With fintech’s appeal to the young and tech-savvy, one might assume, wrongly, that the

Recent research challenges these stereotypes. What is the “right” age to become an entrepreneur? And does fintech — promoted as a solution for younger professionals — have solutions for those who have already retired or are close to? The answers to both of these questions might surprise you.

Researchers at the Georgia Institute of Technology and Hitotsubashi University in Japan

Three 40-plus entrepreneurs — all winners of AARP’s startup competition known as Innovation@50+ LivePitch — counter the existing stereotype. Howard Tischler is the chief executive and co-founder of EverSafe, which aims to protect families and seniors from fraud by monitoring their accounts for suspicious activity. Evin Ollinger is chief executive and co-founder of Golden, a software tool for users to help manage their parents’ finances. Chris Wong is co-founder and chief executive of LifeSite, billed as an online safe deposit box to protect a family’s critical information.

The three executives are part of a

This demographic is large and powerful. Recent AARP research found that people 50 and older will generate $83 billion in revenue for the fintech sector over the next five years. We also know that 50-and-older consumers represent only 35% of the U.S. population; however, they control more than half of the nation’s investible assets.

Entrepreneurs focused on this customer segment often cite financial issues that affected their parents as inspiring their startup ideas.

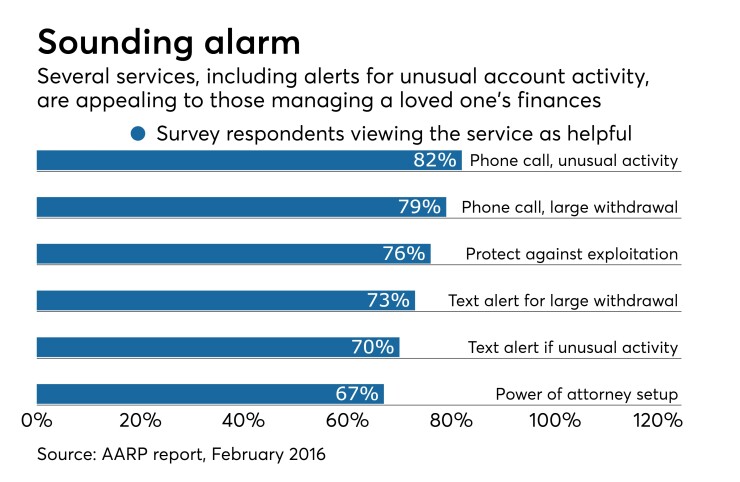

Howard Tischler created EverSafe after his mother was financially exploited. He sought a fraud solution so others could avoid being targeted with fraud and scams.

Evin Ollinger’s mom suffered a fall that sent her to the hospital. He found piles of bills and paperwork on her kitchen table, and it took him weeks to get them all sorted and organized. Golden works as a financial caregiving tool, helping adult children manage their parents’ bills and medical expenses, create a fixed-income budget and help identify government benefits for which parents might be eligible.

Chris Wong recognized the need for a digital vault that family members could access in times of crisis when his father experienced a medical issue. He was admitted to the hospital, and Chris was bombarded with questions about his dad’s medical history and medication schedule.

These startups reveal a strong trend toward fintech-based solutions making inroads in households of all ages. Just as personal financial management tools can help young consumers plan their financial future, they can also help older consumers manage a future that has already arrived. Just as artificial intelligence benefits solutions designed for millennials, AI-driven algorithms can also be used to detect fraud activity by bad actors attempting to target retirees.

I