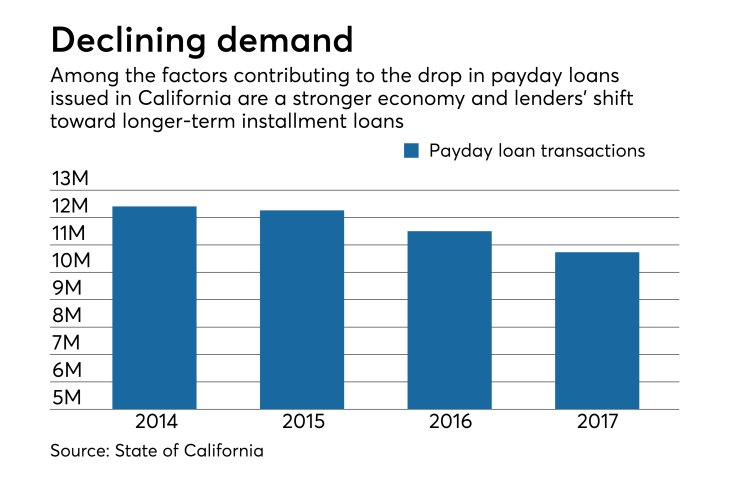

In California, the number of installment loans between $2,500 and $10,000 rose by 6.5% between 2016 and 2017, while the number of payday loans fell by 6.7%. It was

The arrival last November of Mulvaney, a longtime critic of the CFPB, has cast doubt on whether the Obama-era payday rule will ever be implemented.

But if it is eventually overturned — Kathy Kraninger, who is President Trump’s nominee to head the agency,

Will small-dollar lenders decide to re-emphasize two-week payday loans, and run the risk that the next CFPB director will be appointed by a Democratic president, which could force them to change course once again?

Or will they maintain their current trajectories, since installment loans can also be quite profitable, particular in states where triple-digit annual percentage rates are allowed?

Florida’s example suggests that payday lenders who find sympathetic state legislators may be able to shrug off whatever restraints Washington puts in place.

Under the new Florida law, a borrower who takes out a 60-day, $1,000 loan will owe fees of around $215 — or almost twice as much as someone who uses two 30-day, $500 payday loans.

No matter what happens at the CFPB, all 50 states still have the ability to regulate this market. That leaves the states where they have been for decades — at the center of the debate over subprime consumer lending.

Bankshot is American Banker’s column for real-time analysis of today's news.