Woodforest National Bank in Houston has opened more than 100 branches in Wal-Mart Inc. stores in the past 20 months and has no plans to slow the pace.

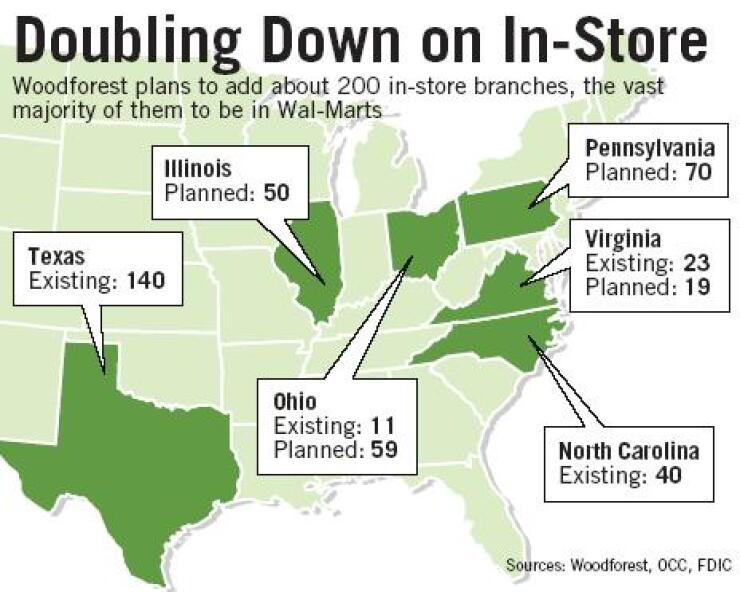

The $2.2 billion-asset Woodforest, which has in-store branches in Texas, Virginia, North Carolina, and Ohio, filed applications with the Office of the Comptroller of the Currency this month to open as many as 120 branches in Illinois and Pennsylvania during the next three years. It also filed applications to add 19 more in Virginia.

The expansion would increase the number of branches to about 400 by the end of 2009 - and the number very likely will rise even higher. Its chief executive officer, Robert Marling, said last week that the bank is also considering expanding into stores in up to four more states, though he would not name them.

Mr. Marling said that when Woodforest was founded in 1980, he put a map of east Houston in his office to depict the area where it wanted to add branches. A decade or so later, he added a map of Texas, and since early last year he has added maps of North Carolina, Virginia, and Ohio.

"About a month ago, I got a map of the U.S.," Mr. Marling said. "I'm not saying we are going to move into the whole U.S., but I got enough states to worry about now that I need the whole map."

Woodforest has 37 stand-alone branches in Texas and is looking to open six more in the Houston area during the next two years. Mr. Marling said the traditional branches are focused on commercial lending, while its in-store branches are mainly for generating deposits.

Some in-store branches are in grocery stores, and one is in a furniture store, but the vast majority are in Wal-Marts.

An in-store branch can be opened for about 20% of the cost of a traditional branch, according to information from Financial Supermarkets Inc., an in-store branching consulting firm in Cornelia, Ga. They also attract more foot traffic; grocery stores and department stores can get as many as 30,000 visitors a week.

Woodforest opened its first branches in a Wal-Mart store in 1996 and started ramping up its in-store efforts in 2001. It started in Texas, moved into North Carolina last year and Virginia and Ohio this year. The strategy has worked well for the privately held Woodforest. Its assets have more than doubled since the end of 2001, and it is expected to turn a profit of $80 million this year - more than four times its earnings in 2001.

The bank's condition ratios are enviable. Its return on equity at June 30 was 35%, compared with the 13.36% average for all commercial banks with $1 billion to $10 billion of assets, according to the Federal Deposit Insurance Corp. Its return on assets was 2.92%, compared with the 1.45% average for banks its size.

About 300 banks have branches in Wal-Mart stores. Woodforest accounts for about 10% of in-store branches, the most of any bank, said Kevin Garner, a Wal-Mart spokesman. Woodforest's new locations are mostly in stores where space has become available, and no bank branches are being displaced to make room for Woodforest, Mr. Garner said.

Of course, many community bankers say Wal-Mart would prefer to have its own bank rather than lease space in its stores to Woodforest and other banks.

Wal-Mart is seeking a Utah industrial loan company charter, which it maintains it would use to process electronic payments. But community bankers have argued that Wal-Mart wants to use the charter as a way of entering retail banking. The application generated so much controversy that the FDIC put it on hold in July and called for a six-month moratorium on ILC applications.

Mr. Marling takes Wal-Mart at its word. Why, he asks, would the retail giant sign 15-year lease agreements with Woodforest if it expected to be in retail banking before then?

"The more branches I open inside Wal-Mart, the less chance Wal-Mart has of opening branches," he said. "I feel good about going into stores with Wal-Mart."

Woodforest has even adopted some of Wal-Mart's retail practices. Stressing convenience, it keeps many of its in-store branches open seven days a week, and some are staffed 24 hours a day. Woodforest processes customer deposits every day of the week and credits them to accounts that same day if they are deposited by 8 p.m.

Woodforest is also trying to reach out to Wal-Mart customers - particularly Hispanics - who do not have bank accounts. The bank announced this year that it would offer check cashing in all its branches.

Perhaps Woodforest's biggest challenge in expanding so quickly is staffing. The bank hired 710 people over the past three months, extensively promoting from within, and now has almost 3,000 employees, Mr. Marling said. About 30% of the bank's employees are part timers, many of whom are college students.

Mike Van Hoozer, a human resources consultant and executive coach with Total Best of Houston, said that when a company adds staff so rapidly it must be extra cautious about hiring people who will not damage its reputation.

That said, the fact that Woodforest promotes from within quickly is likely to attract ambitious young people, especially college students looking to get a taste of banking, Mr. Van Hoozer said.

"If they start to see it as a culture that promotes people early on and there is upward mobility, they are going to want that," he said. "Seeing that early on, I think you will get them for the longer haul."