Editor’s note: This

The scope of regulation has, in many respects, reshaped entire sectors of the economy. Consider just a few key industries that have been disproportionately affected by regulation. Energy, health care, housing and finance, which in combination contribute 29% of U.S. economic output, have together faced a total of 7,260 new regulations just since the beginning of 2009. The effects of such regulation are sweeping and often severe—its deployment invariably well intentioned, yet its implications often unappreciated or misunderstood. As just one example, a recent survey suggests that, on average, regulation adds nearly $85,000 to the cost of developing and constructing a new home. Perhaps not coincidentally, fewer new homes were sold in 2016 than in 1973, a time when the U.S. was one-third less populous than today. It is instructive to consider the ways in which regulation has transformed the industry with which we are most familiar—our own.

Regulation, more than any economic force in memory, has changed the face of banking. And because the fates of banks and the communities they serve are so intertwined, the regulatory impacts borne by regional banks are inextricably linked to the repercussions experienced by their customers. When oversight efforts made in good faith to alleviate one perceived problem inadvertently create another, the consequences, unintended as they may be, are tangible and far-reaching.

In the wake of the financial crisis, legislators and regulators imposed a wide array of new laws and regulations, ostensibly to instill confidence in the U.S. financial system by limiting the amount and type of risks the largest financial institutions could undertake. So cataclysmic was the crisis, lawmakers felt pressured to react swiftly. It was decided, abruptly and arbitrarily, that banks whose assets exceeded a $50 billion threshold would be subjected to the most demanding requirements of the subsequently enacted Dodd-Frank legislation, regardless of an individual bank’s complexity or the nature of its business activities.

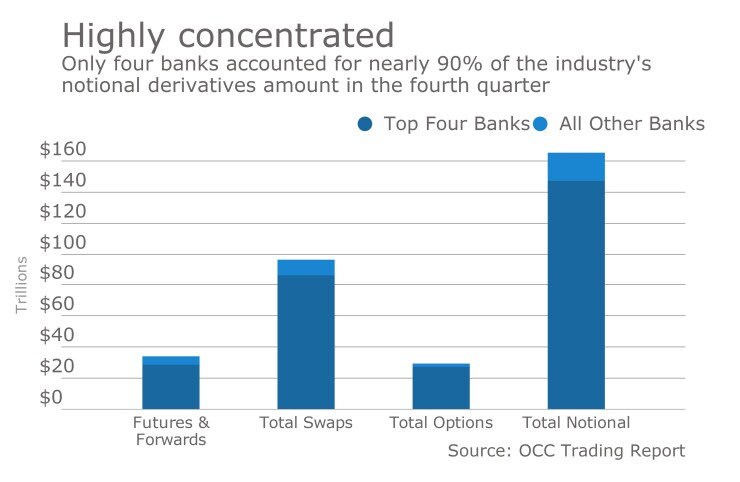

Of course, not all banks are of equal size and complexity and not all companies that would call themselves banks are actually in the business of traditional banking—taking deposits and making loans to support community growth. Nonetheless, regional banks such as M&T find that they must meet the same onerous requirements as the largest global systemically important banks or “G-SIBs”—essentially those banks that have been deemed too big to fail. Significantly, these large banks generate a substantial portion of their revenue both through trading activities and lending to some of the largest companies in the world. To wit, just five of these large banks account for 90% of the industry’s total trading revenue with total notional derivatives exceeding $200 trillion, or more than 11 times U.S. GDP—a mix of business that differs drastically from the community-focused approach employed by regional banks.

The differences between the largest banks and their regional counterparts extend not just to their business models but also to the ways in which they are executed. Indeed, there is compelling evidence to suggest that the regulators themselves would concur with such assertions, as evidenced by the sheer volume of regulatory sanctions and fines that these large firms have distinguished themselves by incurring. Particularly concerning are the instances where institutions or their employees placed their interests before those of their own customers. In the past decade, five large banks alone were subject to at least 187 legal settlements and fines totaling $158 billion, with at least another 89 investigations and lawsuits currently pending. The magnitude and frequency of these events have brought the wrath of the public upon the entire industry, creating a perceived necessity for more regulation. Leadership has an obligation to set a moral tone.

What’s more, regional banks pursuing straightforward, traditional business models have been determined to pose low levels of risk, as measured by the scorecard designed by the Basel Committee on Banking Supervision to assess the risk that any given bank poses. This measure considers a host of factors including a bank’s size, complexity, interconnectedness and international exposures. The commendable marks for regional banks stand in stark contrast to those of the largest banks, which operate across the globe and have much higher risk scores.

If M&T and our 10 regional bank peers that individually have total assets between $50 billion and $500 billion were combined into a single institution spanning the country, the systemic risk score of that entity would not be nearly as large as that of any one of these five large banks. But despite the fundamentally lower risk that regional banks pose to the financial system as judged by the regulators’ own yardstick, they are still subject to nearly the same number of regulators and volume and character of regulations that rightly apply to their much larger and far more complicated brethren, with all of the attendant costs.

One-size-fits-all rulemaking has thus created an uneven playing field, to the particular disadvantage of regional banks. The largest banks can bring their vast resources to bear in addressing these new measures of oversight, while the smallest banks escape many of the most punitive regulations altogether. This arbitrary approach confers, as well, a distinct benefit on an emerging class of nonbank lenders—a group indirectly empowered by regulation that has ensnared traditional banks. These lenders have subsequently capitalized fully on the cost advantage resulting from their lesser regulatory burden. Such firms participate in many facets of banking. To understand the damage, consider mortgage banking, where nonbanks originate more than half of new U.S. residential mortgage loans, compared with just 9% seven years ago.

Regional banks are penalized at the starting line, paying dearly to try to narrow the gap but not always succeeding. At M&T, our own estimated cost of complying with regulation has increased from $90 million in 2010 to $440 million in 2016, representing nearly 15% of our total operating expenses. These monetary costs are exacerbated by the toll they take on our human capital. Hundreds of M&T colleagues have logged tens of thousands of hours navigating an ever more entangled web of concurrent examinations from an expanding roster of regulators. During 2016 alone, M&T faced 27 different examinations from six regulatory agencies. Examinations were ongoing during 50 of the 52 weeks of the year, with as many as six exams occurring simultaneously. In advance of these reviews, M&T received more than 1,200 distinct requests for information, and provided more than 225,000 pages of documentation in response.

The on-site visits themselves were accompanied by an additional, often duplicative, 2,500 requests that required more than 100,000 pages to fulfill—a level of industry that, beyond being exhausting, inhibits our ability to invest in our franchise and meet the needs of our customers. The sheer magnitude of this cost and requisite management focus diverted to compliance with expanding regulations overextends traditional banks’ finite resources—thereby hindering their ability to introduce new products and technologies, or pursue other projects that might be in the best of interests of their shareholders, customers and communities. But as substantial as the compliance cost burden may be, regulatory consequences extend far beyond mere dollars and hours. Regulation has altered the fundamental underpinnings of traditional banking activities, including prudent decision-making regarding lending and, ultimately, the efficient allocation of capital.