It’s not exactly news that banks have seen their reputation with the public tumble since the financial crisis, but what gets talked about less frequently is what’s at risk for the industry if it can’t turn public opinion around.

A lack of widespread trust raises questions about banks’ relevance in the digital age and leaves them open to further political attack.

A recent review of

The crisis “put a real scare in the American public,” said Karlyn Bowman, the AEI senior fellow who compiled the survey data. “The hangover is still there.”

That’s especially true for banking executives — likely an overhang from frustrations that so few individuals were punished for their role in the crisis. Only 14% of people had “a great deal” of confidence in the people running banks, the latest data from 2016 show, down from roughly 30% before the crisis. Another third had “hardly any” confidence in banking leaders — up from about 10% in pre-crisis times.

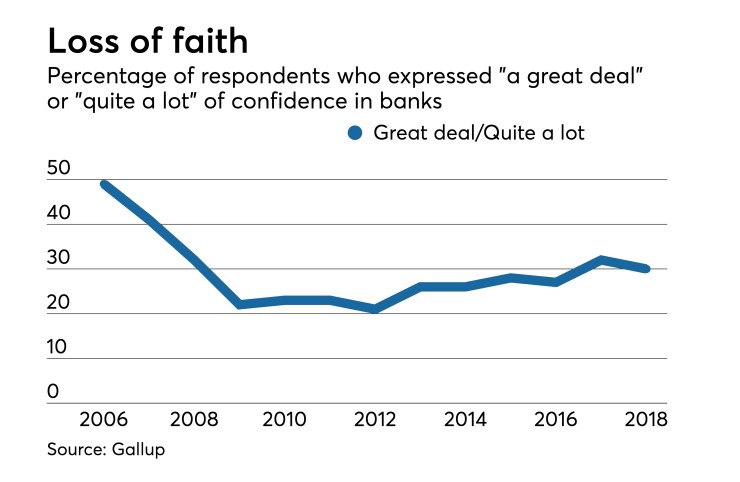

While confidence in banks (as opposed to bank leaders) has ticked up slightly over the past decade — some 30% of people had “a great deal” or “quite a lot” of confidence in financial institutions as of this year — that’s still down from closer to 50% before the housing collapse. At the same time, two-thirds of people reported in 2015 that they felt the financial system was no more secure than before the crisis, and a similar proportion said last year that they predict another crisis like 2008 could be just around the corner. (One bright spot: 90% of respondents to one poll seem to be

What’s at stake? Customers have more choice than ever when it comes to where they do their banking, including from an increasing array of fintech competitors with arguably less cultural and emotional baggage than the traditional banking industry.

Banks remain “highly vulnerable to disruption from tech companies,” said Dan Ryan, banking and capital markets leader at PwC. “The banking industry must continue to work hard to gain public trust and confidence.”

And while the Republican administration and Congress have blunted some of the political threat for now, a “

“The less-than-positive public outlook gives license to the extreme parts of the political establishment to vilify bankers,” said Con Hurley, a professor of banking law at Boston University.

Banks have revamped many of their operations over the last decade, and they’ve spent billions of dollars complying with a host of new rules. But if they can’t figure out a way to win back more of the public’s trust, all that work could be for nothing.

Bankshot is American Banker’s column for real-time analysis of today's news.