Editor's note: This post originally appeared, in slightly different form, on the author's

Although it is clear to everyone that the financial services industry is finally transforming itself, said transformation means different things to different people.

With every new conversation I have in the industry I remain fascinated with the multiple dualities that float in our financial services industry subconscious. Jung and Freud would have a field day.

I will use "finserv" as the abbreviation for the financial services industry throughout this post.

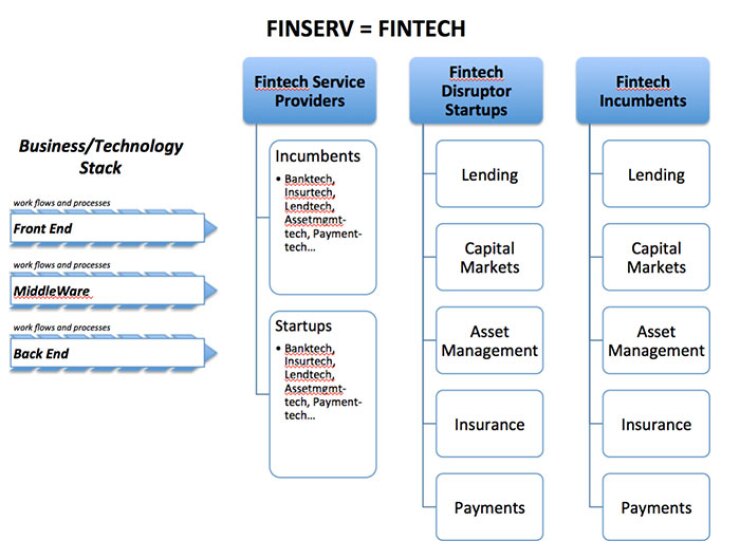

I define the finserv industry as the sum of five spaces: lending, capital markets, asset management, insurance and payments.

I view the crypto/blockchain/distributed ledger ecosystem as a vertical technology that has the potential to optimize or completely reinvent workflows and processes in the finserv industry which is why I do not add it to the five spaces above.

Now, onto the dualities I have detected.

First duality: There is a fintech industry or ecosystem and there is the financial services industry.

Second duality: The fintech industry is a two-headed beast, one head being comprised of service providers that sell their products and services to incumbents and the other of startups that compete and disrupt the finserv incumbents.

Third duality: The fintech industry is about banking and payments and maybe some wealth management. Everything else – that is insurance, asset management, capital markets – is not really fintech.

Fourth duality: The fintech industry is about business-to-consumer models. Business-to-business models are not really fintech.

Fifth duality: The fintech industry is about digital, the rest is just technology or plain business.

Sixth duality: To become digital means to rethink the front end, the distribution channels, the rest stays the same.

Needless to say I do not agree with any of these dualities.

I think a much more profound systemic shift is taking place. A shift enabled by societal changes (how we interact, how we organize ourselves socially and in business, new approaches to consumption and ownership), and technological changes ranging from the obvious (networks, faster/better/cheaper, instantaneity, mobile, high-speed Internet) to the mind-blowing (artificial intelligence, machine learning, the Internet of Things, cryptocurrency).

To me finserv = fintech.

All participants in the finserv industry, be they incumbent service providers, startup service providers, disrupting startups competing against incumbents, incumbents, small, medium or large, old or new ... All of them will have to become fintech organizations.

By that I mean A) all participants will have to stop doing business the old way which usually meant selling "internally" generated products and services to customers and enterprises via one-way distribution channels; and B) all participants will have to start behaving, thinking, organizing themselves as technology companies and focus on three things: technology, data and customer (or, better yet, user) experience. This they will have to do from the front end, middleware and back ends of their business and technology stack. The effort is global and systemic.

As such, finserv incumbents will become fintech incumbents — fintech banks, fintech broker/dealers, fintech insurance carriers. Technology will not be a tool one applies to a specific area of one's business, it will become one of the central blocks off of which participants will articulate their businesses. Technology + data + customer/user experience will add up to a new business approach (one technology companies in other industries already have applied with much success, by the way – see Google, Facebook, Apple, eBay, Intel, Amazon).

Some banks have started the journey towards transforming themselves into fintech incumbents: Santander and DBS Bank in Singapore come to mind.

Some banks claim they see the threat: JPMorgan Chase, where CEO Jamie Dimon warned shareholders this year that "

Some banks are capitalizing on the investment opportunity: Goldman Sachs, which is exploring

Some insurance companies already think and breathe fintech:

All fintech startups are, of course, on such a wavelength, be they service providers or disruptors.

Some regulators have awoken to the possibilities: The Prudential Regulation Authority and Financial Conduct Authority in the U.K., the Monetary Authority of Singapore.

What of asset management firms, the rest of the insurance industry, capital markets participants, most of the payments incumbents, most banks? What about the rest of the industry? What about regulators at large? Many still need to change their outlook as the cozy way of doing business is a thing of the past. Most navigate between feelings of fear or benign neglect.

Finally, because of the sheer magnitude of the effort in developed countries, where the financial services stack needs to be optimized, and in emerging countries, where it needs to be built from scratch in some instances, this shift encapsulated within the paradigm finserv = fintech will take the better part of the next 10 to 15 years. One does not reinvent a significant portion of GDP overnight.

Pascal Bouvier is a general partner at Route 66 Ventures, an investor in early- and growth-stage financial services and financial technology companies.