Early Warning's Zelle network on Thursday reported strong second-quarter growth, and it's connecting more payments systems with each other — which experts say could contribute to U.S. efforts to develop faster payments.

Zelle processed $120 billion of payments, a 68% gain from a year earlier, and conducted 436 million transactions, a 58% increase. During the quarter it also added the 1,000th financial institution to its network, the Syracuse Fire Department Employees Credit Union in New York.

At the same time, Zelle has also been increasing its interoperability with other networks by linking to payment rails such as The Clearing House's real-time payments network. A recent

Earlier this year Zelle said it was

"The magic of Zelle is the fact that it is interoperable in the way cash and checks are," Baker said. "If your bank participates in Zelle, you can send money to nearly every single other bank whether they are part of Zelle or not, thanks to the debit card networks. Technically, you should think of Zelle as a giant directory, and this provides the interoperability. It associates consumers’ bank accounts and their mobile phone numbers or e-mail addresses but moves money through the traditional settlement rails."

In the future, Zelle may be able to connect to new real-time payment networks like the Federal Reserve’s FedNow, which is in development. Zelle's ability to connect with several U.S. networks makes it appealing to some as the possible connecting tissue for faster payments.

"I think about Zelle a lot [regarding interoperability] because it is an example of a service provider that connects to all networks," said Reed Luhtanen, executive director of the faster payments council.

"Zelle users don't have to know what network is being used, because it doesn't matter to them," Luhtanen said. "You just send it on Zelle, and they receive it on Zelle, and in between Zelle chooses the network to reach those endpoints."

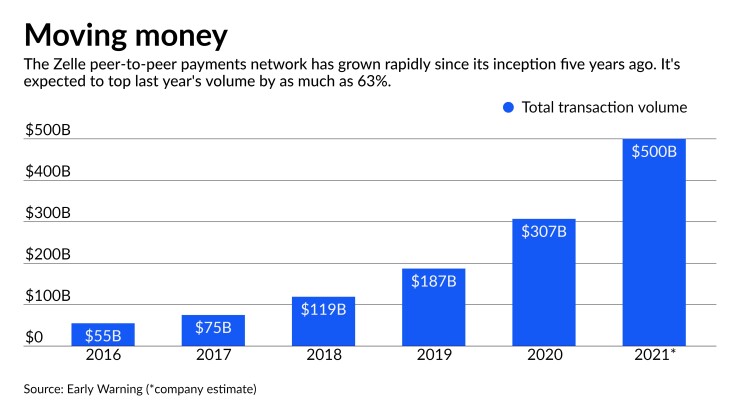

Through the first two quarters of 2021, Zelle processed $226 billion in payments and handled 828 million transactions. This is a carryover from strong increases in 2020 during the height of the pandemic, which drove more consumers and businesses to digital money movement amid lockdowns and social distancing.

"This thing is a freight train that keeps going," said Al Ko, CEO of Early Warning. "When you start to think about the scale of Zelle, I can say with confidence that this year we will move about a half trillion dollars and about 2 billion transactions."

It's not just the numbers that continue to boost Ko and Early Warning's confidence in their P2P service.

"It's the everyday customer problems we are solving, and it is driving customer engagement right into the bank apps," Ko said, adding that users will soon find it easier to send through Zelle Ready Friends, a feature that kicks in when a user types in a recipient's name and is automatically informed if the person is on the network and which phone number or email that person uses to receive funds.

The Zelle service for small businesses continues to expand, with the P2P process being integrated into banks' business checking accounts.

Bank of America informed Early Warning that 75% of its Zelle users no longer write paper checks, Ko said. "And of those 25% of users who still write checks, they went from writing five checks [a month] before using Zelle to two checks [a month]."

In a

"Zelle at 14 million [Bank of America users], these are just stunning amounts of activity," Moynihan said.

Even with its impressive growth, Early Warning cannot overlook the competition that PayPal's Venmo and other service providers pose.

Earlier this month, the credit union services provider

Ko declined to comment about competitors, but he acknowledged that a bank is not likely to offer more than one P2P solution to its customers.

"The power of the Zelle network is that it has large banks, small banks and credit unions with virtually universal coverage, with hundreds more being onboarded regularly," Ko said.

After a year operating as a bank joint venture called clearXchange, Zelle made its debut through Early Warning in 2017. That year the network handled $75 billion in payments and 247 million transactions.

It has grown significantly each year, getting its biggest bump during the pandemic months of 2020, a year it finished with $307 billion in volume and 1.2 billion transactions.

Customers who download the mobile app of a bank on the Zelle network can enroll in the P2P service, eliminating the need to download a separate Zelle app.