But, Eno, isn’t Arie just appalling?: Even though Capital One’s digital assistant Eno is gender-neutral, the two women leading its development are determined to design it with human traits like empathy, so that it can establish an emotional connection with customers. Developing a backstory for Eno and deciding how it “views the world and itself” was critical for determining how it would interact with customers, right down to the words it chooses to use, said Audra Koklys Plummer, head of AI design for Capital One. “It likes ‘The Bachelor’ because it’s totally fascinated with human behavior,” said Plummer, a former digital filmmaker at various studios including Dreamworks, Lucasfilm and most recently Pixar Animation. “This is the type of backstory we started building.” The learnings that Capital One gets from how customers use the chatbot, which turned a year old Saturday, go into making Eno function even better — such as with a recent trend of customers texting “NAP.” “We were like, ‘What’s going on? Are customers tired? Why is everybody texting NAP?’ And we realized the letters N-A-P are next to the letters B-A-L,” so they were mistyping, Plummer said. “Eno eventually recognized that, and now whenever you type NAP, you get your balance.” Carla Saavedra Kochalski, director of conversational AI products for Capital One, said as Eno gets smarter, it will be become better at providing customer service through texting, with the potential to reduce use of higher cost channels like call centers.

No Amazonophobia here: Amazon may have succeeded in disrupting nearly every area of retail — including iconic brands like Borders Books and Toys R Us — but bankers insist it isn’t a threat to their business. If anything, Amazon is more of a potential partner, according to Nandita Bakhshi, Bank of the West’s president and chief executive “Hardly anybody wants to get into banking, meaning get a license and be regulated the way we are,” she said. “The real thing we have to balance out is, who is the partner and how do we leverage them for our customers?” Amazon is rumored to be exploring bank partnerships to do mortgage lending, to create checking accounts for its unbanked millennial customers, and more. JPMorgan Chase and Capital One are among those vying for the business.

What disruption looks like: When Anthemis Group evaluates startups, the diversity of the company’s management is viewed as a priority. “I would love to see companies starting from scratch in financial services that are paying attention immediately to building more diverse workforces,” said Amy Nauiokas, a co-founder of Anthemis, which recently closed the $106 million Anthemis Venture Fund I, its first discretionary fund focused on supporting fintechs in sectors such as corporate and business banking, wealth and asset management, and capital markets. “It’s not surprising that financial institutions that were started 200 years ago by white men have different needs now; they’re serving a different demographic and market. We need to be smarter about the way we build our companies.” Nauiokas said that the entire financial system is due for an overhaul as it moves from the industrial age to the digital age, and that the overhaul has to be about more than technology. “If you’re bringing divergent opinions together, you’re more likely to solve bigger problems,” she said. “When we think about issues around financial wellness and the inequalities in our society, which have a lot to do with the way our financial infrastructure is set up, then you need thinkers who are thinking differently than they have in the past.”

Goldman’s not breaking any glass: Goldman Sachs needs to do a better job elevating women to its top ranks, its heir apparent, David Solomon, said recently. When asked why more women haven't climbed higher, Solomon couldn't give a good reason, but said, “It's our job to change it.” In being named Goldman’s sole president Monday, Solomon became the front runner to succeed Lloyd Blankfein as CEO, rising atop a small and male group. There are two women among Goldman's 11 executive officers: Karen Seymour, co-general counsel, and compliance chief Sarah Smith. On the 31-member management committee, Isabelle Ealet, who has been on our list of the Most Powerful Women in Finance in the past, is struggling to stabilize a commodities business that just posted its worst year since Goldman went public. Dina Powell also will join the management committee when she returns to Goldman from a stint at the White House, as noted here previously.

No plastic needed: After testing cardless ATM service with employees and customers in Cincinnati, Ohio, Fifth Third started offering it more widely on March 1. The service lets customers withdraw cash from ATMs by logging into their mobile banking app and tapping the ATM, which will prompt the app to provide a code that the customer then enters at the ATM. Chief Digital Officer Melissa Stevens said the bank was trying to create more customer engagement points on mobile after seeing a 40% increase in logins over the last year. But the service also offers a convenient and secure way to withdraw cash from an ATM for those who don’t have a card with them. “When we did customer testing, what we heard from them is it felt more secure,” she said. “The ability to log into your mobile app and also use your PIN at the ATM ensures you have as much or greater security as with a piece of plastic.”

Sexual harassment at work

For the past few months SourceMedia’s editorial and research departments have been collaborating on a study of the impact of sexual harassment across industries such as banking, payments, mortgages, wealth management, accounting, human resources and capital markets. Check out the full project here.

The first part of the series, published this week, highlights 10 key findings from a survey of more than 3,000 men and women, along with several articles that do a deep dive on the perspectives of those who work in particular sectors. Here are some highlights.

“If you say it is inevitable, you are just giving up before you start”: Many people who work in banking said they are, at minimum, aware of sexual harassment in the workplace, but survey responses show there’s also a lingering feeling that this type of misconduct might be inevitable. It's critical that companies change this mindset, experts said. "It is a learned behavior,” said Jim Quick, a professor of leadership and organizational behavior at the University of Texas at Arlington. “If people have learned these kinds of comments and actions, they can unlearn them. Does the organization have the will and the principle to not tolerate that kind of behavior? That’s the bottom line.”

“When you go to a meeting room, they just ‘manspread’ and it’s vulgar”: Silicon Valley bro culture is less of an issue for tech employees in other industries, but it still exists in subtler forms that may fall short of a legal definition of sexual harassment. Ill-concealed snickering when a new female employee joins an all-male team. Hearing a woman who is not present described as a “harlot.” Being treated in a dismissive matter. Such microaggressions – “small acts like a senior male not allowing you to express your opinion, or shutting you up when you try put forth a point that is contrary to his” – are common and wearing, said Arathi Mohan, a consultant at KPMG. Professionals should not need “lessons in etiquette” to treat co-workers with respect, she said. This type of hostile behavior, especially repeated over time, can cause low morale and high turnover among women and minorities.

“More training is more of the same”: Nuances in sexual harassment pose a difficult task for human resources departments: how to handle inappropriate behavior that crosses the ethical line but does not necessarily fall under the legal definition of harassment. Such behavior – like flirting, for example – is often ignored or even initiated by senior management. That’s why fostering a respectful company culture is paramount for curbing problems, according to survey respondents from the HR sector. “Training, investigations — we’ve checked those boxes,” said Johnny Taylor, president and CEO of the Society of Human Resource Management. “We’ve got to get HR focused on culture.” Colleen O’Leary, director of human resources at a nonprofit with 600 employees in three states, agreed. Promoting workplace culture “is the most important thing I do,” she said. “If you don’t buy into it, you shouldn’t be in the business.”

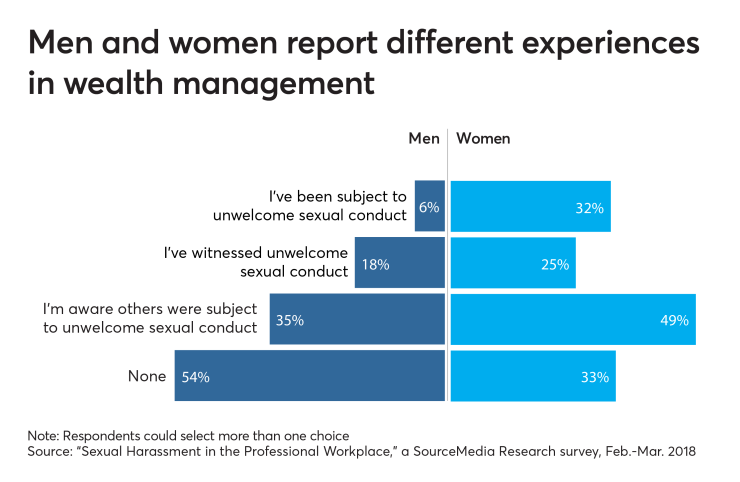

“They don't see it because it doesn't happen to them”: One-third of female survey respondents in wealth management said they believe sexual harassment is highly prevalent in their industry. The women reported much more exposure to such behavior than the men: 32% said they’ve been subject to it, compared with 6% of men, and 25% have witnessed it happening to others, compared with 18% of men. “Sometimes there are jokes, and there's no question — no one thinks they are serious,” a financial adviser at a wirehouse said. “But when you have 80% to 90% of the advisers in the office making between $150,000 to $450,000, and the sales assistants are 80% to 90% women and their salaries average $45,000 to $50,000 … it lends itself to a situation where the men can say certain things."

This companywide project, led by Bonnie McGeer, Chelsea Emery and Dana Jackson, will continue next week, with more coverage for American Banker and other SourceMedia publications.

Beyond banking

Edit-a-thon: This weekend the National Museum of Women in the Arts in Washington, D.C., is hosting its fifth annual Wikipedia edit-a-thon where people can create, edit and add to Wikipedia pages on women in the arts. The intent is to promote gender equality in art history and among Wikipedia contributors (reports suggest less than 20% of contributors are women). This year’s theme is female art museum directors, curators and gallerists. “It can get aggressive,” said Sarah Osborne Bender, the museum’s library director. “I wrote a Wikipedia article about a woman gallerist and the next day I got a message saying it was deleted because she is not a ‘noteworthy person’, but someone in our community gave me advice on how to edit it to make the page stay.” What began as informal gatherings in 2011 has grown to 500 events worldwide, with more than 7,000 volunteers and 11,000 Wikipedia articles. It has helped raise the proportion of biographies about women on the English language edition of Wikipedia from 15% to 17%.

Weekend longread: Apparently female rappers are too expensive to get signed to major music labels. Too much money goes into making them look good: their hair stylists, nail artists, clothes, makeup. The number of women who are signed by labels has been dropping since the 1980s, and this article looks into why. As many women as ever continue to rap, but they aren’t getting as much label attention as their male peers. Some of them say it is just as well – they aren’t interested in being signed right now because they’d rather have the freedom to work on their own terms. But one big reason for the lack of interest apparently has to do with women’s looks, which are viewed as both necessary and burdensome to the labels. This story offers up industry professionals who question the myths of styling expectations and budgets. “You can give a woman a $50 pair of jeans and she will make it look like it’s $2,000,” said the Chicago rapper CupcakKe, who is currently unsigned but says she is exploring label deals. “Nowadays guys are like, ‘I’m not wearing a pair of $50 jeans.’ … I think [men] might even be more expensive actually.”

To subscribe to this weekly newsletter, go to our Women in Banking homepage, scroll down to where it says “join our mailing list,” and enter your email address.

Check out last week’s newsletter — which included items on Ally Bank and JPMorgan Chase — here.