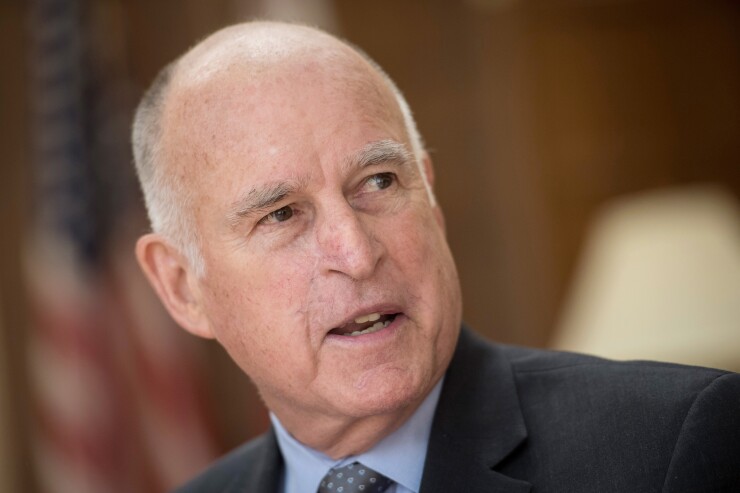

As president of the Commercial Finance Association, a trade organization representing hundreds of banks and asset-based lenders that provide tens of billions of dollars in working capital annually to small and medium-sized businesses, I am urging Gov. Jerry Brown of California to veto a

First, I’d like to make it clear that we applaud the intentions behind this bill: to protect financially unsophisticated small business owners by making it easier for them to compare financing proposals offered to them, thereby helping them understand the true cost of borrowing.

In recent years, a large number of online lenders have emerged offering very high-rate “cash advance” term loan products. Requiring those term lenders, who do not already do so, to disclose their hidden fees and true cost of financing is a worthwhile pursuit. But, the bill does not accomplish this goal and has serious unintended consequences, which could actually impede small business owners’ access to capital and expose honest and well-intentioned commercial lenders to litigation.

In practice and by its very terms, the bill will not accomplish its goal, as it creates a requirement for all lenders to provide a “one size fits all” standardized disclosure document to potential borrowers using estimated financial information.

Simply put, the vast majority of CFA’s members, including my own company, do not offer financial products that can be accurately described in the proposed “one size fits all” standardized disclosure document. Most CFA members offer “revolving” credit facilities and use a vast array of risk management tools to actively monitor an ever-changing pool of collateral that secures the credit facility. These types of facilities cannot be standardized and compared against each other in the way that term loan or cash advance facilities can. While the bill does allow for our members to provide an example of a transaction that might occur, this will not achieve the disclosure requirement’s objective because the “example” cannot accurately be compared to another transaction which may have an entirely different structure and be based on different financial assumptions. Therefore, it would only be a matter of time before a California asset-based lender is sued for “misrepresenting” the terms of a loan. Once this occurs, the impact would inevitably be to further limit lending and the availability of credit to small businesses in California. It’s self-evident that reduced availability of capital in California would actually result in fewer options and less favorable financing structures available to California small businesses.

Our members’ loans go to middle-market companies employing hundreds of thousands of workers. If our members run crosswise with the proposed legislation, as it is written, and are unable to comply with the “one size fits all” disclosure document and are subject to litigation and/or fine for lack of compliance with the bill, they will be forced to stop lending. This hurts the underlying borrowers and endangers all of those workers’ jobs. One such client, David Weinstein, president of CP Shades, Inc. in Sausalito, stated, “Our company has benefitted greatly from our relationship with our capital provider, who is a CFA member, and it is just that: a relationship. Our provider provides us capital on a ‘revolving’ basis and spends the time to actually understand our business and provide transparent terms with which we are happy. If this access to capital were restricted, it would be detrimental to our business and our 105 employees.”

The Commercial Finance Association believes SB 1235 will cause irreparable harm to the asset-based lending and factoring industries by creating an environment that causes confusion to the borrowers, rather than more transparency. We respectfully ask Gov. Brown to veto this bill as it ensnares reputable and well-established commercial finance lenders, along with the subset of predatory term and cash advance lenders at which it is aimed. Our association is committed to transparency and would welcome the opportunity to help craft legislation that attains the goals of this bill, but without the unintended consequences.